Dive Brief:

- Digital payments company PayPal started offering its buy now-pay later (BNPL) and credit services in recent weeks to merchants who develop their websites through Wix, the companies said today. The initial roll-out was last month, but the companies announced the new aspect of their partnership today in a press release.

- San Jose-based PayPal has partnered with Tel Aviv-based Wix and its merchants since 2018, but as of Nov. 11, the merchants also gained access to the PayPal 'Pay in 4' and PayPal Credit tools, plus related messaging, said PayPal Spokesperson Joe Gallo. Wix merchants in the U.S. will be the first with access to the tools followed by those in the U.K. and France in "coming months," the release said.

- “As we head into the holiday shopping season, business owners need to do everything they can to increase their sales conversions and offering Pay Later solutions is one way to do it,” PayPal's Global Pay Later Vice President Greg Lisiewski, said in the press release. “Businesses need help in order to recover from the past 18 months — and by providing PayPal Credit and Pay in 4, they have one more tool to do so.”

Dive Insight:

The bump for yearend holiday shopping this year follows on a rise in e-commerce transactions last year as the COVID-19 pandemic boosted buying from home. Retail spending from last Friday, the Black Friday shopping extravaganza following Thanksgiving, through Sunday (excluding auto transactions) climbed 14% over the same period last year, according to data from card company Mastercard.

While in-store spending rose 16.5% over last year, e-commerce outlays increased only 4.9% as shoppers returned to in-person shopping. That was a reverse from last year when online spending surged after the deadly virus arrived in March. Last year, e-commerce shopping during the same period jumped 28.7% over 2019 while in-store transactions edged up just 1.6%, Mastercard said.

In an interview with CNBC Tuesday, PayPal CEO Dan Schulman called his company one of the top BNPL players in the world even though it just got into the arena a few years ago. He said that BNPL transactions more than quadrupled this year on Black Friday, with some 750,000 such transactions that day. That contributed to the company cresting more than $1 billion in monthly BNPL transactions in November for the first time, he said.

PayPal and other online payments companies have rushed to cater to the surge in online commerce, developing new tools, like BNPL, for consumers and seeking out new ways to be part of their digital wallets.

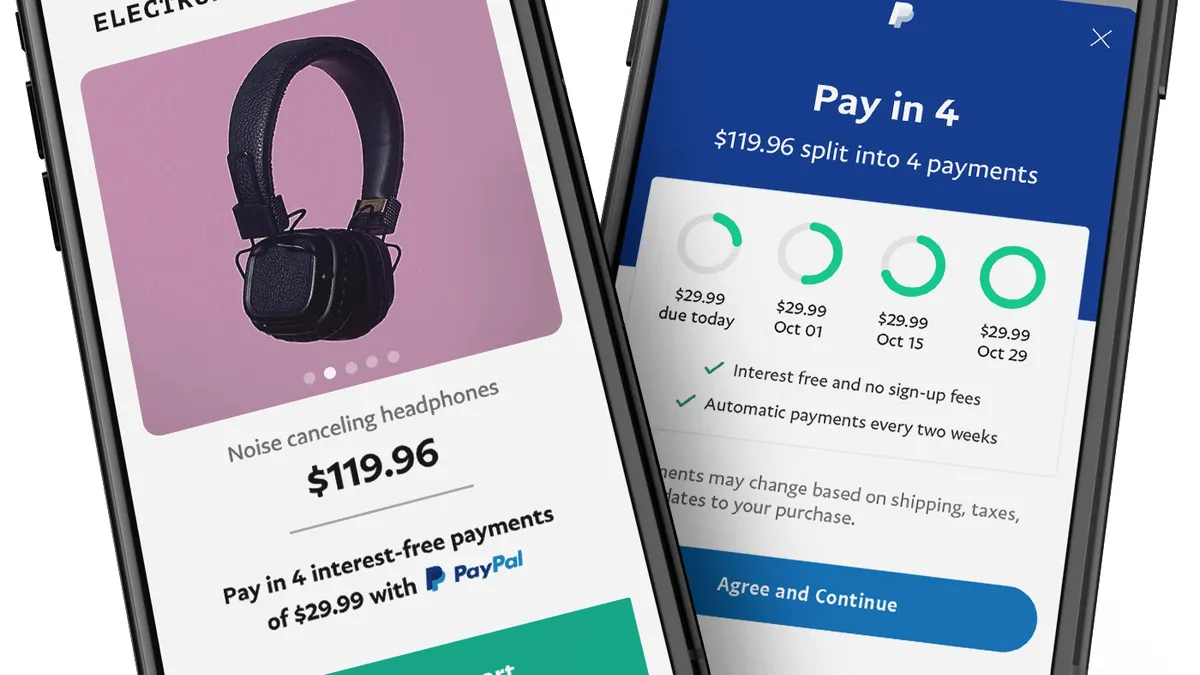

In its latest move, PayPal is keeping up with a growing list of BNPL companies seeking to attract online customers gravitating to their interest-free installment financing. Consumers that tap the PayPal 'Pay in 4' button can make four equal payments, starting at the date of purchase, over six weeks every two weeks without paying any interest fees. With PayPal Credit services, consumers can receive financing over six months with no interest on purchases of $99 or more.

PayPal first made the 'Pay in 4' services available in the U.S. at the end of August last year after having rolled the offering out in France in June 2020, Gallo said by email. In October of this year, the company dropped BNPL late fees on new purchases in the U.S.

Gallo declined to comment on how many Wix merchants PayPal works with or how much the company anticipates the new extension to Wix might increase transactions.

Wix mainly caters to small and mid-sized businesses that set up their own online businesses. It has 215 million registered users that are businesses, artists, organizations and individuals, according to a company earnings press release last month. "Wix caters to a variety of global businesses and sizes ranging from a single-person operation to multi-million dollar businesses," Wix Co-head of Payments Amit Sagiv said in an emailed statement.

PayPal's new Wix extension comes as competition from BNPL is mounting. Swedish rival Klarna also teamed with Wix in October to offer BNPL services to those merchants.

The BNPL trend has gained momentum over the past decade with Afterpay building a clientele from Australia and Klarna spreading such services across Europe, with a worldwide uptake in recent years.

Now players that drew a following outside the U.S., including Klarna, Afterpay and Zip, have arrived in the country to compete with homegrown BNPL providers such as PayPal and Affirm.

To gain traction, some companies are making acquisitions, including PayPal's $2.7 billion acquisition of Tokyo-based Paidy earlier this year and rival Square's $29 billion purchase of Melbourne-based Afterpay.

Afterpay Co-CEO Nick Molnar said in an interview earlier this year that he believes it’s “early days” for BNPL with only 2% penetration or less across the world market.

Correction: The story has been updated to reflect Zip's acquisition last year of QuadPay, a U.S.-based business that was then rebranded with the Zip name.