A PayPal vice president last week defended the digital payments pioneer’s position in the competitive buy now-pay later space, maintaining the company is just as popular with young shoppers as its rivals are.

Greg Lisiewski, PayPal’s vice president of global pay later products, seemed to take issue with other installment payment providers branding themselves as the BNPL company for Gen Zs or millennials. Lisiewski, speaking during a Sept. 15 appearance at the Autonomous Research virtual Future of Commerce Symposium, also noted he recently heard San Jose-based PayPal called a “legacy fintech.”

“The reality is, PayPal has as many millennial and Gen Z customers as any player in the market. Actually probably more,” he argued, during a webcast of the conversation. “We just also happen to have a lot of other people in our book.” He noted the company has between 20 and 40 million Gen X and older customers.

Lisiewski acknowledged the competition PayPal faces in the BNPL market, especially among those vying for larger merchants’ business. San Francisco-based Affirm, Swedish Klarna, Block-owned Afterpay and Australian Zip are other big players in the space.

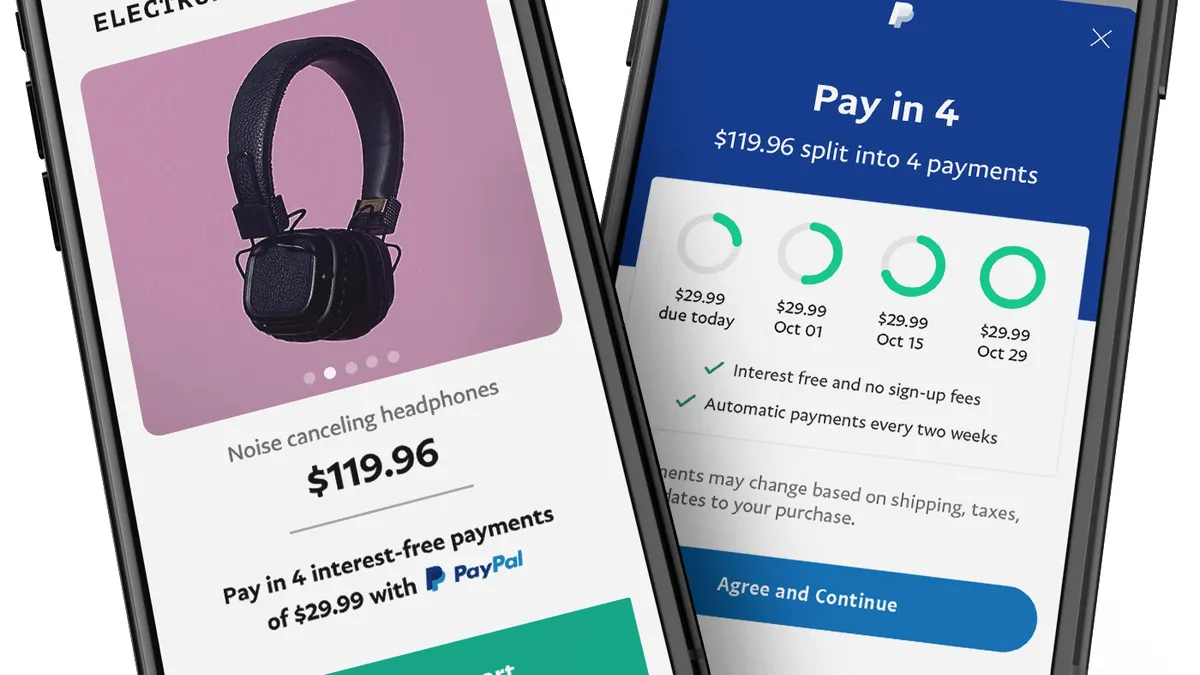

For its part, PayPal debuted its Pay in 4 offering in October 2020, and about 22 million customers have used its installment payments options, Lisiewski said. The company added a Pay Monthly offering in June.

“I think it’s fair to say, there’s only so many ways to say, four payments of $25 for a $100 purchase,” he said. But he touted PayPal’s longevity and the trove of data available from some 400 million customer accounts. That proprietary data allows the company to maximize approval rates while lending responsibly, he said.

“There’s undoubtedly consolidation going to happen in the marketplace — that’s starting or has already happened,” Lisiewski said of the crowded BNPL market. “We’re not going anywhere. … We present zero operator risk in terms of longitudinal survival.”

Competition in the payments sector has taken a toll, though. Earlier this year, PayPal lowered its growth goals for 2022, recorded a second-quarter net loss and revealed activist investor Elliott Investment Management has a $2 billion stake in the company.

As the company bets on BNPL growth, Lisiewski called out PayPal’s move to add BNPL as a feature within its digital wallet. That’s resulted in user growth across generations and verticals, given the prevalence of the company’s payment button at online checkouts, Lisiewski said.

Between 70% and 80% of its customers are still using pay later products after six months, he said. In light of macroeconomic challenges such as inflation, PayPal is keeping a close eye on when and how its BNPL customers are making payments, Lisiewski said.

With the Pay in 4 model, “because the durations are so short, you have really great insights into first payment default, which is always a leading indicator of how a loan’s going to end up,” he said.

The majority of BNPL installment payments are made with debit cards or by bank or ACH transfer, Lisiewski noted, but PayPal does accept credit cards. “We’re paying attention to the mix,” he said. An increase in the share of payments made with credit cards “would be a sign of something worth looking at,” he added.