The American marketplace is becoming more crowded with companies offering 'buy now, pay later' (BNPL), as non-U.S. companies race to attract American consumers newly interested in a financing option already popular in other parts of the world.

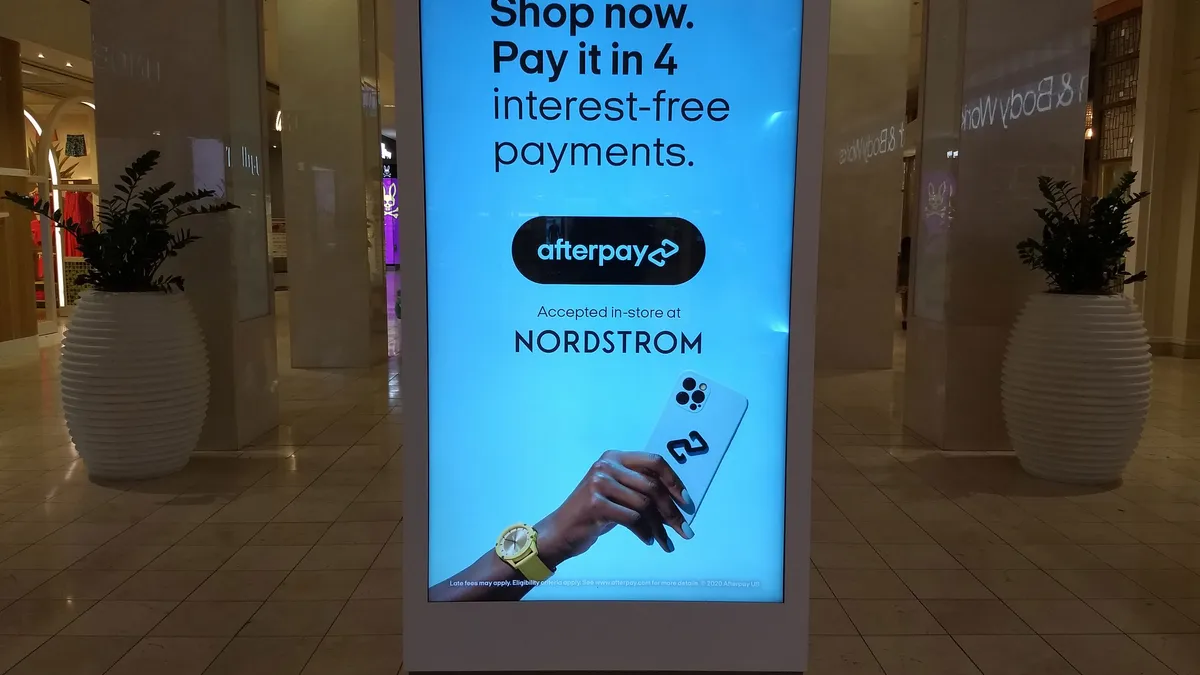

Zip Co, a Sydney, Australia-based BNPL company with a market capitalization of $5 billion, acquired New York-based Quadpay last year, and sees the U.S. market as ripe for the picking, though it's playing catch up with Melbourne-based Australian peer, Afterpay. They've been drawn to the U.S. because consumers here are increasingly using BNPL in lieu of credit cards. Zip aims to replicate its Australian success in the in the U.S., where it's the #2 player nationally behind Afterpay.

"Australia's almost the playbook of what we're going to deliver globally," Larry Diamond, co-founder and CEO of Zip, told Payments Dive. "Right now in America, we have a 'pay in four' [offering] that's doing very very well, but if you look at Australia, we do short and long duration installments [and] we'll be taking that globally."

Zip is catching a BNPL wave early, as the U.S. is still largely seen as a nascent market for BNPL entrepreneurs. Precursors of BNPL have been around for hundreds of years and layaway, a purchase agreement whereby the buyer pays for an item over time and doesn't receive it until it's fully paid off, became popular during the Great Depression. Layaway gradually phased out, as credit cards took hold in the 1980s. But with the rise of digital payments after 2000, BNPL emerged as a payment method of choice for a growing number of consumers.

