Dive Brief:

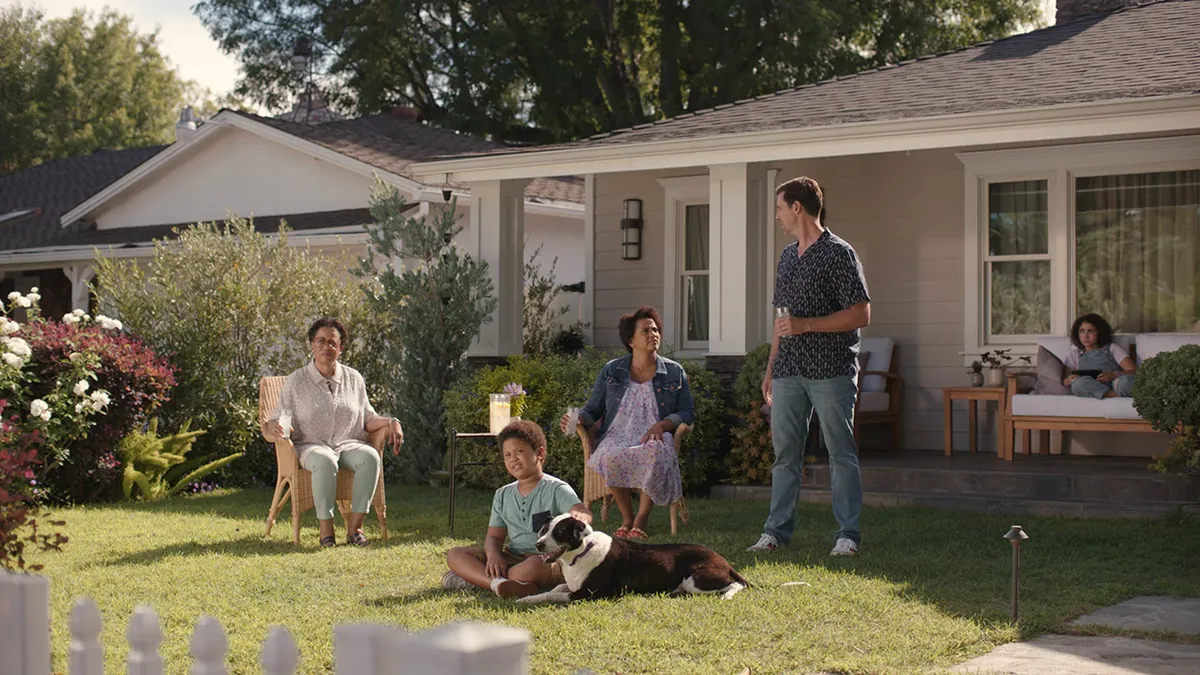

- The digital money transfer service Zelle kicked off a new advertising campaign this month, rolling out a series of commercials centered around an American family. The company that owns Zelle, which is called Early Warning Services, has significantly boosted its marketing budget for that product this year, more than doubling it relative to each of the last two years, said Melissa Lowry, EWS's vice president of marketing and branding. She declined to specify a dollar amount.

- More people discovered the peer-to-peer digital money service during the COVID-19 pandemic as consumers shifted to contactless payments, and now EWS wants to sell busier, older Americans on more Zelle use cases for the service, Lowry said in an interview. In a shift, its advertising is now targeting a narrower, older age demographic, zeroing in on 35- to 54-year-olds, as opposed to its former focus on those aged 18 to 54.

- “This group has a high trust in their banks,” so Zelle wants to remind these consumers that money transfer isn’t just for splitting a restaurant tab, it can also be used for splitting a payment on kids’ sports uniforms or grocery store bills, Lowry said. “That demographic had been a bit ignored in the (P2P) category,” she added.

Dive Insight:

The Zelle network is owned and operated by EWS, which in turn is owned by a group of big banks, including Wells Fargo, Bank of America, JPMorgan Chase, Capital One, US Bank, Truist Financial and PNC Bank. Beyond those bank owners, the service is available through about 1,100 banks and other financial institutions (it's mainly accessed through individual banks' apps, though there is a Zelle app as well). About 40% of those Zelle providers have less than $10 billion in assets.

When the Zelle peer-to-peer service launched in 2017 it made more sense to focus on a broader group as the company was introducing the service to Americans, Lowry said. Now, it’s become more efficient and effective for EWS to focus on the upper end of its former target audience, and to leave advertising targeting younger consumers to the individual banks involved.

There is still a lot of opportunity across that broader age group, but Zelle’s national campaign doesn't have to target the whole range because it can rely on its bank partners to address different parts of the market, Lowry said. Plus, Zelle is already experiencing above average use from the younger crowd, she noted.

The current campaign will run on broadcast TV, social media, streaming services like Hulu, in display ads and through public relations — "everywhere" except in print magazines and newspapers, Lowry said.

EWS is boosting its Zelle marketing just as a pack of rivals, including PayPal and its Venmo unit, Spare’s CashApp and ApplePay, swoop in to lure more customers too, all at a time when Americans are discovering the convenience of digital payments, partly due to the deadly pandemic keeping people at home.

In the second quarter, the number of Zelle transactions jumped 58% to 436 million transactions and the value of those transactions climbed 68% to $120 billion, Scottsdale, Arizona-based Early Warning said in a July 29 press release.

“Zelle plays the role of digital cash for tens of millions of people and businesses," Early Warning Services CEO Albert Ko said in the release.

Another difference this year is that EWS is spreading its Zelle advertising throughout the year as opposed to its past practice of splurging in just one quarter, Lowry said. What the larger budget “allows us to do is stay live consistently throughout the year” she said.

Lowry understands there is a lot of competition in the market right now for consumers' attention, with companies fighting for customers returning to their pre-COVID habits, especially as the yearend holidays near. That’s why EWS engaged in additional research this year to understand the target audience and how to break through the noise with a more "relatable" ad campaign, she said.