In a wide-ranging, 2½-hour hearing Tuesday, Federal Reserve Chair Jerome Powell sought to reassure and update Senate Banking Committee members on the central bank’s positions regarding inflation, prospects for a Fed digital currency and an ethics scandal that may have contributed to three Fed officials' resignations.

Much of the hearing centered on inflation. Powell acknowledged the Fed could raise interest rates and start to shrink its $8.8 trillion portfolio of bonds and other assets this year.

"It is really time for us to begin to move away from those emergency pandemic settings to a more normal level," Powell said Tuesday. "We’re really just going to be moving over the course of this year to a policy that is closer to normal, but it’s a long road to normal from where we are now."

Analysts expect Fed officials to make three or four interest rate increases in 2022. At least two Fed regional presidents — Loretta Mester in Cleveland and Raphael Bostic in Atlanta — have said an increase in March would be appropriate.

At least two Republican senators Tuesday voiced concerns the central bank may be acting too slowly.

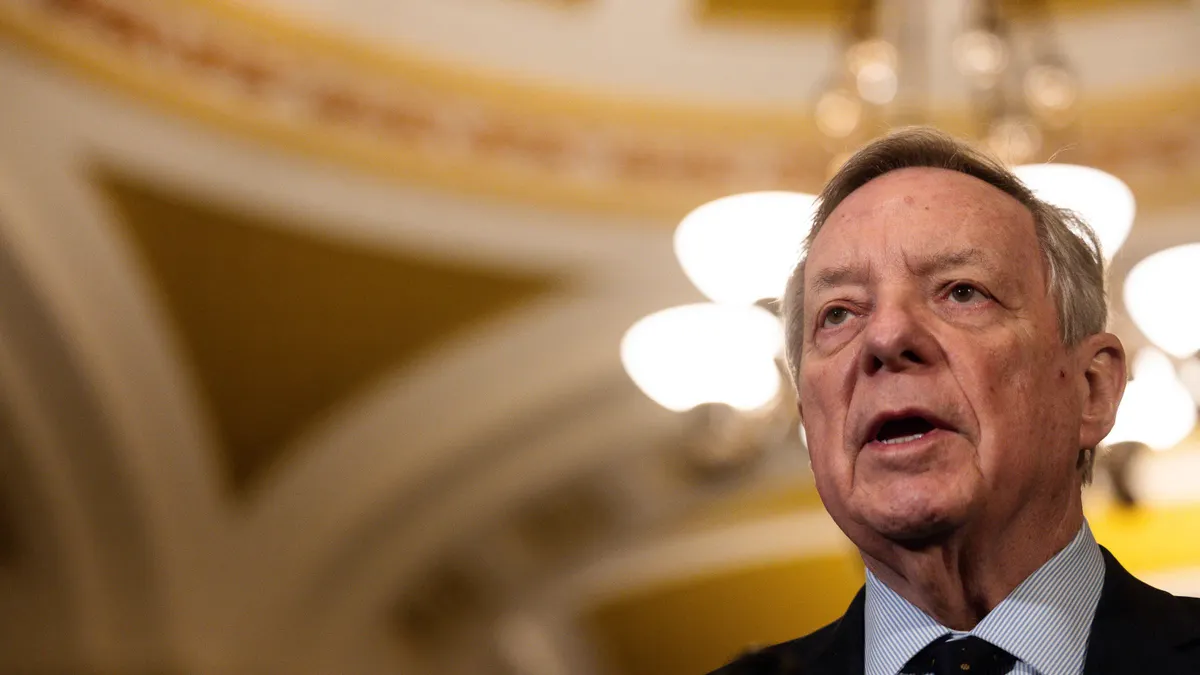

"I’m concerned that the Fed missed the boat on addressing inflation sooner," Sen. Richard Shelby, R-AL, told Powell on Tuesday. "A lot of us are. And as a result of that, the Fed under your leadership has lost a lot of credibility."

