Earlier this month, one Wall Street analyst made a rare call: He downgraded Visa to a “neutral” rating, questioning the future of the company’s card business.

And that was before the card network giant reported fiscal third-quarter financial results last week that showed payments volume growth slowing, as did preliminary July numbers.

That analyst, Bank of America’s Jason Kupferberg, called the quarterly performance even “worse than expected,” and said in a July 23 report that the results could “spark louder debates about the growth outlook for [Visa’s] core business.”

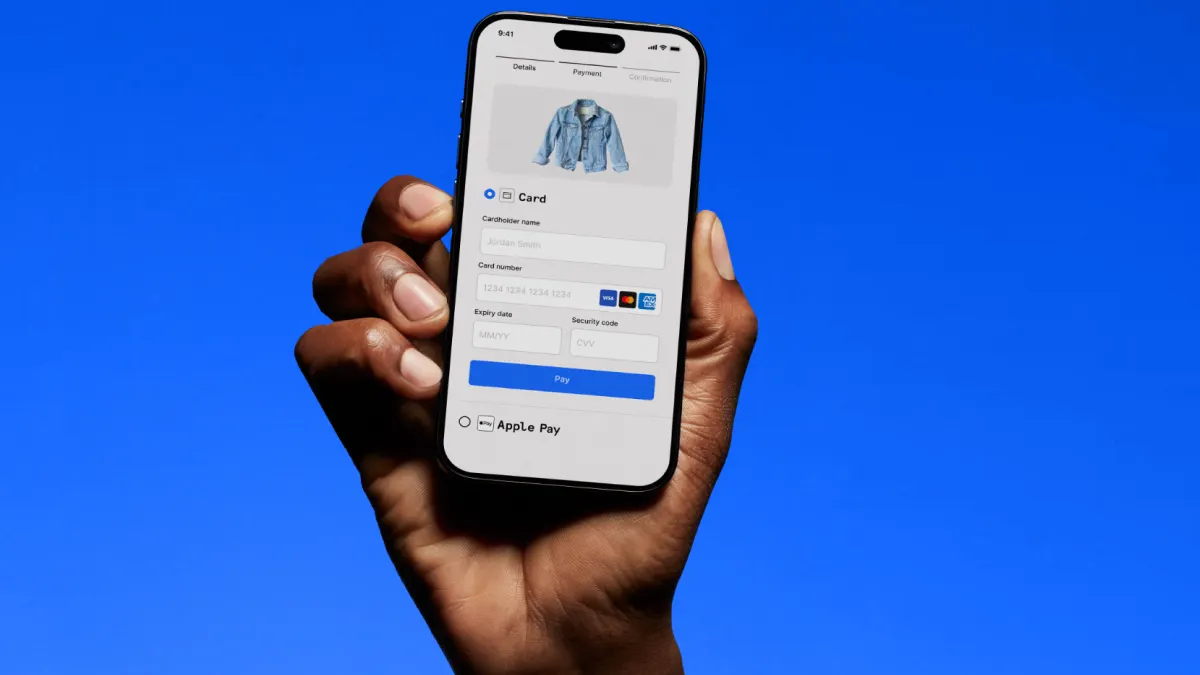

While doubts about the long-term sustainability of the card business have been swirling around Visa for years, threats on the horizon seem to be coming into sharper focus lately. Digital competition, including real-time payments, related pay-by-bank options and buy now, pay later financing, are increasing the alternatives to card payments. In addition, legislative and regulatory pressures are building.

While Kupferberg also downgraded Mastercard, it’s more striking that he would take aim at the industry-leader, given Visa’s dominant global market share of about 39%, compared to Mastercard’s 33%, according to the research firm Nilson Report.

The card business is more than a mature industry, with roots reaching back nearly a century. And in many parts of the world, it’s fading as a payments tool.

In Asia, digital alternatives such as Alipay linked to smartphones are gaining more traction. In Africa, digital wallets are similarly advancing more rapidly than cards. And in India and Brazil, nationalized real-time payments systems are letting consumers bypass cards. In the U.S., two such real-time payments systems, RTP and FedNow, are now competing for growth too.

Even in Europe, where the cards still have a sizable presence, regulatory pressures have reduced the card industry’s key interchange fee revenue.

So, it’s not surprising that U.S. analysts and other payments professionals are wondering how much longer a very American attachment to cards can persist, even as loyalty programs remain entrenched. The COVID-19 pandemic accelerated digital payment plays in the U.S. too.

Buy now, pay later financing, earned wage access, big tech payment systems like Google Pay and Apple Pay and cryptocurrencies all are making significant inroads against cards. Some of them link to cards, but as competition rises, the battle over fee revenue will increase.

To that point, JPMorgan Chase, the biggest U.S. bank and a major card issuer, recently barred BNPL users from tapping its cards to use the alternative financing method.

Visa, too, is positioning itself for a card endgame, says California industry consultant Ken Musante. That’s why Visa is developing card alternatives, including a pay-by-bank service, Musante explained at the Midwest Acquirers Association conference in Chicago this month. Visa is working with JPMorgan to provide domestic pay-by-bank services via its Visa Direct services, which also offer cross-border money movement services.

“Even Visa is seeking to disintermediate interchange,” Musante said during the July 25 panel discussion, noting that Visa doesn’t benefit from such fees directly anyway. Bank card issuers nab interchange fees, while networks like Visa rely on network fees, and benefit indirectly from bank partners reaping higher interchange.

“I can tell you, with certainty, real-time payments will overtake card payments – can’t tell you when, but I can tell you that will certainly happen,” said Musante, president of Napa Payments and Consulting.

He hedged though, explaining that many fintechs have sailed to sea seeking to challenge Visa, only to be destroyed on the sharp shoals of that competition. “I don’t know what the tipping point is going to be,” he said in an interview after the panel discussion.

To be sure, Visa executives defend the card business as remaining robust, even as the company spools up ancillary services, such as Visa Direct. They recently shrugged off the quarterly slowdown, attributing it to one-time events, including the CrowdStrike outage and Hurricane Beryl in the southern U.S.

“So far this fiscal year, we have seen strong revenue and [earnings-per-share] growth as a result of relatively stable volume and transaction growth,” Visa CEO Ryan McInerney said during an earnings call with analysts last week. “I remain very excited about the opportunity that lies ahead of us.”

Visa isn’t facing just competitive market pressures. It’s also being challenged by regulators, legislators and even judges confronting the company’s card dominance.

The Federal Reserve for the first time in a decade proposed last year to lower the amount that card issuers and their network partners can levy for debit card transactions. In Congress, the Credit Card Competition Act, aimed at introducing more competition, has persisted, with one of its proponents, Sen. J.D. Vance, recently becoming the Republican vice presidential nominee.

Meanwhile, a federal judge overseeing a class action against Visa and Mastercard rejected a proposed injunctive settlement this year because it didn’t offer millions of retailers and other businesses enough relief from interchange fees.

To the extent that government and market forces keep whittling away at the card profit proposition, the expiration date for the business could appear sooner rather than later.