Rapidly changing consumer preferences — including the demand for seamless, personalized customer experiences — have raised the stakes for small and mid-size business owners hoping to attract and retain their customers. Both vertically specialized and horizontal SaaS platforms play a central role in helping these business owners manage their operations, from managing inventory to creating financial forecasts.

And, increasingly, business owners are looking to SaaS platforms for embedded finance: Financial products like payments, business cards, accounts and capital, delivered within the platform’s native ecosystem to allow owners to manage business operations and financials in one central location.

Embedded finance is particularly beneficial to small and mid-size businesses — a typically underbanked market category — as it gives them access to secure and compliant financial services that are tailored to their needs and delivered at a standard of speed and convenience that traditional banking institutions fail to achieve. In providing this differentiated value, embedded finance not only conveys a competitive advantage to platforms competing for customers, but also unlocks additional revenue streams, as platforms can monetize these products.

The demand for embedded finance continues to surge, but there’s still plenty of untapped potential

As embedded finance moves into the mainstream, more and more businesses are seeking out platforms with embedded finance capabilities. Adyen and BCG’s new Embedded Finance Report unveils that the total addressable market for embedded finance has now expanded to $185B — an increase of 25% over the past two years.

Although early-adopting platforms are already reaping the rewards of embedded finance, crucially, supply has not yet caught up with demand. With less than 20% of the market for embedded finance addressed, with the exception of payments, SaaS platforms have an opportunity to set themselves apart as trusted providers of embedded financial solutions and emerge as leaders in this field.

Finally, embedded finance can help platforms drive revenue as embedded finance can amplify platform revenues by up to three to four times their current subscription fee income.

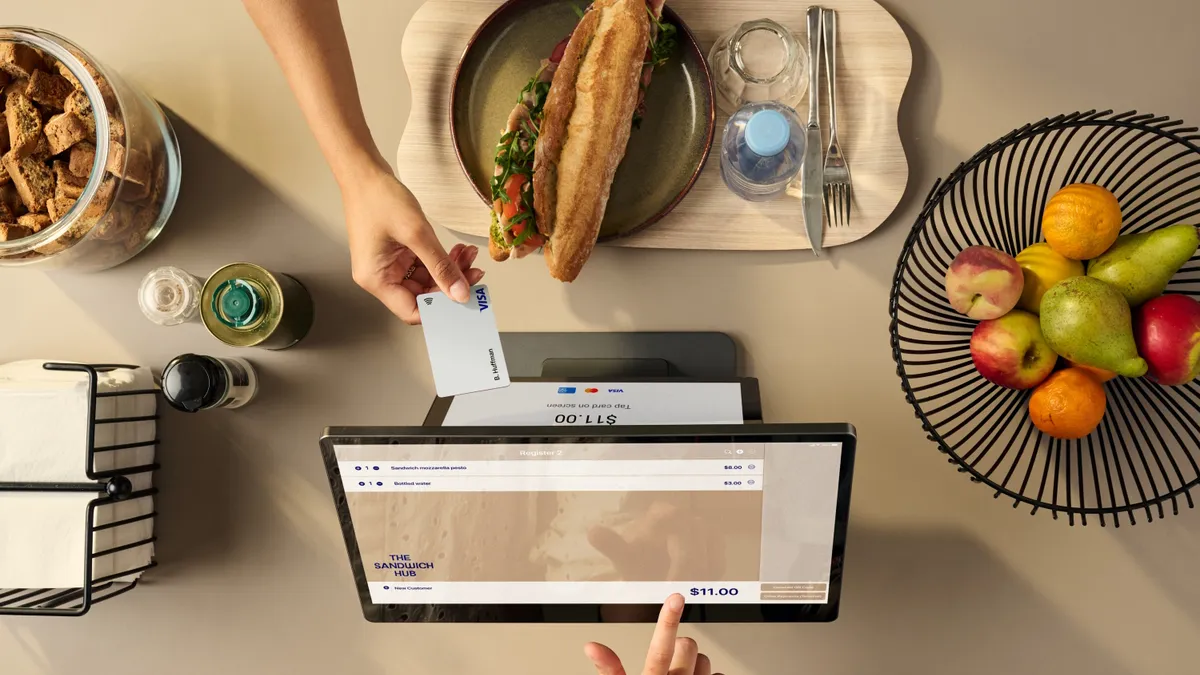

Payments continue to lead the way in embedded finance

Payments is the largest and most mature market for embedded finance. According to Adyen and BCG’s report, payments make up the foundational layer for leading platforms’ embedded finance offerings, with these platforms generating up to 80% of their revenue from payments.

However, there remains a largely-untapped market for embedded payments. Industry adoption runs at two speeds.

-

Leading sectors — hospitality; beauty, wellness, and fitness; food and beverages; transportation and logistics; and retail — show adoption rates of 50-55%.

-

Lagging sectors, such as healthcare, professional services, and construction, on the other hand, still rely on traditional payment options like traditional invoices, checks or wire transfers, and report adoption rates of around 40%.

Platforms have an opportunity to reach these underserved industries by putting the customer experience front and center. As a baseline, platforms should offer fully integrated payments for a convenient user experience. And platforms have an opportunity to drive revenue by communicating how embedded finance benefits business owners in lagging sectors. For example, how a convenient embedded payment solution can alleviate the burden of traditional accounts receivable (AR) processes on overworked healthcare staff.

Capital offers emerging revenue opportunities

Access to capital is essential to fuel business growth — but 40% of small and mid-size businesses report struggling to secure financing. Business owners face a spate of challenges on this front, and many find that there are few attractive solutions offered by traditional financial institutions (FIs), or opt to self-fund rather than navigate complex application processes.

So it’s perhaps no surprise that business owners are looking beyond banks to meet their financing needs. Capital is the fastest-growing segment in embedded finance, with adoption rates rising from 5% to 15% in 2022 to 10 to 20% in 2024. And platforms have the ability to provide their users with tailored financing solutions, often at lower rates than traditional FIs.

"Most of our customers have been with us for a couple of years. They prefer to work with us then with a legacy bank or capital provider as they trust our relationship,” says Chris Rich, director of financial services at ROLLER, a cloud-based venue management software solution that serves the attractions industry. “Providing an easy-to-apply offering without paperwork or worries about credit score is an additional bonus."

To succeed with embedded capital, platforms must have the flexibility to offer personalized financing options to the right customers at the right time. The ability to offer a broad range of products allows platforms to meet a broad range of needs, from short-term loans to facilitate cash flow management to longer-term loans to help grow the business.

Delivering on the promise of embedded finance requires the right partner

A platform’s embedded finance solutions are only as strong as its partner, and asking the following questions can help you find the right fit.

Do they have a track record of excellence in your industry?

The ideal partner should be able to understand and anticipate your needs, and be able to share customer success stories from businesses similar to yours.

Can they offer an exceptional customer experience?

A strong CX is key to success with embedded finance. The ideal partner should understand your business’ current pain points around CX, and be able to offer a seamless experience — both to you and to your clients.

Are their solutions scalable, flexible and innovative?

Business moves fast, and so does embedded finance. The ideal partner should embrace innovation, adopting emerging technologies, such as AI, to continually improve and expand their offerings. Importantly, they should also offer solutions custom-fit to your needs today, as well as be able to scale along with you to help fuel growth tomorrow.

Adyen for Platforms allows SaaS platforms to unlock new revenue streams with embedded financial solutions, from embedded payment processing to capital, accounts and issuing. Visit us online to learn more.