Point-of-sale payments providers Toast and Clover are increasingly battling for restaurant customers, and that combat could become fiercer if a recession arrives.

Toast and Fiserv’s Clover are new entrants seeking a slice of a restaurant clientele that has principally been served by a pair of heavyweights, Oracle-owned Micros and NCR Voyix. But the fintechs are nipping at their heels with sizable shares, according to a report last month from Swiss bank UBS.

The report, which focused on Toast, predicts growth opportunities for the company. “The net new location additions over the medium term appear achievable,” said Chris Zhang, one of the UBS analyst authors of the March 20 report.

Boston-based Toast was launched in 2012 and offers several services, including point-of-sale payment processing. The company’s card readers have become widespread at U.S. restaurants in recent years.

Clover — which is owned by payment processor Fiserv — offers point-of-sale card readers mostly to small businesses. It was founded in 2010, making it and Toast relatively new entrants to the restaurant point-of-sale market, but both have gobbled up significant shares of that market in their relatively brief lifetimes.

Fiserv acquired Clover in 2019 when it bought the point of sale service’s parent company First Data Corporation for $22 billion. The Milwaukee payment processor has singled out Clover as a key driver of future growth, and recently launched the service in Australia and Brazil.

Point-of-sale services like Toast and Clover make money by charging restaurants upfront for card reader hardware and software services, and then collect a percentage of each transaction.

In addition to Clover and Toast, and the heavyweights Micros and NCR Voyix, smaller U.S. rivals noted by the UBS report include SpotOn and TouchBistro.

Of the 730,000 U.S. restaurant locations, Clover covers about 160,000, while Toast has about 130,000, the UBS report said.

Meanwhile, Redmond, Washington-based Micros and Atlanta-based NCR Voyix have about 190,000 and 107,000, respectively, according to the report.

Nonetheless, Toast has a larger 16% share of the $962 billion U.S. restaurant payments volume compared to Clover’s 8%, UBS said, citing data from IbisWorld. Micros processed the largest share, 30%, while NCR captured 16%, while Block’s Square also had 8%.

That left about 23% up for grabs, according to the UBS research, which “attempts to size the U.S. market and the number of locations that are reasonably available to be won in a given year,” Zhang said.

Toast should focus on restaurants that are not part of chains, where it has historically experienced the most success, Zhang said. “Two-thirds of all restaurant locations in the U.S. are independents, which we believe are most readily addressable by Toast,” Zhang said.

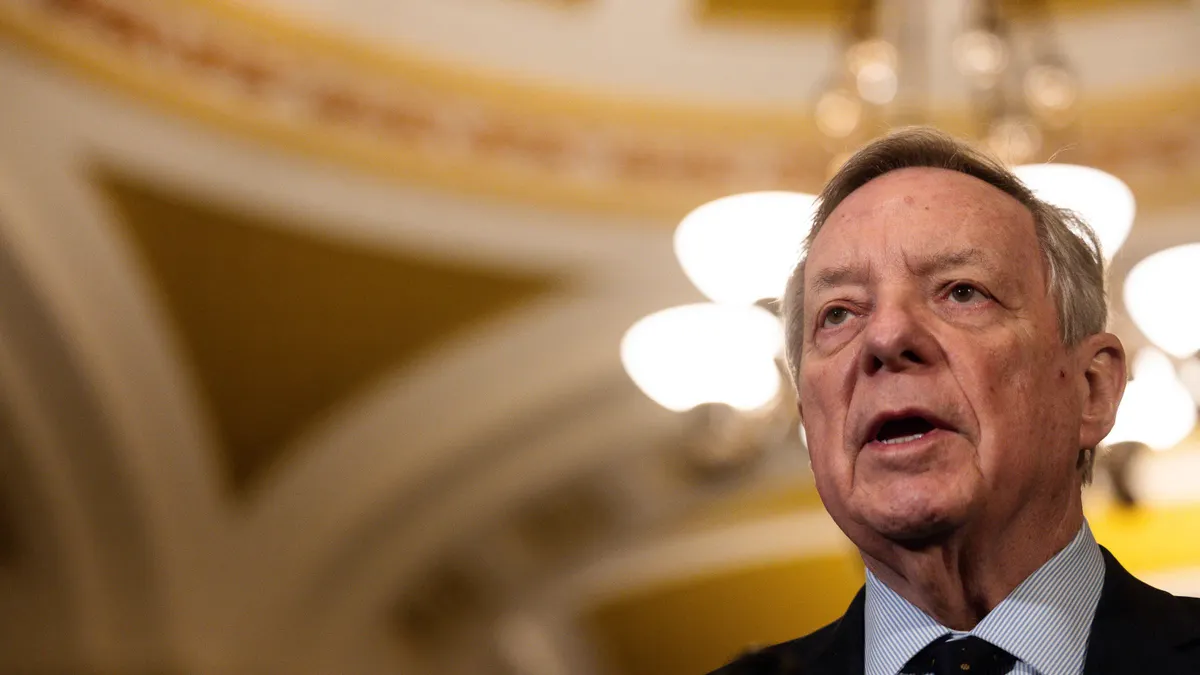

The competition could get stiffer if the tariff battle started by President Donald Trump leads to a recession, said a separate report from Bank of America. That’s because the companies would face a possible consumer spending slowdown, according to the bank’s April 14 analysis.

Economic uncertainty creates “a modest amount of trouble,” for services like Toast and Clover, Bank of America analyst and report author Jason Kupferberg said in an interview. “But it’s not cataclysmic. We’re not talking about another pandemic.”

For reference, at the height of the Great Recession in 2008, restaurant spending fell about 3% year-over-year, he said.

A Toast spokesperson declined to comment and a Fiserv spokesperson did not respond to a request for comment.

Toast depends on full-service, independent restaurants whose customers could trade down in the event of an economic downturn, Kupferberg said.

“On a Saturday night, a family might say, ‘Instead of going to that steak restaurant, we’re going to go out to the local Italian place for pizza and pasta,” he said.

Signs already indicate consumers are eating out less, the Bank of America note says. Restaurant spending slowed year-over-year in the first quarter of 2025, while it increased in the fourth quarter, the analysts wrote.

Tariffs imposed by Trump have increased the odds of an economic slowdown, according to economists. Investment bank Goldman Sachs earlier this month raised the chance of a recession this year to 45% from 35%, citing the uncertainty stemming from the trade war set off by Trump’s import duties, some of which have since been paused.

There are signs that Clover has already been impacted by reduced consumer spending, Kupferberg said.

The first-quarter point-of-sale revenue growth was 27% over the year-earlier period, down from 29% percent growth for the final quarter of 2024, Fiserv said in an earnings presentation.

“The stock got smashed,” Kupferberg said. “And part of what they blamed it on was some softness in the more discretionary types of spending.”