In the competitive restaurant payments arena, Toast’s move to add a fee to restaurant customers’ tabs for online orders isn’t likely to be replicated by rivals, analysts said.

In late June, Boston-based Toast said it was adding a 99-cent customer-paid fee to online orders of $10 or more placed through the company’s online ordering channels.

“Competitors are more likely to … position themselves away from Toast in that regard,” said Dorothy Creamer, a research manager following hospitality and travel digital transformation strategies at market intelligence firm IDC, during a July 6 interview.

That prediction seemed to play out when rivals were asked how they would react to the Toast move. Merchant payments processing rival Square, a unit of Block, needled its competitor over the fee. “The last thing a restaurant operator needs is to be blindsided by the tools they rely on without any choice,” a Square spokesperson said in a July 6 email, calling it a “blatant money-grab.”

Another competitor, SpotOn, opposes “getting between our clients and their guests,” said Kevin Bryla, SpotOn’s head of customer experience, in a July 6 email. SpotOn, which also provides payment and technology services for restaurants, allows its restaurant customers to take online orders without commissions or guest fees.

While a Toast spokesperson said the company takes changes to its pricing model “very seriously,” its approach may not play well in the marketplace with its clients either.

In the restaurant industry, Toast’s move is “not being met well,” Creamer said. Some restaurant owners view it as an overstep on Toast’s part, to insert itself into the customer relationship, she said.

Typically, merchants have the option to turn off added gratuity or service charges, she said. That’s not the case here, and it’s an “uncomfortable precedent to set,” Creamer added.

Toast contends that the fee will help fund product investment and innovations that “maintain the (restaurants’) direct relationships with their guests,” the company told Restaurant Dive. That includes Toast’s next generation online ordering suite.

