Dive Brief:

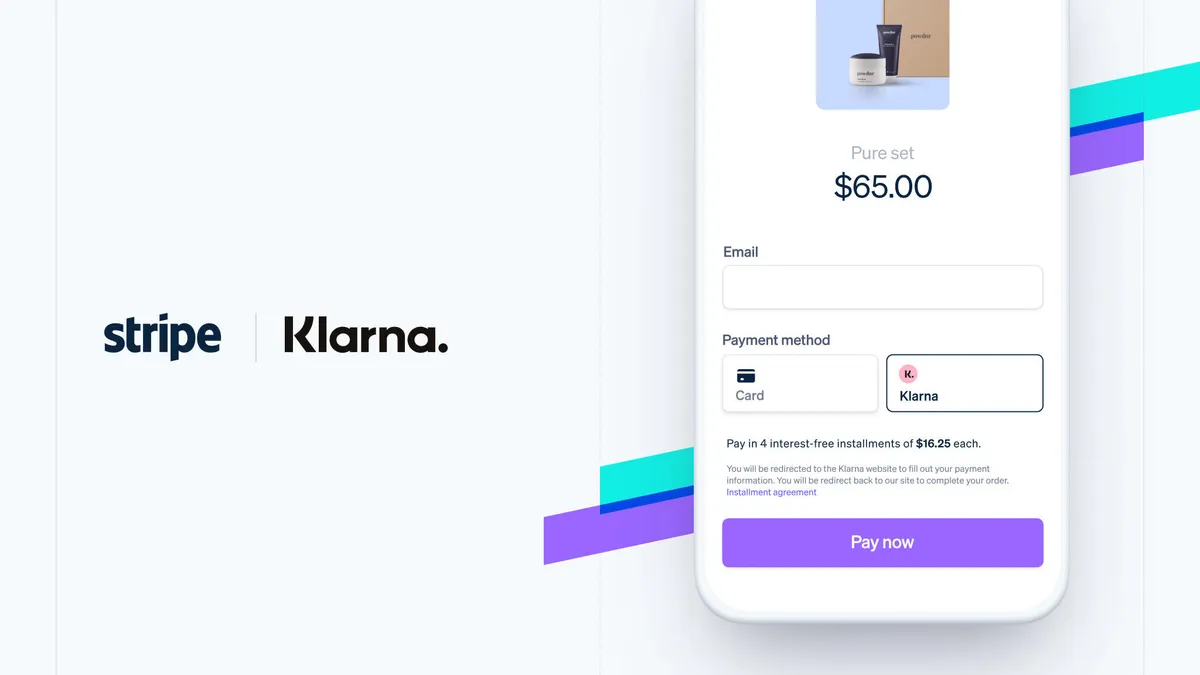

- Millions of businesses in 20 countries that use Stripe's online software for operations will now have the option to offer customers Klarna's buy now-pay later installment payment choices, the companies said in a joint release Tuesday. Meanwhile, Klarna will tap Stripe to take payments from consumers in the U.S. and Canada, according to the release.

- In addition, Stripe has designated Klarna as its "preferred payments partner" for consumer purchases, the release said. As a result, after a customer’s purchase is funded by Klarna and the first payment is made, subsequent payments will be processed by Stripe.

- "After initial tests with Stripe yielded significant improvements in reliability and performance, Klarna decided to shift even more of its payments volume to Stripe than initially planned," the release said. "Klarna will now rely on Stripe to process around 90% of its payment volume in the US and Canada."

Dive Insight:

Stripe and Klarna are two of the most prominent digital payments companies to emerge in the past 20 years, with Stripe revolutionizing the way small and mid-sized businesses do business online and Klarna helping usher in a new era of digital installment payment processes.

Now, the two privately-held companies, both backed by hundreds of millions of venture dollars, are teaming up in a pact that's likely to keep drawing businesses and consumers to their online offerings.

$Stripe, based in San Francisco and Dublin, earlier this year raised $600 million, giving the company a $95 billion valuation. The company has been using the new capital to make acquisitions globally, including an agreement announced last week to buy the Indian software company Recko, and to expand its hiring worldwide.

The Swedish Klarna, based in Stockholm, has been equally active, raising $639 million earlier this year and seeking to expand its reach internationally. The company says it has attracted some 90 million customers worldwide to its payment service since its inception in 2005. While its just one among a number of BNPL providers competing for U.S. consumers, including Melbourne-based Afterpay and San Francisco-based Affirm, it has collected more than 17 million users in the U.S. since arriving in the country in 2015.

“Klarna’s payment options are a powerful tool for online businesses to attract more customers, boost conversion rates, increase basket sizes, and thus grow their revenue," Stripe Chief Product Officer Will Gaybrick said in the release.