President Donald Trump called on the federal government to do away with the use of paper checks and shift to electronic payments by Sept. 30, except in certain limited cases.

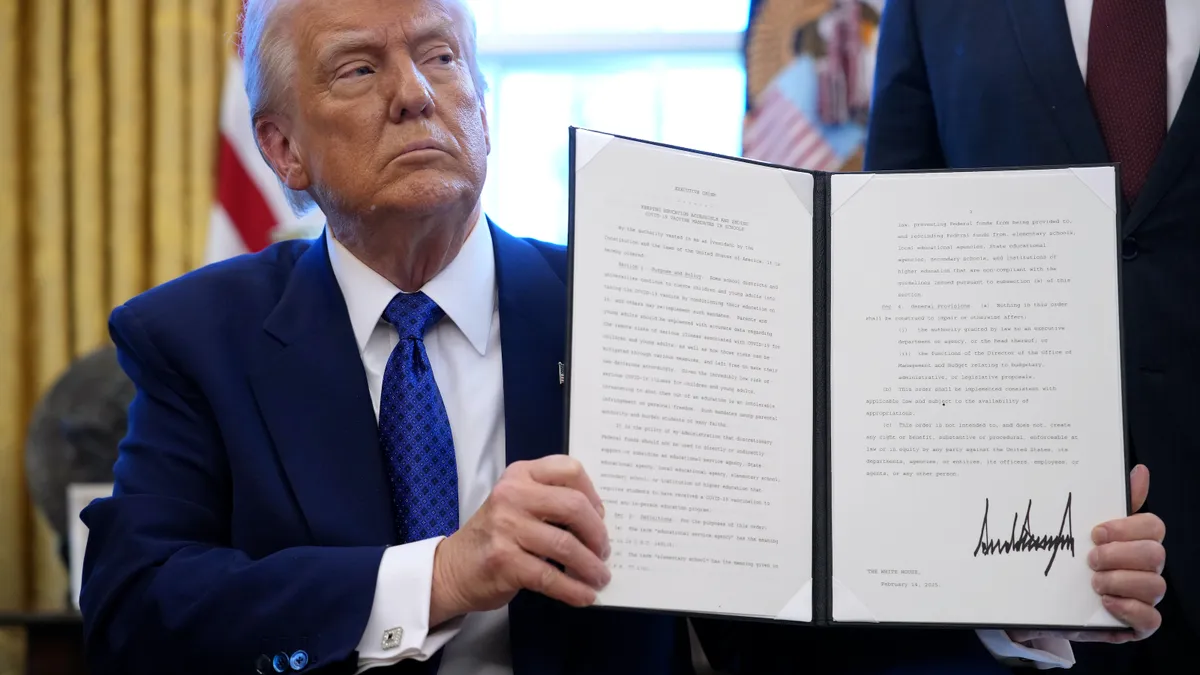

In a White House order Tuesday, the administration said it was tossing out the use of checks to modernize “outdated paper-based payment systems that impose unnecessary costs, delays, and security risks.”

“Paper-based payments, such as checks and money orders, impose unnecessary costs, delays, and risks of fraud, lost payments, theft, and inefficiencies,” the March 25 order said, citing an increase in mail theft of checks since 2020 and a bank-documented increase in check fraud.

The FBI warned in January about the rising toll of check fraud in the U.S., mainly due to mail theft, saying that bank reports regarding the crime nearly doubled between 2021 and 2023.

There were about 8,000 incidents of check fraud reported to the Federal Trade Commission last year, with losses totaling $2.25 million, according to an agency report for 2024. Despite that significant impact, that payment category was relatively lower, in the number of cases and value, than fraud reported to the FTC relating to electronic payment rails, including via bank transfers, credit cards and digital assets.

The administration ordered all federal government payments for intragovernmental purposes, benefits, vendors and tax refunds, to make the transition to some electronic form, whether by credit or debit card, direct deposit, real-time payment or digital wallet. The edict also said that payments to the government for fees, fines and taxes would also be required to be made electronically, where permissible by law.

Having the Treasury Department phase out physical lockboxes and avoid collection and processing of paper receipts is aimed at saving the federal government money. “Maintaining the physical infrastructure and specialized technology for digitizing paper records cost the American taxpayer over $657 million in fiscal year 2024,” the order said.

There will be exceptions made for people who don’t have access to electronic payment tools, in emergency situations and for law enforcement activities, the order said.

To the extent that the government shift forces U.S. consumers and businesses to make the transition too, it’s not likely to be a simple task. Although consumers generally have been moving to electronic payments for more than a decade, American businesses have lagged, and their systems are still significantly tied to paper checks.

A third of all payments in the U.S. and Canada between businesses were made by paper check as of 2022, according to a digital payments survey by the Association for Financial Professionals that year. While that figure has been trending down, it only accounts for payments between businesses, with corporate payments to individuals likely just as high a percentage, if not higher.

It’s a “big swing,” payment industry consultant Peter Tapling said by email regarding the White House move. “They are correct that moving all payments away from check will carry with it significant benefits from fraud controls to improved tracking to reduced cost,” said Tapling, whose PTap Advisory firm is based in Chicago.

Nonetheless, detractors are likely to have a slew of complaints against the administration’s plan to shift payments to electronic forms, Tapling added. They include that providing benefits to unbanked recipients will be tougher; government payments may not have “known” bank endpoints; checks with multiple payees will have to be revised; and, simply, a preference by some for paper checks, he said.

The Trump administration plans to undertake a public awareness campaign to make federal benefit recipients aware of the change and to counsel them on setting up electronic payments.

"The announcement puts financial institutions, corporates, and service providers on notice that payments modernization is coming fast," said Reed Luhtanen, who is executive director at the U.S. Faster Payments Council. "Financial institutions, in particular, will need to dramatically accelerate their faster payments strategies to meet the September deadline."

The business community will have to react swiftly to the federal government's move too, Luhtanen noted in an emailed comment. "Corporates can now be assured that the reach of faster payments will grow quickly and ubiquity will be reached much sooner than previously anticipated," Luhtanen said.