Two Democratic senators raised concerns regarding a recent statement JPMorgan Chase made, indicating it would impose new checking account fees.

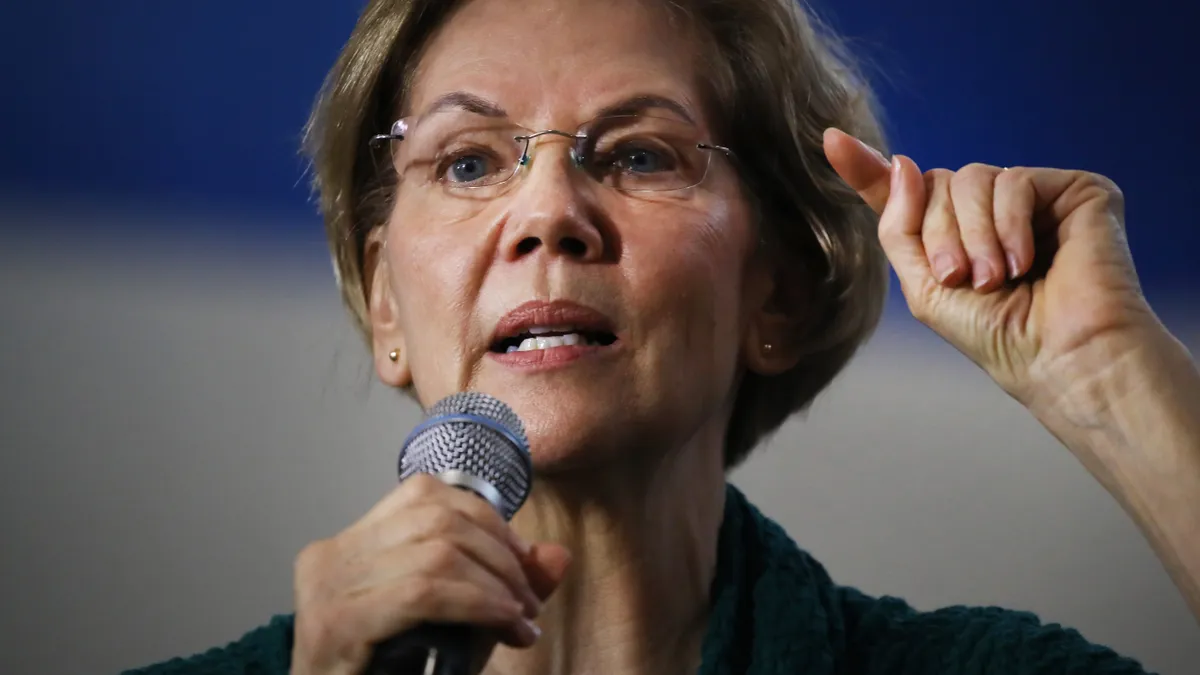

In a letter addressed to the bank’s CEO, Jamie Dimon, Sens. Elizabeth Warren, D-MA, and Chris Van Hollen, D-MD, called the potential new costs “outrageous,” especially contrasted against a record $49.6 billion JPMorgan notched last year in profit.

“JPMorgan Chase’s potential imposition of new costs on its customers in response to legal and long-overdue efforts to limit abusive fees — at a time when the bank is making record profits and funneling those profits straight into the pockets of its executives — is outrageous,” the senators wrote Friday. “JPMorgan Chase should put a hold on any plans to levy additional charges on working Americans.”

Marianne Lake, JPMorgan’s consumer and community banking chief, told The Wall Street Journal last month that the lender plans to counterbalance higher regulation costs by charging consumers for checking accounts and wealth-management tools if proposed regulations take effect.

“The people who will be most impacted are the ones who can least afford to be, and access to credit will be harder to get,” Lake told the publication.

The senators cited the Consumer Financial Protection Bureau’s finding that 9% of consumers pay roughly 80% of all overdraft and non-sufficient fund fees — and those 9% are often the most vulnerable.

The CFPB in January proposed cutting the overdraft fees charged by banks with $10 billion or more in assets to as low as $3 and as high as $14. The proposed rule requires banks to classify overdraft fees under extensions of credit, bringing them within the same consumer protections as credit cards. It would also force banks to disclose an annual percentage rate for these charges.

The proposed rule gives banks the choice to either make their own calculations or charge the benchmark amount set by the CFPB. The proposed changes aimed to reduce the $9 billion per year banks make in revenue from overdraft fees, according to the bureau’s estimates. That $9 billion total itself is down from $12.6 billion in 2019.

JPMorgan collected $1.1 billion in overdraft revenue last year and is channeling $30 billion to its investors through stock buybacks program, the senators wrote Friday.

“There is no justification whatsoever for imposing new fees on working families when your bank is hugely profitable,” the lawmakers wrote, calling the lender “the industry leader when it comes to usurious overdraft fees.”

In 2023, JPMorgan, Wells Fargo and Bank of America took in $2.2 billion in overdraft fees, according to a CNBC report from February that cited regulatory filings from all three banks. That figure is down roughly 25% — $700 million — from a year earlier, the broadcast outlet said.

Warren and Van Hollen argued that JPMorgan would lose 2% of its profits if it did not charge overdraft fees and asked if a 2% loss justifies imposing broad new rules on customers.

The senators asked what specific new fees the bank plans to impose after the CFPB rule is finalized and how JPMorgan plans to protect its low- and middle-income customers from the fees.

They also wanted an estimate of how much the bank would collect in overdraft fees under the CFPB’s rule and if the lender would reduce stock buybacks or executive pay instead of imposing the new fees. They’re seeking a response by Aug. 28.

Overdraft fees haven’t been the focus for a while, but they grabbed attention in 2021 and 2022, when a number of banks reduced or eliminated them altogether. Citi and Capital One were the largest banks to get rid of them, while Bank of America and Wells Fargo cut them back significantly.

JPMorgan, for its part, gave customers an additional business day to restore overdrawn accounts to $50 or less in the red before a fee was charged. Those changes are “not insignificant,” JPMorgan executives said at the time.

Warren and Dimon have frequently clashed when the CEO has appeared on Capitol Hill. In a hearing addressing overdraft fees in 2021, Warren famously called Dimon “the star of the overdraft show,” and asserted that JPMorgan would have made enough profit without collecting the fees.