B2B: Page 17

-

PayPal CFO: Pandemic has created 'inflection point' for digital payments

The virtual payments processor does not anticipate a post-pandemic drop in business, and intends to double its user base and triple total payment volume, according to John Rainey.

By Jane Thier • March 5, 2021 -

Seattle-based payments company suffers ransomware attack

The company Automatic Funds Transfer Services offers payments processing, billing and other services for customers and municipalities in Washington and California.

By Anthony Epling • March 4, 2021 -

Explore the Trendline➔

Explore the Trendline➔

innni via Getty Images

innni via Getty Images Trendline

TrendlinePayments players eye digital B2B opportunity

Companies offering digital payments services envision billions of dollars in U.S. business payments flow ripe for transitioning to the electronic realm.

By Payments Dive staff -

Square launches long-awaited industrial bank

The FDIC gave the fintech conditional approval for an ILC charter nearly a year ago. Now the company can originate small-business loans rather than doing so through its previous partner, Celtic Bank.

By Dan Ennis • March 2, 2021 -

Inside Marqeta's plans to grow its 'card-as-a-service' offering

The card issuer and processor is differentiating through a flexible, API-based platform that helps clients launch card offerings in months instead of years.

By Suman Bhattacharyya • March 2, 2021 -

Why Global Payments went multicloud

Large companies venture down the multicloud path to support different business arms.

By Katie Malone • Feb. 11, 2021 -

Plaid sees 'opportunity' after $5.3B Visa deal ends

The data aggregator's biggest priority now is getting 75% of its traffic dedicated to application programming interfaces by the end of 2021 — a prospect John Pitts, Plaid's head of policy, calls an "immense challenge."

By Anna Hrushka • Jan. 19, 2021 -

American Express expands small business perks as it reportedly falls under federal investigation

As the credit card issuer caters to merchants migrating online, multiple agencies are scrutinizing its sales practices.

By Tatiana Walk-Morris • Jan. 8, 2021 -

Banks can use stablecoins, blockchains for payments, OCC says

The move follows a letter the agency issued in July clarifying national banks are allowed to provide cryptocurrency custody services, and hold unique cryptographic "keys" associated with cryptocurrency on behalf of customers.

By Anna Hrushka • Jan. 5, 2021 -

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

Valadi, Sam. (2012). "Empire State - New York City" [Photograph]. Retrieved from Flickr.

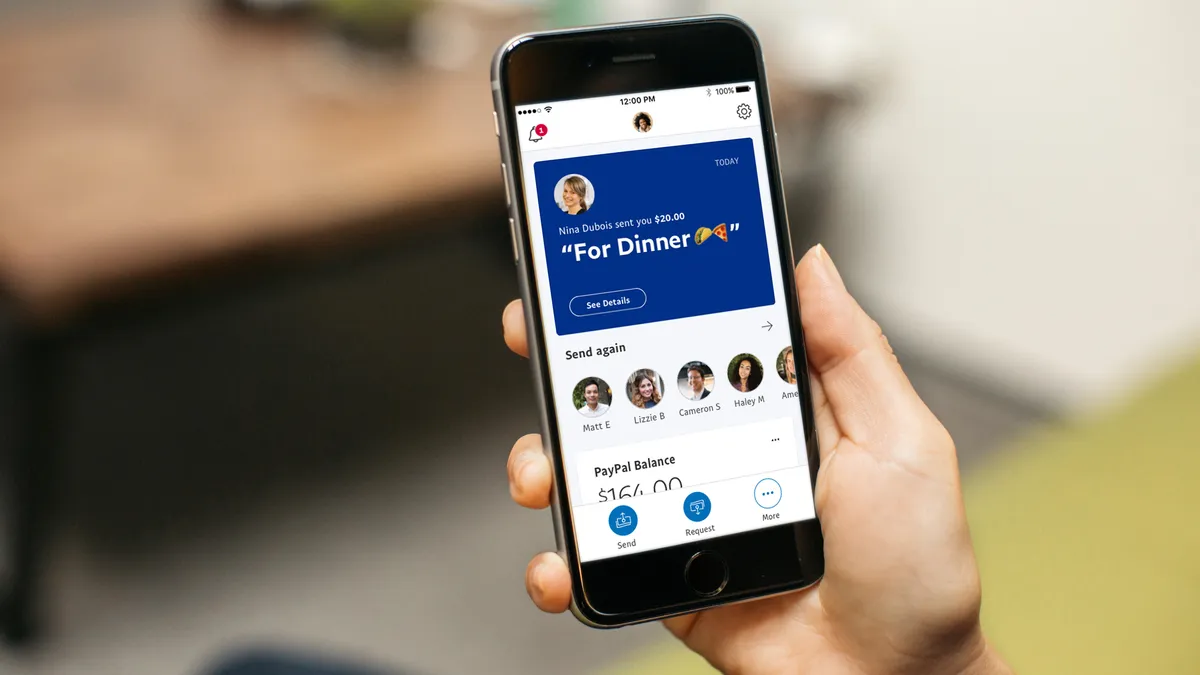

Behind BNY Mellon's war against B2B checks

Peer-to-peer payments have made consumer transactions cheap and efficient. BNY Mellon wants to do that for business payments, with additional communication, reporting and security measures.

By Suman Bhattacharyya • Nov. 25, 2020 -

Remote work exposes payment system inefficiencies

Although most organizations want to automate payments, only about 8% have fully done so.

By Robert Freedman • July 22, 2020 -

Banks mostly fear payments and money transfer fintechs, survey finds

Less of a concern among banks is competition from online investment and crowdfunding upstarts.

By Robert Freedman • March 3, 2020

To find more content, use the "Topics" in the menu above.