Sen. Pat Toomey, R-PA, the panel’s ranking member, said he worries the Fed’s monetary policy framework "has caused it to be behind the curve."

Powell outlined the potential repercussions of policy decisions to counteract inflation.

"If inflation does become too persistent, if these high levels of inflation get entrenched in our economy, and in people’s thinking, then inevitably that will lead to much tighter monetary policy from us, and it could lead to a recession, and that would be bad for workers," he said.

Ethics rules

Inflation wasn't the only area where the Fed's credibility came into question.

Powell said the Fed is "nearing completion" on an overhaul of its ethics rules, spurred on by financial disclosures in September and October that revealed the central bank’s outgoing vice chair and two regional Fed presidents engaged in stock-trading activity while also setting monetary policy at the start of the COVID-19 pandemic.

"We do take the need to protect our credibility with the public very seriously, and I think our new system is easily the toughest in government and the toughest I’ve seen anywhere," Powell said Tuesday.

The comments come less than a week after an amended disclosure revealed Fed Vice Chair Richard Clarida sold an exchange-traded fund Feb. 24, 2020, then re-bought it Feb. 27 — a day before Powell issued a statement signaling the central bank might cut interest rates. Clarida, whose term at the central bank was slated to end Jan. 31, resigned Monday.

Clarida was the third high-ranking Fed official to resign since September, following exits by Fed regional presidents in Dallas and Boston last year after they were connected to 2020 trading activity revealed in financial disclosure forms. The activity, uncovered in September and October, meets the Fed’s code of ethics but has generated blowback because of the information to which Fed officials are privy.

The Fed in October issued new rules to bar its board governors, 12 regional presidents and senior staff from buying individual stocks, holding investments in individual bonds or agency-backed securities, or entering into derivatives. Senior officials’ future investments would be limited to "purchasing diversified investment vehicles, like mutual funds," the central bank said.

Policymakers and senior staff, under the new rules, would have to provide 45 days’ notice before buying or selling any allowed securities, must obtain approval for those transactions, and must hold any investments for at least a year, the Fed said. "Further, no purchases or sales will be allowed during periods of heightened financial market stress," the central bank said.

The new ethics code "effectively ends any ability [by senior officials] to actively trade," Powell said Tuesday.

"There will be no ability to time the market," he said.

Sen. Elizabeth Warren, D-MA, took a moment to follow up with Powell on a letter she’d written Monday, asking the Federal Reserve to "release all available information" regarding Fed officials' stock trades by Jan. 17.

"You will get either a response or we’ll update you on where we are," Powell told her.

"I’d like to have a response," Warren pressed.

CBDC white paper

Powell also tempered expectations regarding the Fed’s oft-delayed white paper on central bank digital currencies (CBDCs).

He said the paper would be released "within weeks," adding, "it’s more going to be an exercise in asking questions and seeking input from the public, rather than taking a lot of positions on various issues … although we do take some positions."

Powell said last May that the Fed would deliver the paper in the summer of 2021 to kick off a public conversation. In July, he estimated the report’s release at September. At a September press conference, he said the report would arrive "soon." The timeline given Tuesday appears to have moved little since Powell told a Senate hearing in November the paper would surface in "coming weeks."

"We didn’t get it to quite where we needed to get it," Powell said Tuesday. "But it’s effectively there now, it’s within weeks [that] we will be publishing it."

When Toomey asked whether anything would keep a "well-regulated, privately issued stablecoin" from coexisting with a potential Fed digital dollar, Powell said "No, not at all."

Odds for renomination

Sen. Sherrod Brown, D-OH, the panel’s chair, told Bloomberg after the hearing he expected Powell would be confirmed for a second term by roughly the same tally as he was for his first term, which had an 84-13 vote.

"I don’t see more than a small, small handful of ‘no’ votes on the committee, and I can’t imagine there are that many on the floor," Brown said.

Warren said as early as September she would oppose Powell’s renomination. Sixty-eight of the senators who approved Powell’s first-term nomination are still serving.