Dive Brief:

- Visa, the largest U.S. credit card network company, is increasing enforcement of rules related to programs under which merchants impose surcharges on consumers who use a credit card to pay for goods or services, according to a memo last month from one payments processor.

- The payments processor, a unit of Priority Technology Holdings, told independent sales vendors that offer its services that their merchant clients who don’t comply with Visa’s surcharge rules could be fined between $50,000 and $1 million.

- “In our ongoing commitment to adherence to industry standards, we would like to make you aware of the increased enforcement by Visa on non-compliant surcharge programs,” the Dec. 21 memo said.

Dive Insight:

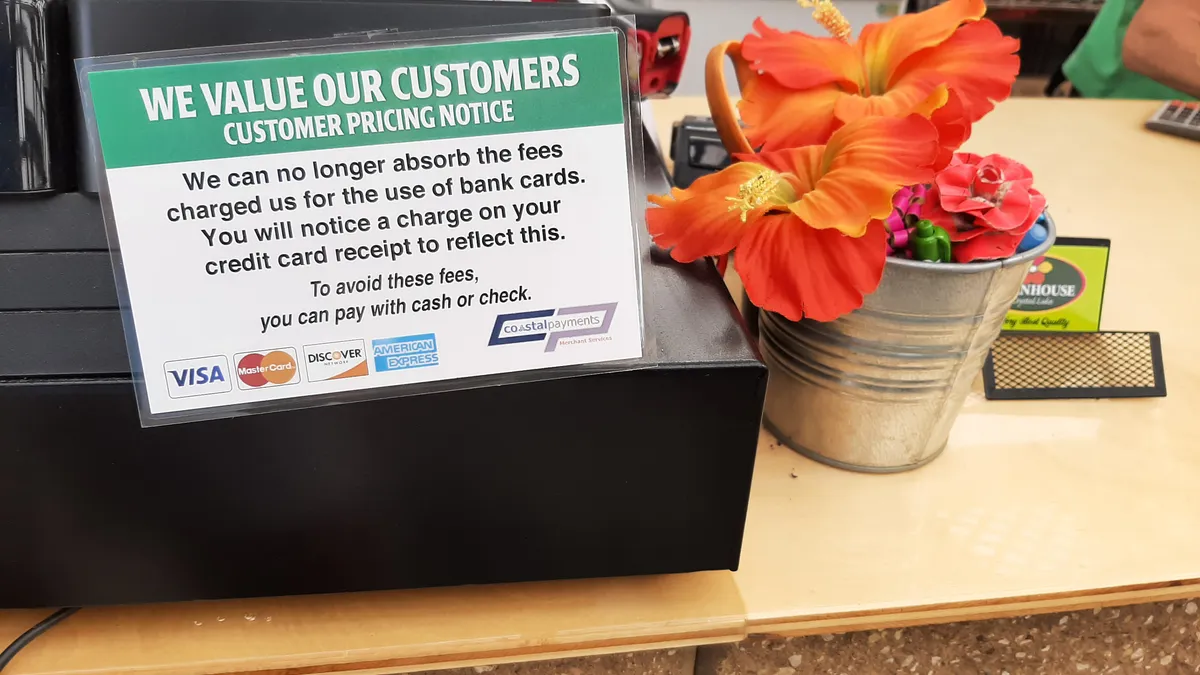

The increased enforcement by Visa comes as the battle over interchange fees, also known as swipe fees, escalates, with the card network pursuing its right to increase the fees and merchants trying to keep them in check. The surcharges come into play when merchants try to recoup the cost of the interchange fees by imposing a surcharge on customers who use credit cards.

Visa has made clear that it’s not a fan of such surcharges, with its CEO, Ryan McInerney, telling analysts last year that “it’s not a great customer experience.” At the same time, he acknowledged it’s merchants’ choice whether to tack on the surcharge. Though they must abide by Visa’s rules with respect to added charges.

The memo from the Priority Payment Systems unit, which processes credit card payments in partnership with independent sales organizations, made clear that Visa is aiming to better enforce those rules.

“Both Priority and its sponsor banks have aligned with card brand regulations, and it has come to our attention that Visa is intensifying the enforcement of the Surcharge Rules,” the memo said. “To safeguard our partnered merchants from potential fines imposed by card brands due to non-compliance, we strongly urge you to conduct a thorough review of both existing and new surcharge programs associated with your merchants.”

The battle over interchange fees and surcharges is playing out in government, at both the national and state levels, as well as in the courts.

In Congress, a bipartisan effort is underway to pass a new law, the Credit Card Competition Act, that would seek to ensure that merchants have access to an alternative credit card network other than Visa and the No. 2 U.S. network, Mastercard. Bank card issuers and the networks have opposed the legislation through their trade groups, saying the fees pay for key features, including security, and noting that any savings is unlikely to be passed on to consumers.

At the state level, New Jersey and New York recently passed laws forcing merchants to keep a lid on any surcharges, requiring that those charges not exceed the costs that merchants pay for processing the transactions.

While merchants have been litigating against the card networks over the fees for years, to the tune of billions of dollars, a new lawsuit against Visa was also filed last month. Scottsdale, Arizona-based processor MiCamp Solutions alleged that Visa seeks to “obscure the extent of its interchange fees” and “to deter ISOs from presenting their programs by enforcing penalties tied to ambiguously formulated regulations.” That lawsuit seeks class-action status.

Alpharetta, Georgia-based Priority Technology Holdings has 820,000 active customers in small, mid-sized and large customers across various payment channels and processes about $118 billion annually, according to a press release on its website.

“Consistent with our continued practice to ensure card brand compliance, we sent a notice to our customers to highlight our observation of increased fines by card brands and to ensure that our partners remain informed about compliance issues,” a spokesperson for Priority Technology said by email.

Visa didn’t immediately respond to a request for comment.