Dive Brief:

-

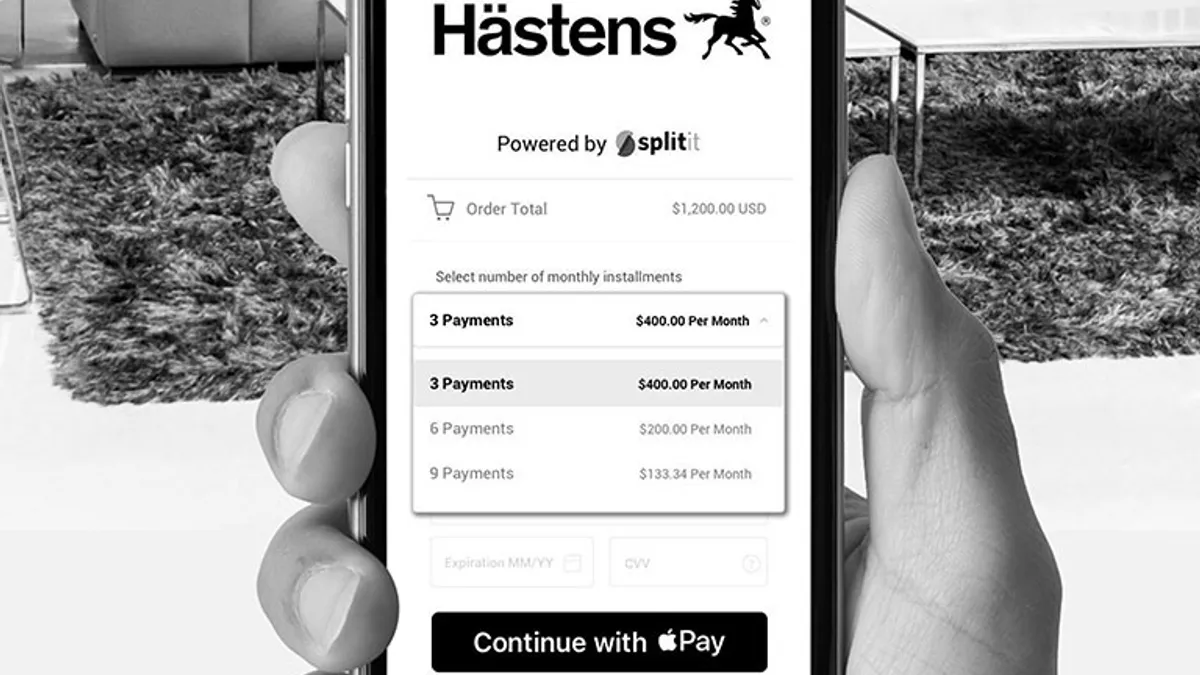

Splitit, an Australian buy now-pay later (BNPL) payments provider targeting the U.S. market, enabled customers to use new Google Pay and Apple Pay payment options for in-store purchases starting today, the company said in a press release. Consumers can leverage QR codes or weblinks to initiate BNPL payments and pay through those Google and Apple digital wallets, according to the July 7 press release.

-

Consumers can pay through their Apple Pay or Google Pay digital wallets and Splitit will divvy up the payments on the consumer's credit cards for all their in-store purchases. Merchants can enroll with Splitit and provide customers with a QR code at the point-of-sale (POS) to initiate BNPL payments, Splitit CEO Brad Paterson said during an interview Tuesday.

-

La-Z-Boy, Febarge and Afterschock PC are some of the retailers that will offer Splitit's in-store BNPL payment option. Consumers can decide how many payments they would like their purchase to be split in at the POS over anywhere from about six to 24 months, Paterson said.

Dive Insight:

Splitit is competing in an increasingly crowded BNPL market, though European and Australian markets have developed faster than the U.S. market. Now, companies from those other markets are flocking to U.S. consumers too. Splitit rivals include the American competitors PayPal and Affirm, but also Australian peer Afterpay and Swedish BNPL pioneer Klarna. Afterpay has been offering in-store Google Pay in the U.S. since last year.

Merchants can now provide Splitit's BNPL payment options at their physical stores without going through a lot of software and hardware integration.

“Any merchant enrolled with us can use the payment option at their terminal,” Paterson said. “Or the merchant can send a link to the consumer, by email or via text message" to allow for payment via a QR code, Apple Pay, or Google Pay.

Given that Splitit does not open a new credit line for consumers but rather divides payments on existing credit lines, the acceptance rate for in-store BNPL purchases is 90%, Paterson said.

The new offering lets merchants provide more financing options, which will presumably help boost sales.

“Many consumers like the fact that buy now-pay later is more predictable than an open-ended credit card balance,” Bankrate.com Analyst Ted Rossman said in an email. “With buy now, pay later, they know exactly how many payments they need to make, and exactly how much each one costs ... especially for a debt-averse consumer.”

Any credit card on the Visa, Mastercard or Chinese UnionPay card networks can use Splitit's in-store BNPL payment option even if they have never used Splitit before, Paterson said. The offering is aimed at mid- and high-cost purchases like furniture, jewelry, fashion and electronics but any retailer can offer the options, Paterson explained.

Despite a rise in e-commerce shopping due to the pandemic, many customers still prefer shopping in stores. Nearly 21% of customers prefer shopping in-store compared to 33% preferring an online shopping experience, according to a recent report by PayPal and BigCommerce.

E-commerce sales increased to $794 billion making up 14% of total sales volume in 2020, according to an eMarketer research report. Despite skyrocketing e-commerce sales, retail store purchases overshadowed online sales with a total sale volume of $4.71 trillion in 2020, the research stated.

Although in-store retail purchases fell by nearly 3% year-over-year (YoY) in 2020 due to the pandemic, they are expected to rebound in 2021 to $4.78 trillion, a 1.6% increase YoY, according to the eMarketer research.

“We have been hearing a lot of demand from our retailers about having an in-store buy now-pay later payment option and we have been working since the start of the year to give them that," Paterson said.

Splitit follows other BNPL companies like Sezzle, Laybuy and QuadPay in offering in-store deferred payment options to increase sales. One major hurdle for mass BNPL adoption is the lack of in-store options, Rightpoint Chief Commerce Officer Phillip Jackson said during an interview last month. “Companies need to be able to provide frictionless and similar payment channels for consumers for online and in-store purchases for the payment channel to stick.” It will also "help reduce abandoned sales," he said.

Some 70% of consumers are likely to spend more when shopping at a merchant that provides their preferred payment channels, the PayPal and BigCommerce report stated.

Global expansion plans

Splitit currently serves merchants in 35 countries and plans to expand its operations in all geographies that have credit cards, Paterson said. The company partnered with Tabby, a buy now-pay later payment provider in the Middle East last month to penetrate the market as a BNPL service provider, Paterson said.

“We plan on providing full services in our core markets (Australia, New Zealand, North America, Canada and Europe) and will white label our services for local service providers in other regions,” Paterson said.

The company is very focused on expanding its operations across the globe but is taking a cautious approach about how it plans to penetrate different markets, Paterson said.