Treasury Prime, an embedded software company, announced Tuesday that it partnered with Narmi to enable its banking customers to send and receive money instantly through the FedNow service.

Narmi, a platform providing digital banking solutions for financial institutions, will act as the small and mid-sized banks’ official service provider for FedNow and connect directly to the Federal Reserve posting transactions to the core banking system. The fintech will also empower the operations team of the financial institutions to meet the compliance requirements, the companies said.

The digital banking platform’s FedNow service will support a range of FedNow service offerings, including receiving, sending to linked and external accounts, and offering request-for-payment options.

“It's our bet that [real-time payments] may have struggled a little bit just because of adoption,” Treasury Prime CEO Chris Dean told Banking Dive. “There are so many banks in the U.S. that enough coverage is challenging. But FedNow has really been the opposite of that; the amount of coverage they have on banks, it's just extraordinary.”

The partnership will help financial institutions in Treasury Prime’s network to offer their fintech clients a secure and user-friendly platform for real-time payments and boost their revenue, he added.

Grasshopper will be the first bank to offer the FedNow capabilities that the Treasury Prime and Narmi integration allow their clients to make use of. This will be the first time the roughly $700 million asset-worth bank will be offering FedNow capabilities to a fintech.

The bank is planning to launch receive-only capabilities to a subset of their clients by the end of the first half of the year, Luther Liang, director of product at Grasshopper Bank, told Banking Dive via email.

“On the Grasshopper side, we saw an increase in requests from our fintech clients for this service and, as an innovative bank, we want to ensure their needs are met,” Liang said.

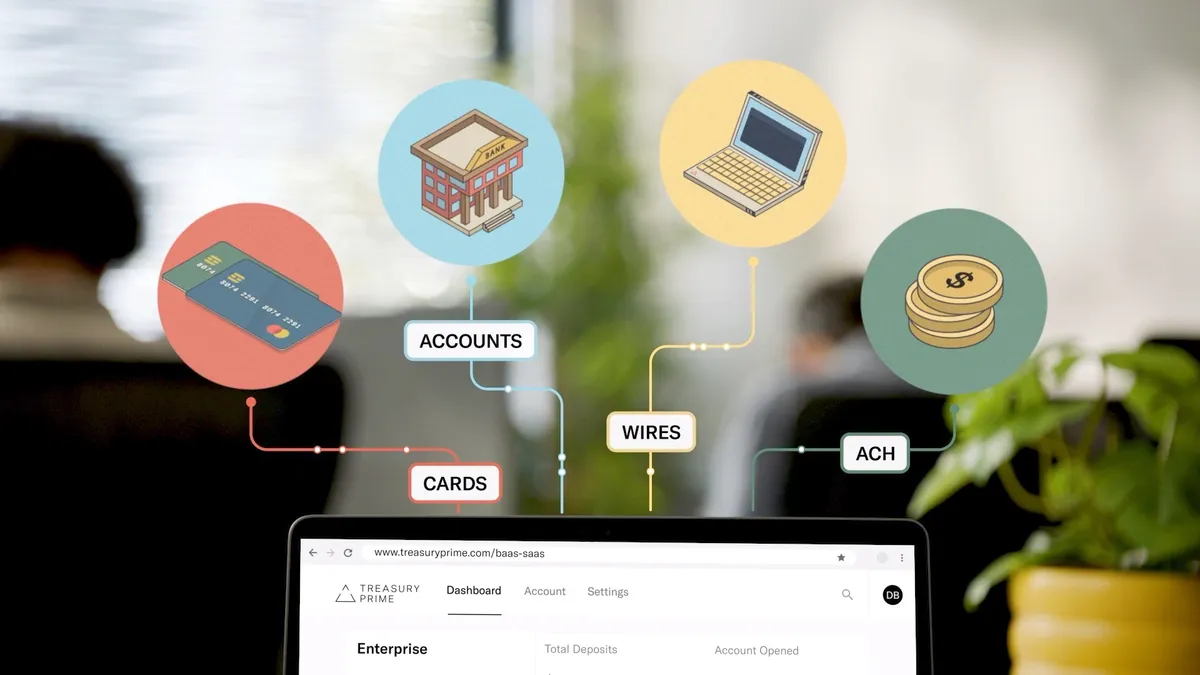

The different methods used to transfer money, including the Automated Clearing House network, wire transfers, or paper checks, are either expensive or slow, according to Dean. FedNow fills in the gap with fast and less expensive money transfers and is a sign of the maturity of the U.S. banking system, he added.

Liang echoed the importance of FedNow and the bank-fintech partnerships using the Fed’s infrastructure.