PopID CEO John Miller aims to raise about $50 million in coming months for the software company as it attempts to scale its business that verifies consumer identity based on a photo of an individual's face.

Pasadena, California-based PopID has collected $25 million in funding so far, mainly from its parent company, which is CaliBurger restaurant holding company Cali Group, and its partners.

Launched four years ago, PopID's face-pay technology was initially used at the CaliBurger restaurants before it became popular at small and medium-sized restaurant chains in southern California college towns, Miller said, and it now has 85,000 users.

"You get 5,000 to 10,000 college students enrolling in the platform and then using it everywhere they go around campus, to buy pizza and tacos and haircuts," Miller said.

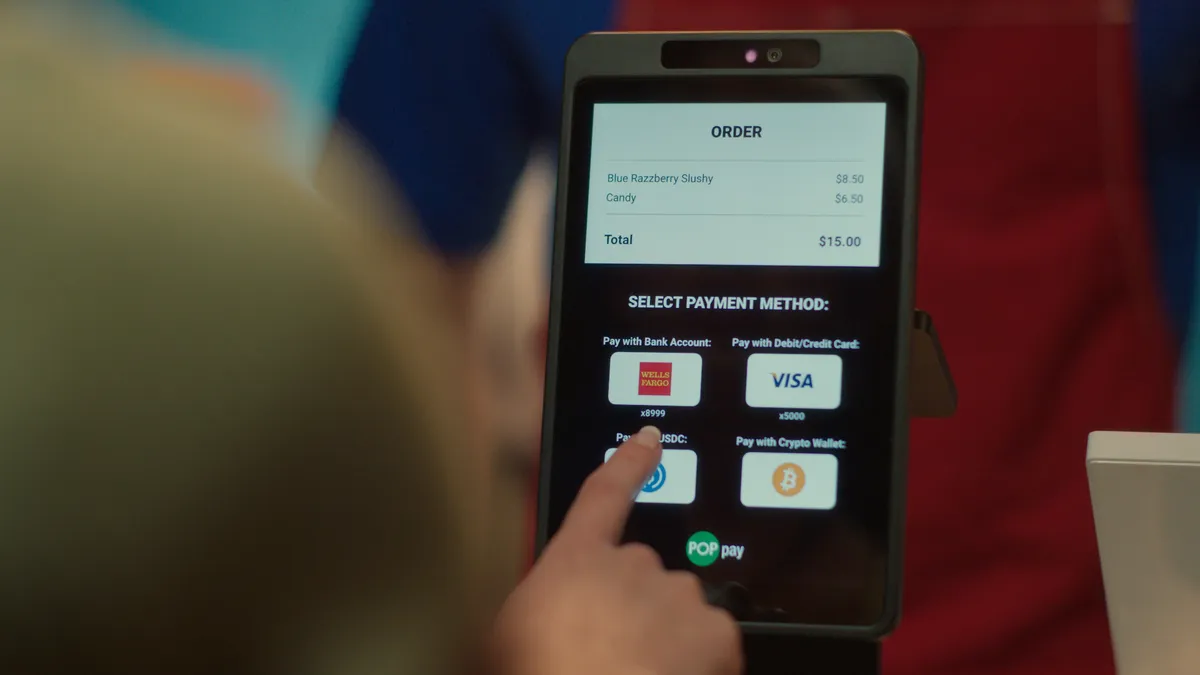

How it works: A user submits a selfie when enrolling with PopID's PopPay and links a credit or debit card to their account. When that user goes to pay at merchants using PopPay, a camera snaps a photo of the customer's face and brings up payment information linked to their account to complete the transaction. Photos taken at the point of sale are saved for 14 days for fraud purposes, Miller said. The payment method reduces merchants’ payment processing fees, Miller said, since PopID floats $50 to a user for them to spend, then charges their card once they’ve accumulated $50.

Miller acknowledged expansion plans – to establish more of a presence nationally and globally – are ambitious, so the company is targeting a funding round in the $50 million range that would close in early June. The exact timing, however, is likely to depend on the current market.

"Assuming the markets are healthy, we’ll raise capital," Miller said. "If the world falls apart, we’ll hunker down and just keep executing with our current balance sheet." In the latter case, PopID may opt to wait until September to raise more funds.

A fresh infusion of capital would go toward facilitating the company’s rollout in the U.S., as Miller targets partnerships with brick-and-mortar chains that offer national scale, and on the international stage through joint venture partnerships. Last fall, PopID partnered with SoftBank’s Japan Computer Vision to roll out PopPay software in some Wendy’s First Kitchen locations in Tokyo.

With its portfolio of companies focused on restaurant and retail tech, including Kitchen United and Miso Robotics, Miller’s Cali Group has invested "as much capital as we can in the early stages" before seeking outside investors, like Alphabet's venture arm GV, for later funding rounds to scale the businesses.

"I think we’ll do something similar with PopID," said Miller, who's dating actress Jennifer Garner.

Facial verification to enable payment has become popular in China with Alipay, and that has Miller confident the technology could become the favored payment method elsewhere in the world.

As the payment industry focuses on faster, frictionless experiences, the use of biometrics is poised to skyrocket. Amazon has brought its palm pay abilities to some Whole Foods locations. Recent data from Juniper Research revealed the use of biometric cards — with embedded fingerprint sensors — will jump over the next five years. Shipments globally are expected to total 173 million by 2026.

There is some hesitation, however, around such face-related technology. Consumer interest in paying this way remains limited: Only 16% of U.S. respondents said they're likely to pay via facial recognition rather than with a payment card, according to 451 Research’s VoCUL: Connected Customer, Disruptive Technologies 2022 survey. Gen Z and millennials showed the most interest, at 23% and 18%, respectively.

Limited consumer familiarity could suppress investor excitement, but "if facial biometrics vendors can showcase a robust ecosystem of hardware and software partners, this will help demonstrate to investors that there is a pathway for broader market adoption," said Jordan McKee, principal research analyst with 451 Research, part of S&P Global Market Intelligence.

PopID’s introduction on college campuses was strategic, Miller said, since Gen Zers "have grown up taking pictures of themselves to do everything and putting them all over the internet."

"There’s a generation of consumers that this platform makes a lot of sense for," and there are others Miller doesn’t expect will take to the idea. PopID will remain focused on its target consumers and the merchants that serve them, which is often fast-food chains, Miller said.

In response to the technology, Illinois, California, Texas and Washington have enacted biometrics-related laws, while Oregon has statutes related to facial recognition. The Internal Revenue Service recently backed off a plan to have taxpayers submit selfies to log into online accounts, NPR reported.

Miller referred to PopID’s technology as "face verification," and stressed consumers opt-in to the service. "We only take your picture and do biometrics at the point of sale if you say, affirmatively, I want to check in with PopPay, or I want to use PopPay to checkout," he said.

The company's approach is fundamentally different from what those states have regulated, which relates to surveillance and lack of consent, Miller argues. In states that have enacted laws to regulate facial recognition technology, "we’ve gone into the market to very clearly distinguish what we’re doing, written our terms and conditions to make it crystal clear that this is opt-in, consent only," he said.

Still, Miller added, the company has spent a fair amount of time reviewing the statutes with lawyers. While he said they’re confident such statutes don’t apply to PopID, Miller acknowledged the public will continue to have questions and the regulation of facial recognition technology will be a recurring issue.

"We have to distinguish ourselves to make sure people understand we’re sort of the pro-consumer face ID brand," Miller said.

Educating consumers on the security and potential benefits of biometric payments will be key to furthering interest in the payment tech, McKee said.