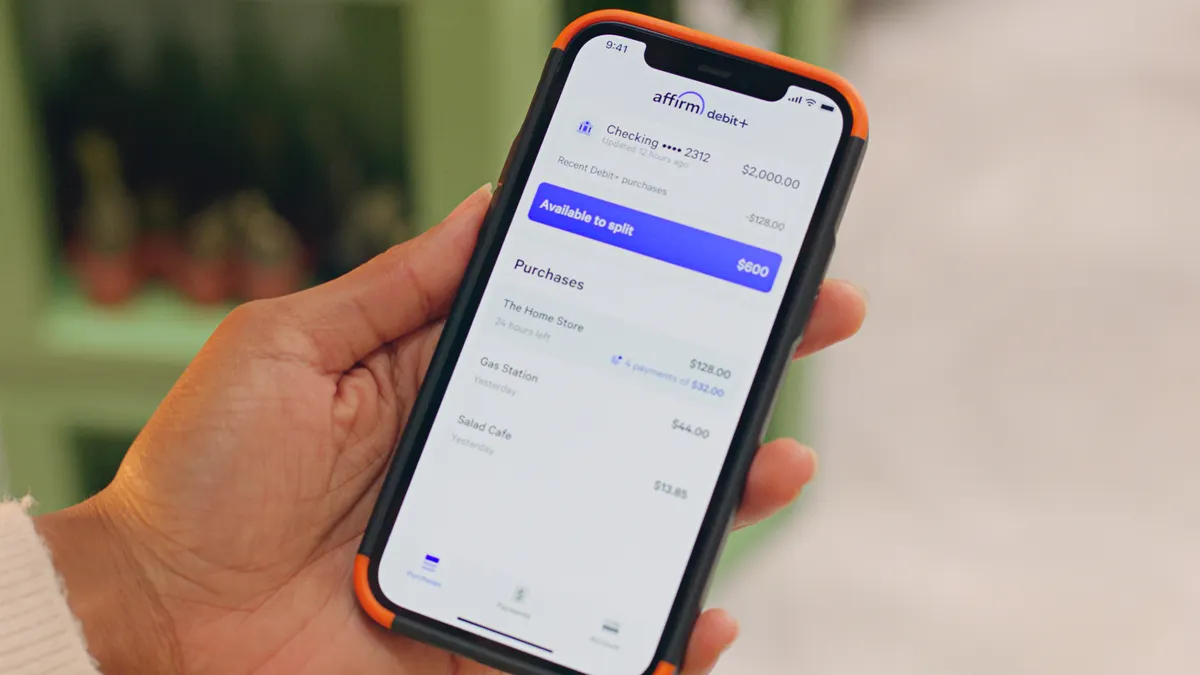

Klarna, an early Swedish mover in this space, was founded in 2005 and expanded to other European markets in the years that followed, reaching the U.K. in 2014. In the U.S., Bill Me Later was an early company in the arena, founded in 2000, and acquired by PayPal (which was then part of eBay) in 2008. Affirm, based in San Francisco, was founded 12 years later, and the concept took off in the past couple of years.

An analysis of transaction data from payment processor FIS Worldpay shows 'buy now, pay later' transactions made up 10% of Australian e-commerce payments in 2020. By contrast, BNPL adoption in North America is comparatively small: In 2020 those transactions made up a mere 1.6% of e-commerce purchases, but FIS Worldpay projects that BNPL transactions will jump to 4.5 % of e-commerce transactions in the U.S. by 2024.

Of course, Zip isn't the only foreign player looking to grow market share in the U.S. Klarna, which reported global gross merchandise volume of $53 billion last year, said the U.S. is its fastest growing market behind Sweden and Germany (it didn't provide U.S. figures). Afterpay, which launched in the U.S, in 2018, nearly tripled sales to $3.3 billion for the first half of 2021, compared to last year, with the U.S. market forming 43% of sales. For the first three months of 2021, Zip reported that its U.S. quarterly transaction volume through Quadpay in the U.S. was $591 million, or 48% of its global transaction volume.

Standing out

Non-U.S. BNPL firms face competition from U.S. firms Affirm and PayPal as well as BNPL services offered through banks like Citizens Bank and Ally Financial.

BNPL providers typically generate revenue through merchant fees that amount to a cut of transactions. Rates vary by provider and range from 2% to 8%.