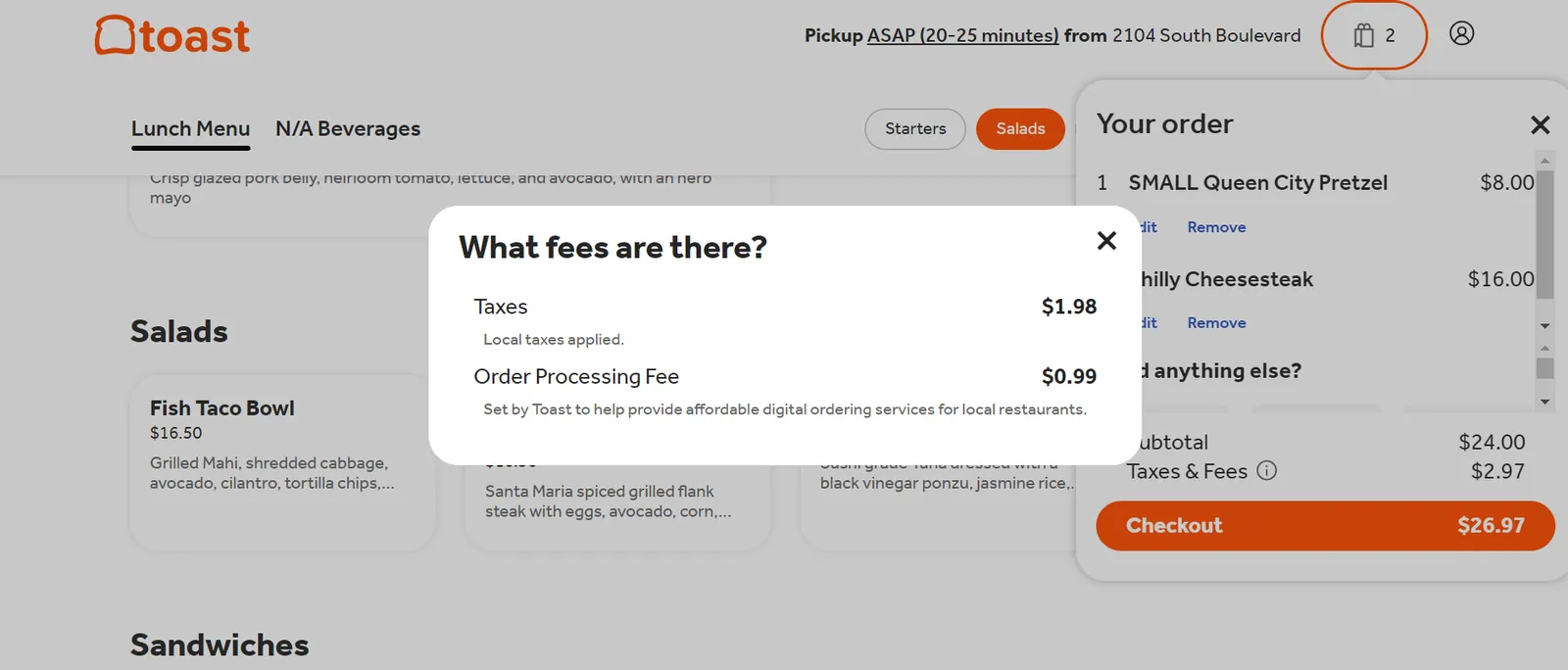

The 99-cent “order processing fee” is lumped under “taxes and fees” on Toast’s online ordering platform. To make clear that Toast, not the restaurant, is charging the fee, consumers will see a note mentioning that distinction when clicking on “taxes & fees” while placing an online order through the company's platform, a Toast spokesperson said in a Monday email.

Still, restaurant customers might not be aware the fee comes from the software services provider, and that’s what has the potential to create backlash for restaurants. Diners “will only care that it is the cost of doing business with that particular restaurant,” Creamer said. She has a hunch the company may be rethinking the fee, because a number of restaurants have urged Toast to reconsider the strategy.

Toast provided its services to about 85,000 restaurant locations, as of the first quarter. The company’s spokesperson didn’t respond to repeated inquiries about whether the charge had been implemented across all of Toast’s customer base, or was still being tested with a small group of restaurants.

Petterino’s, a downtown Chicago restaurant, uses Toast, but not extensively for online orders. Justin Torres, a manager at the venue, said he wasn’t aware of the Toast charge, and added that such a change wouldn’t be well-received by the restaurant. “A guest would look at it as a reflection of the way the restaurant does business and it would come off as petty,” he said in a Tuesday interview.

Margins are razor-thin in the restaurant business, so Toast likely viewed charging restaurant-goers as a better option than increasing pricing for its existing and potential restaurant customers, Creamer said.

Nick Lucas, fintech equity research senior associate at Mizuho Securities, said he would be surprised if Toast’s competitors follow suit. Still, Lucas doubts the fee will lead to notable attrition for Toast.

“If you think about some of the other online ordering services, a lot of them tack on a ton of fees that come in much higher than 99 cents,” Lucas said in an email.

It may be a gamble on Toast’s part, but consumers have become accustomed to service fees being added, especially amid the COVID-19 pandemic and the rise of third-party platforms. Tipping prompts, too, have become ubiquitous as more merchants turn to digital point-of-sale systems.

Andrew Beuttel, director of operations at restaurant 800 Degrees Carolinas in Charlotte, N.C., also noted higher fees and inflated costs have become increasingly common in the industry. The fee’s addition is “slightly unfortunate” but diners who’ve used food ordering and delivery platforms are well aware of fees and surcharges that get tacked on, he added. “It’s just a fairly common practice now, particularly in service industries.”

Beuttel hasn’t fielded any customer complaints related to the new fee, which he said Toast informed him of through a recent email. It’s somewhat expected Toast will “nickel and dime when and where they can,” Beuttel said, although he praised the company’s value. “That’s just capitalism in a nutshell.”

Toast investors’ demand for profitability at the company has likely driven implementation of the fee, Creamer said. In the first quarter, Toast’s loss widened to $81 million, compared to $23 million in the same quarter the year prior, according to a filing with the Securities and Exchange Commission.

Lucas expects the fee will provide an incremental lift to Toast’s revenue and will likely improve margins on a per-transaction basis.