U.S. senators put PayPal and Block on notice Thursday that they’re not satisfied with the companies’ responses to inquiries regarding how the companies reimburse customers involved in scams on their Venmo and Cash App payments apps, respectively.

In a letter to the CEOs of PayPal and Cash App, Sens. Elizabeth Warren of Massachusetts, Sherrod Brown of Ohio and Jack Reed of Rhode Island took the executives to task for inadequate responses to an earlier letter on the same topic, and urged them to follow another company’s lead in reimbursing victims of scams perpetrated using their tools.

It’s past time for the companies “to follow industry trends by providing similar reimbursements to wronged consumers,” the senators said in the Dec. 14 letters, which also called on the companies to answer a list of questions concerning their practices on this front.

The letters were to the recently appointed PayPal CEO Alex Chriss and to Cash App CEO Brian Grassadonia. The Venmo brand is owned by San Jose, California-based PayPal while the Cash App business is a unit of San Francisco-based Block.

The senators were doubling down on letters they sent to the companies in June. Warren, in particular, has been vocal about consumers falling prey to incidents in which they’re persuaded by fraudsters to make authorized payments to someone who may be impersonating a representative of a government, financial institution, utility or other business.

The peer-to-peer payments service known as Zelle, which is operated by Early Warning Services, has made a move to improve its response to such scams, according to a Thursday press release from the Senate Committee on Banking, Housing and Urban Affairs, of which Brown is the chairman.

Apparently referencing Zelle, the senators said it had taken an “important step” in seeking to reimburse victims of those types of imposter scams, the senators’ letters said, without naming the company. The lawmakers acknowledged they don’t have details of that new policy or what its impact has been. Nonetheless, they implored PayPal and Block to follow suit.

Millions of American consumers had been scammed using Zelle, with its bank partners, some of which are EWS owners, failing to provide redress, according to a New York Times report on the issue last year.

“We are extremely concerned that instant payment platforms are not taking reasonable, commonsense, and proactive steps to protect their customers,” the letters said.

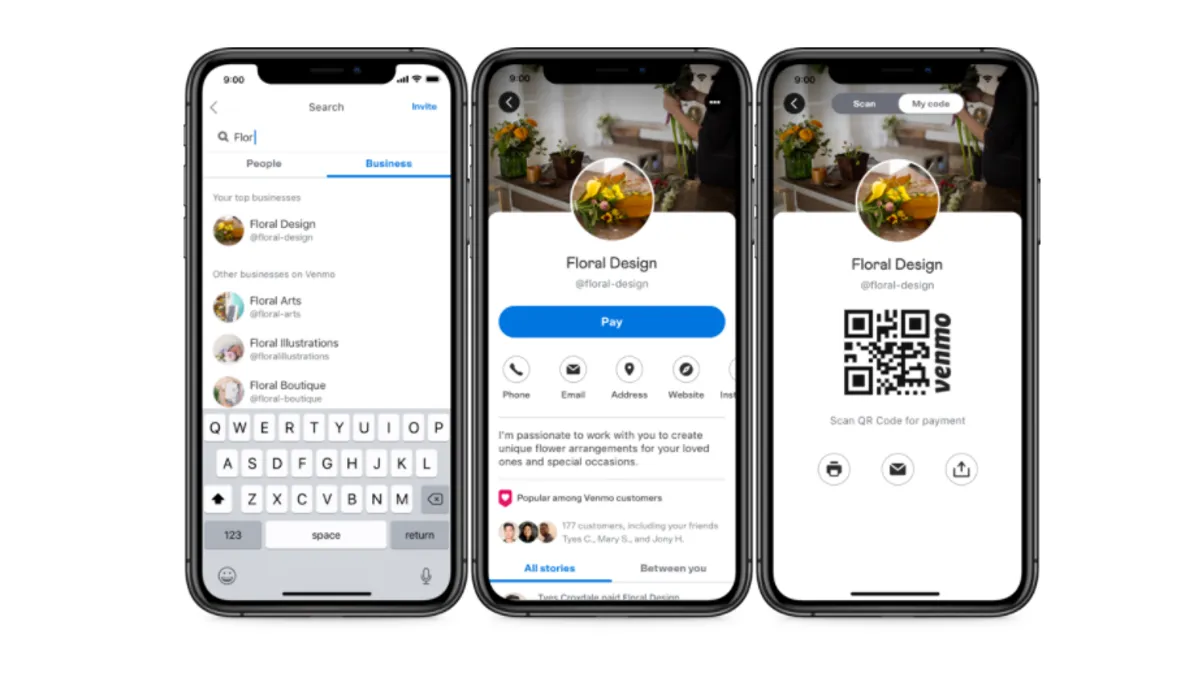

They noted that Venmo and Cash App are closed-end payment systems that should allow the companies significant insights into the account users. The companies “can both identify and block account holders who commit acts of deception and can take the crucial additional step to unwind these transactions,” the lawmakers said in the letters, encouraging them to consider measures to address and prevent “fraudulently induced” payments.

With respect to Cash App, specifically, the senators noted the company’s track record for addressing consumer complaints about unauthorized payments as well, alleging that it refunded customers for about 16% of such transactions reported, and about 19% of the dollar amount, while peers refunded higher amounts.

“We are concerned that Cash App’s refunds for unauthorized payments significantly lag behind its competitors,” the letter said.

Spokespeople for PayPal and Block didn't immediately respond to requests for comment.