Quadpay, like many BNPL providers, doesn't do a deep credit check, but says its selling points include the ease of underwriting new customers and consumers' ability to use Quadpay, either through merchants with which it partners, or with any merchant through the Quadpay app. The ability to use Quadpay for purchase categories that move beyond traditional retail is part of an industry-wide BNPL shift into professional categories, including areas like healthcare, legal and accounting services.

"Being able to serve the consumer in that way where they can use Quadpay for all these other things beyond discretionary retail, is really helping the network," said Adam Ezra, CEO of Quadpay.

Quadpay's underwriting method, Ezra said, doesn't touch a customer's credit score. The company's assessment toolset takes into account consumers' names, addresses and phone numbers. It may also look at digital footprint data, including a customer's operating system, their email address, device type, the time they make a purchase, among other considerations. Should a customer miss a minimum payment deadline, they're charged a late fee of up to $7, and the company doesn't inform credit bureaus if a customer is unable to pay.

Other providers pitch similar offerings to U.S. consumers. For example, Afterpay said its differentiator is an appeal to younger consumers who are moving away from traditional credit; the lack of a hard credit check; and its push into physical retail. Meanwhile, Klarna, which said it performs soft credit checks for U.S. consumers, said what sets it apart is compatibility with online and offline retail, along with added features like a shopping app that offers consumers the capability to shop any online store and access deals and price drop notifications through its loyalty program Vibe.

Dealing with risk

Similar to U.S. providers, overseas-based BNPL providers operating in the U.S. that spoke with Payments Dive said their assessments of the consumer's ability to pay doesn't affect credit scores, and if a customer can't pay, they may incur a nominal fee, but credit bureaus won't be notified. Quadpay said less that 2% of its customers are late with payments.

Nonetheless, mindful of the risk some consumers may take on with BNPL payments, Australian regulators imposed a code for BNPL companies that came into effect in March. It sets caps on the number of late payments a person can accrue, along with mandatory financial checks to assess consumers' ability to pay.

The U.K. also announced plans to regulate the BNPL sector earlier this year. It is unclear whether U.S. regulators will follow suit.

“One of the questions with the new [Biden] administration is: What stance will the Consumer Financial Protection Bureau (CFPB) take going forward?” BTIG analyst Mark Palmer recently told Reuters. He suggested the CFPB under the Biden administration is likely to be "more aggressive."

Zip's Diamond contends that the BNPL industry developed tools that sufficiently insulate them from risk. They also ensure only customers who have the ability to repay are approved to use the platform, he added.

"The 'buy now, pay later' sector has proven that it can withstand seismic shocks," Diamond said, noting that losses are incorporated into their revenue models. "We're getting more information than you would get from a traditional credit card [and] the repayment velocity allows you to adjust accordingly."

Ben Pressley, executive vice president of sales, operations and strategy at Afterpay, echoed similar views on risk management.

"We feel very confident in our approach to risk management, as demonstrated by our strong results in these loss rates which has consistently been below 1% of total gross merchandise volume," he said.

While providers say they're offering a less risky alternative to credit cards, some recent research highlights consumer risks with the model. According to a survey from consultancy and research firm Cornerstone Advisors, 43% of BNPL users have been late with a payment. The problem, according to Research Director Ron Shevlin, stems from "losing track" of the payment.

"The fact that 'losing track of the payment' was the most frequent reason for late payments suggests that many BNPL users are in over their heads from an inability to manage their money efficiently," he wrote in a recent article explaining the findings of the survey.

Others suggest that by not linking repayment behavior to a consumer's credit score, some may be missing out on the ability to build credit over time.

"If they do make all the installment payments over time, it doesn't go to build their credit score, which is a challenge for folks that do need to at some point have access to that to get a car loan or buy a house or whatever the case may be," said Ginger Schmeltzer, senior analyst at Aite Group. "So there's pros and cons to that sort of off-credit-bureau credit assessment."

An expanding market

Schmeltzer contends that at least for now, the BNPL market in the U.S. is in a hyper-growth phase, with growing opportunities for newer entrants.

Quadpay's Ezra said the company plans to expand the field of offerings for U.S. consumers. "There's certainly more product features that millennial consumers are interested in — digital banking, and things like Bitcoin and trading shares," he said. "BNPL will be at our core, but I think there are many ways that we can serve the consumer further with additional products."