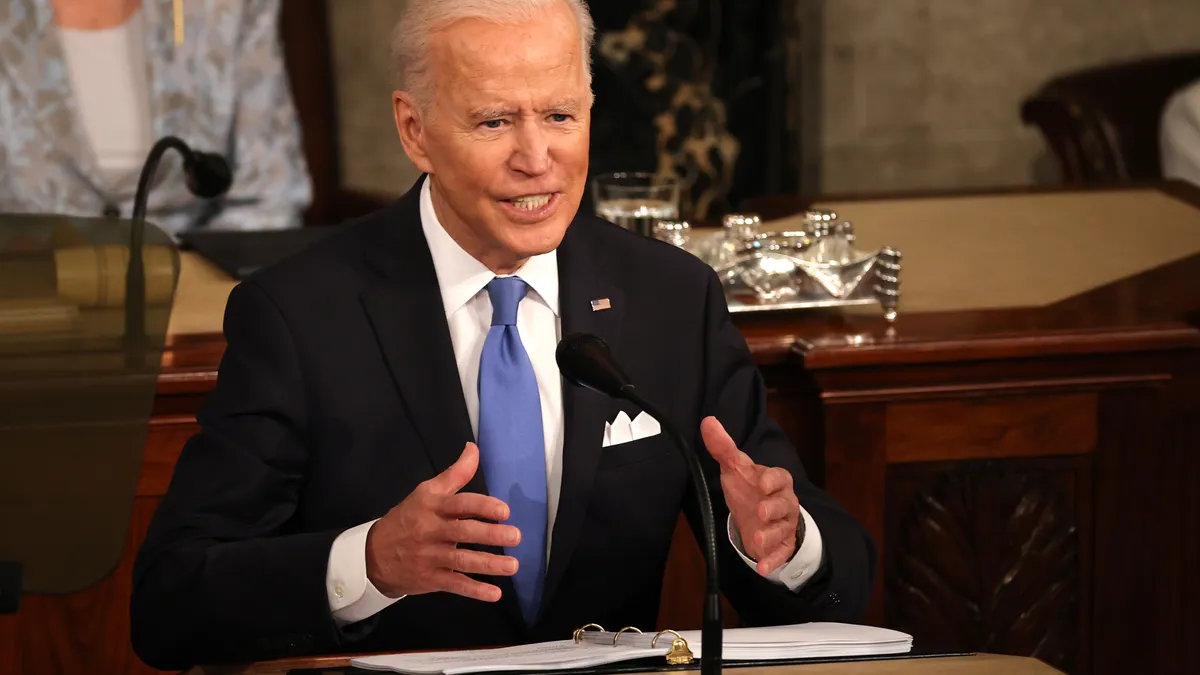

The Merchants Payments Coalition (MPC) called on the Biden administration to include the payments industry in its federal crack down on antitrust concerns in American business.

In reaction to Pres. Biden’s executive order last week pressing federal agencies to foster more competition in corporate America, the MPC urged the administration to take a hard look at the interchange fees charged for processing credit and debit transactions.Those are the fees assessed when consumers pay for goods and services with credit and debit cards. The fees accrue to the banks that issue the cards as well as the card network companies and payment processors.

“Swipe fees charged by the credit and debit card industry are anti-competitive and harmful to Main Street businesses,” the MPC said in a press release Friday. “With this executive order, we welcome action by the Department of Justice, Federal Trade Commission, banking regulators and other agencies to bring an end to anticompetitive practices in the payments industry.”

Those fees have been under attack by retailers and other merchants for decades, with U.S. Sen. Dick Durbin often leading the charge in Congress. His fellow Democrat Pres. Joe Biden didn’t specifically mention the payments industry in his July 9 White House directive, but he did include banking among the industries that deserve more scrutiny, following mergers that led to consolidation in recent decades.

That anti-competitive behavior has allowed card transaction fees to climb, the MPC contends, causing U.S. merchants to "pay the highest swipe fees in the industrialized world,” the MPC statement said. For credit card purchases, merchants pay a fee equal to about 2.25% of the transaction value, on average, the MPC said, citing data from industry research organization Nilson Report. Meanwhile, a federal law, instigated by Durbin, caps big banks’ fees on debit transactions at 21 cents, though banks with less than $10 billion in assets can charge more.

Those seemingly small fee amounts add up. Processing fees for credit and debit transactions tallied $116.4 billion in 2019, nearly double the amount a decade ago, MPC said in the release, also citing data from Nilson Report.

The Justice Department has reportedly opened an investigation of the biggest card network company, Visa, over its possible anti-competitive practices with respect to debit card transactions.

Retailer and merchant trade groups have also taken matters into their own hands, this year adding another lawsuit to their lengthy court campaign against the fees. Two North Dakota retail associations sued the Federal Reserve Board of Governors in federal court over debit transaction fees in April, alleging the central bank board wasn’t properly enforcing the federal cap on those fees.

Another payments industry trade group, the Electronic Transactions Association (ETA) offered support for Biden's efforts on a related front for opening up the U.S. banking system for more interoperability. "President Biden’s antitrust Executive Order is far-reaching and includes support for open banking," ETA's senior vice president of government affairs, Scott Talbott, said in an emailed statement.

"At ETA, we also support open banking, which can expand access to financial services, and we encourage policymakers to use a principles-based approach to any new regulations," Talbott said. "New open banking regulations could, among other areas, provide clarity about the consumer protection and cybersecurity obligations of fintechs that access data from customers’ bank and brokerage accounts."