Dive Brief:

- PayPal disclosed Thursday that the Securities and Exchange Commission is looking into its development of a stablecoin, which is a digital currency typically pegged to a fiat currency, in this case, the U.S. dollar.

- The digital payments company said in a quarterly regulatory filing Thursday that it received a subpoena from the enforcement division of the federal agency on Wednesday requesting documents related to the matter. PayPal said it’s cooperating with the SEC.

- Separately, PayPal disclosed it received a civil investigative demand from the Consumer Financial Protection Bureau last month seeking documents related to how the company probes and resolves errors governed by electronic fund transfer rules; how it handles transactions with customers’ linked bank accounts; and related matters, the filing said. The company said it’s also cooperating with that inquiry.

Dive Insight:

Specifically, the company disclosed this regarding the SEC demand: “On November 1, 2023, we received a subpoena from the U.S. SEC Division of Enforcement relating to PayPal USD stablecoin.”

The San Jose, California-based company, which caters to consumer and merchant customers online and in-store, has struggled in recent years to enable its well-known brand to deliver bigger profits. PayPal has about 428 million active users, including about 35 million merchant accounts, with annual payment flows of about $1.5 trillion, according to the financial firm William Blair, which follows the company for its investment clients.

PayPal is juggling the federal government probes as it recalibrates its corporate strategy under new leadership, with Alex Chriss taking over as CEO in September from long-time leader Dan Schulman.

In an earnings call with analysts Wednesday, Chriss explained in his first public remarks as CEO how he plans to refocus on profitable growth. He didn’t mention the SEC and CFPB investigations. A spokesperson for the company declined to comment beyond the quarter filing.

Schulman had previously extolled the benefits of PayPal’s stablecoin program. During a September investor conference he called it potentially one of the “most important” moves the company will ever make. He said stablecoins would likely shape the future of payments, alongside government-issued central bank digital currencies.

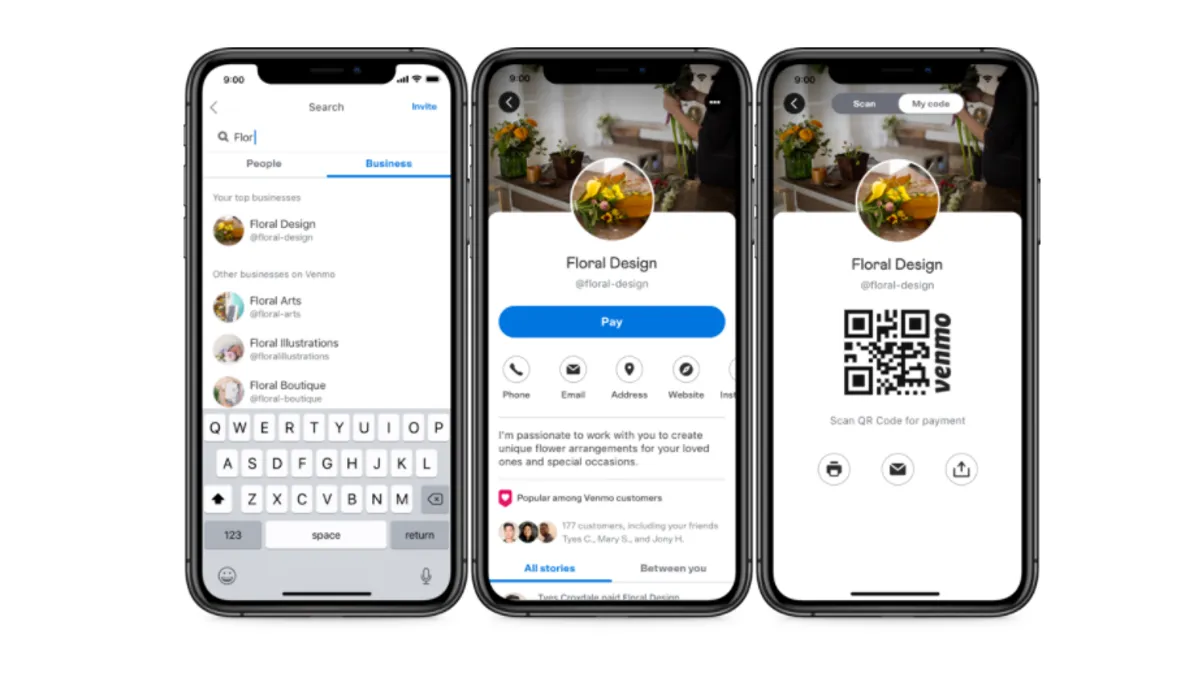

In August, PayPal hooked up with a third-party issuer, Paxos Trust Company, to launch the stablecoin PayPal USD for use by U.S. customers. The following month, the stablecoin became available to users of PayPal’s peer-to-peer payments app Venmo as well, the filing said. The stablecoin was built on the blockchain system operated by cryptocurrency company Ethereum.

In the filing, PayPal separately noted that the legislative and regulatory environments that pertain to stablecoins are changing quickly and that the company risked possible enforcement actions, potential fines and “reputational harm” if it or its partner failed to meet regulatory requirements.

With respect to the CFPB probe, PayPal said this: “In October 2023, we received a CID from the CFPB related to investigation and error-resolution obligations under Regulation E, the presentment of transactions to linked bank accounts, and related matters.”

Reg E establishes the “rights, liabilities, and responsibilities of participants in electronic fund transfer systems,” according to the Federal Reserve, which issued the rule under the Electronic Fund Transfer Act.

In addition to seeking documents from PayPal, the CFPB asked the company for responses to written questions, according to the filing.

Previously, PayPal had disclosed that it received civil investigation demands from the CFPB seeking documents related to Venmo’s “unauthorized funds transfers and collections processes, and related matters, including treatment of consumers who request payments but accidentally designate an unintended recipient.” PayPal said it’s also cooperating with that investigation.