Dive Brief:

- Digital payments pioneer PayPal today introduced a new, monthly buy now-pay later payment option that gives consumers a longer period of time over which to pay for larger purchases, the San Jose, California-based company said in a press release.

- Customers will be able to use the new monthly BNPL service at millions of retailers, including for Outdoorsy, Samsonite and Fossil products as well as at Advance Auto, the June 15 release said.

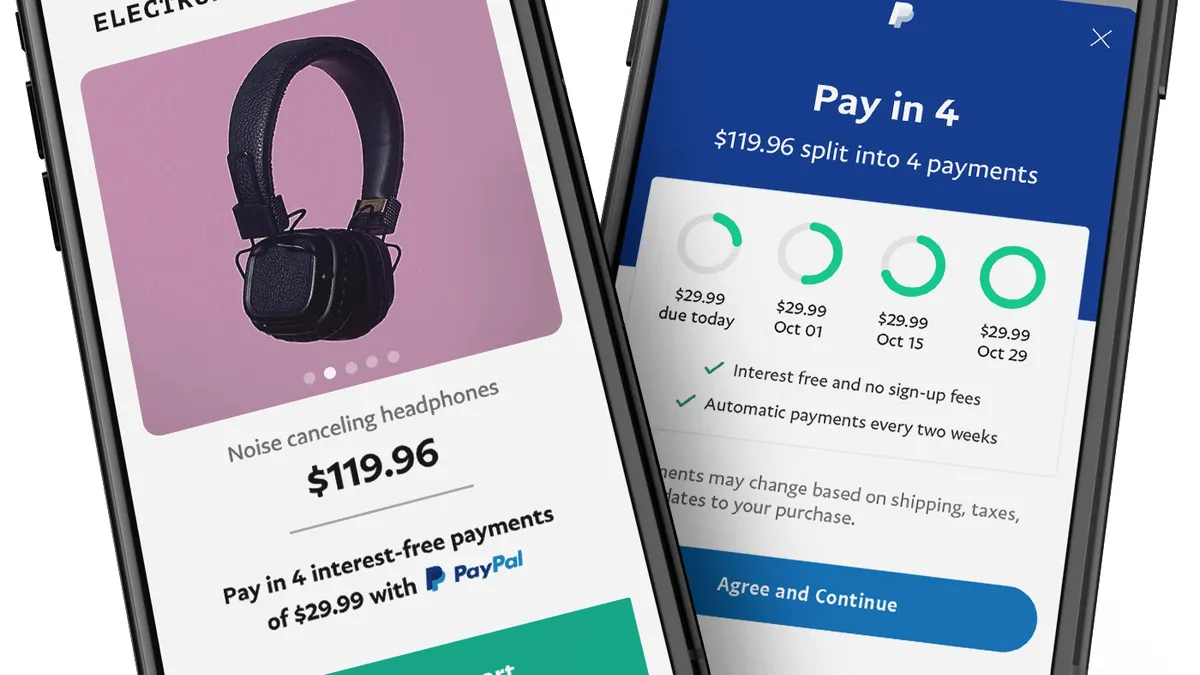

- “Pay Monthly is a new way for customers to make large purchases between $199-$10,000 and lets them break the total cost into monthly payments over a 6–24-month period, with the first payment due one month after purchase,” according to the release.

Dive Insight:

PayPal’s new monthly financing option expands on its existing BNPL portfolio, which already includes an option to pay in four installments and a more traditional PayPal credit financing option. Some 22 million of PayPal’s customers used its “flexible payment options” in the past year, the company said.

The new monthly BNPL financing will be offered via WebBank, a Salt Lake City-based FDIC-insured, state-chartered bank, and it will be subject to credit approval. In the past, PayPal has also linked with other banks to offer its BNPL financing. For instance, its PayPal Credit financing is offered by Synchrony Bank and is tied to a credit card account that lets consumers pay for purchases immediately or over time.

PayPal is expanding its BNPL financing just as deteriorating U.S. macroeconomic conditions, including soaring inflation, raise the possibility more consumers will need credit to cover their expenses, but those same factors also increase the potential for consumer delinquencies and defaults.

PayPal has been eager to expand and upgrade its services, including those it offers at checkout, as it seeks to better compete with a slew of young fintechs arriving on its payments turf. In particular, there are a host of new companies offering various BNPL options, but most of those companies have yet to turn a profit.

PayPal’s new offering, called Pay Monthly, will be automatically available to its merchants free of charge, PayPal said. As is the case with its existing four-installment financing, merchants can add messaging to let customers know early in their shopping that they will have an option to spread out payments at checkout.

“Pay Monthly builds on our commitment to deliver leading payment solutions that offer customers choice to ensure checkout matches their needs and budgeting preferences,” PayPal’s Global Pay Later Products Vice President Greg Lisiewski said in the release.