Open banking uses cutting edge technology to streamline the way consumers and service providers facilitate payment transactions in today’s increasingly digital marketplace.

Among the chief benefits of open banking is the increased access it affords users, who can more readily transact with e-commerce vendors, tech companies and financial services providers like accountants, insurance carriers and mortgage lenders. And a dashboard-style snapshot of their activities lets consumers track spending and link their bank accounts to loyalty programs. What’s more: all of this can be handled without the need to juggle different usernames and passwords for each transaction.

While the global open banking market sector has grown in the last several years, according to some predictions, an even more substantial spike is imminent. Case in point: this market is primed to eclipse $19.14 billion by the end of 2022—up from $15.13 billion in 2021. And according to one report, the market will reach over $43 billion by 2026.

Against this global backdrop, fintech companies are stepping up efforts to provide customers with next-level experiences while transforming traditional relationships between banks and their clients.

Learning curve

Like any emergent technology, it takes time for prospective customers to feel comfortable with something unfamiliar, before ultimately taking the plunge and using the technology to its fullest capacity. After all, the traditional method of swiping a credit card is practically second nature and gravitating away from this habit takes some mental recalibration.

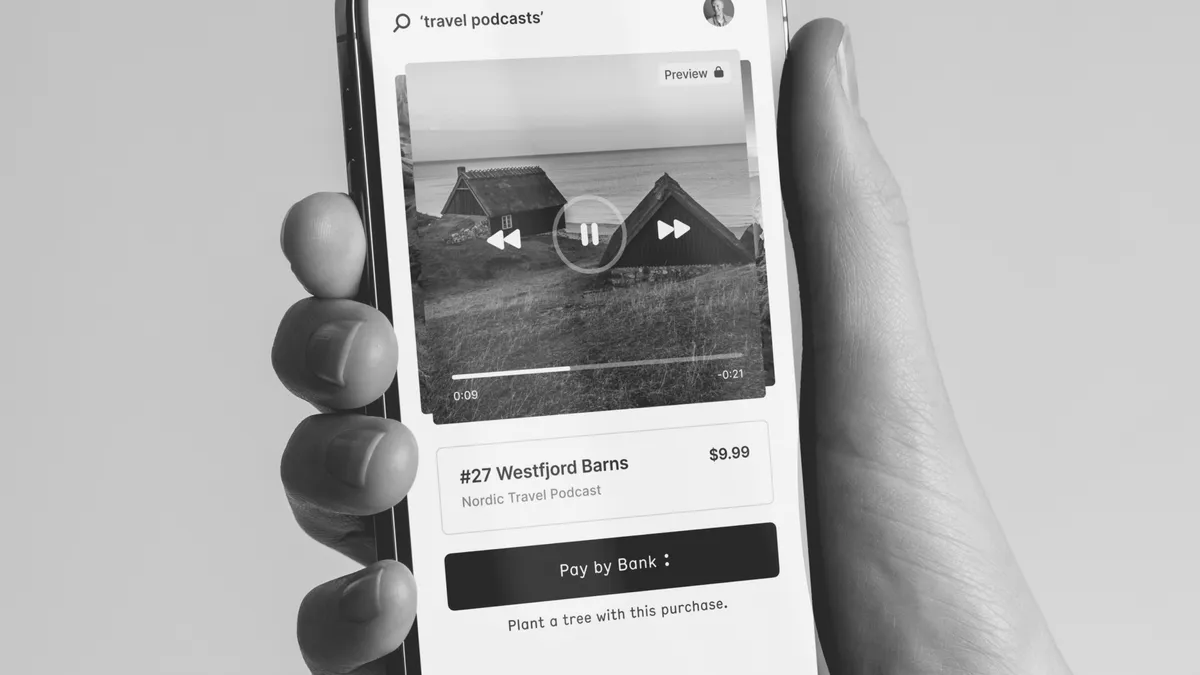

To help encourage the use of open banking, Banked, a fintech innovator that powers real-time payments for consumers, businesses and banks, educates consumers on what to expect with contactless banking, how to integrate the technology and how they can optimally use the product.

The power of incentives

One way Banked encourages customer engagement is by providing an integrated incentives platform to enable merchants to offer rewards and incentives to their consumers—especially when a customer makes a first-time purchase. In such cases, customers may enjoy bonuses like free shipping, vouchers for subsequent purchases and instantaneous cash-back deals.

Interestingly, some studies suggest that consumer engagement in rewards programs intensifies during economic downturns and periods of inflation. In such cases, people often feel compelled to stretch the purchasing power of their dollars in order to stockpile food and other essentials.

On the other hand, some businesses specifically tailor rewards to attract socially and environmentally activist consumers. With these models, known as “intrinsic rewards,” every purchase typically triggers some type of philanthropic event, such as a charitable donation to a worthy cause, the planting of a tree in a deforested region, or the pledge of a business to help offset carbon emissions.

But whatever a given reward program entails, its description is invariably detailed on a merchant’s website, letting consumers curate their spending habits in a way that aligns with their core values—and their budgets.

“Incentivization programs are one of the most often-used, well-known marketing tools available. Almost all businesses offer motivators to get people to try something new,” explains Lisa Scott, Chief Marketing Officer at Banked. “For example, the first time a supermarket stocks a new product, there’s usually an introductory offer, like the new brand of yogurt they’re selling for half price. But these programs aren’t limited to fast-moving consumer goods. The first time you get a new travel insurance policy, they may offer an initial discount.”

And although the broad nature of these motivational campaigns may vary from company to company, the rewards are typically doled out in real-time—unlike programs that rely on the slow and arduous accumulation of points before redemptions can be made—often years later.

Protecting user information

Many mainstream payment facilitators require users to enter their banking credentials, account numbers, routing numbers, or other information to use their service. While this does allow customers to make purchases, it presents risks from a cybersecurity standpoint.

By utilizing an API instead, fintech companies allow customers to enjoy contactless transactions without sharing sensitive information. End users can breathe easy knowing that not only are their accounts protected, but real-time payment reconciliation is far speedier than the typical one-to-three business day clearance windows associated with traditional banks.

Banked takes this one step further by redirecting customers to their banking app in order to biometrically authenticate and authorize purchases. And while it’s imperative to protect consumer data, it’s also important to protect consumer purchases. This means guarding against defective products, potential fraud and dangerous goods and services.

“At Banked, our main mission is to create a simple and intuitive user experience, where customer protection is baked into the process,” explains Scott. “This entails marrying the built-in security protocols people expect from traditional banks with a more nimble infrastructure to give consumers a whole new way of doing things.”

Building a financial ecosystem

Building out partnerships is key to expanding the footprint of fintech companies and part of this involves helping businesses appreciate the assets that this payment method can bring to their operations.

Banked fosters win-win scenarios by organizing data in a manner that helps banks deliver products catering to their customers’ specific preferences and needs. For example, if a consumer uses Banked’s product, Pay by Bank, to purchase a flight to Aspen in February, the odds are that they went on a ski trip. Consequently, their bank might proactively extend an attractive ski insurance package that otherwise might have been overlooked.

"That kind of consolidation can be highly beneficial," notes Scott. “Whether it’s app users, vendor partnerships, or alliances with traditional banks, our goal is to bring everyone to the forefront of a collective experience.”