UPDATE: March 30, 2021: PayPal is set to announce Tuesday it has begun to let U.S. customers use their cryptocurrency holdings to pay for purchases at some of its merchants. The rest will accept digital currencies in the coming months, the company said.

“This is the first time you can seamlessly use cryptocurrencies in the same way as a credit card or a debit card inside your PayPal wallet,” President and CEO Dan Schulman told Reuters ahead of a formal announcement.

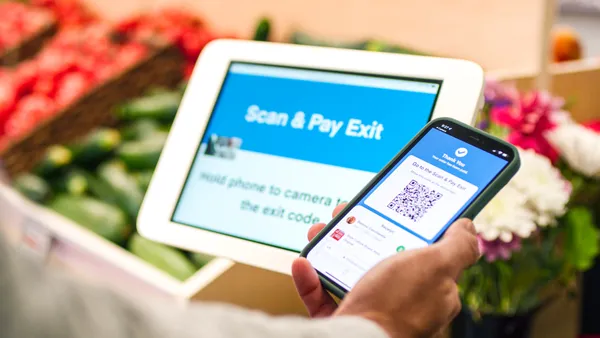

Through Checkout with Crypto, PayPal will convert consumers' Bitcoin, Ethereum, Bitcoin Cash and Litecoin holdings into fiat currencies when they place their orders. That cuts the risk merchants assume from any volatility in cryptos’ value.

Bitcoin, for example, has jumped tenfold in value in the past year, according to Yahoo Finance, and fivefold since Oct. 21, the date PayPal announced it would let customers buy, sell and hold cryptocurrencies and eventually pay with them.

“We think it is a transitional point where cryptocurrencies move from being predominantly an asset class that you buy, hold and or sell to now becoming a legitimate funding source to make transactions in the real world at millions of merchants,” Schulman told the wire service.

PayPal’s product rollout comes less than a week after Tesla said it would start accepting Bitcoin as payment. However, Tesla said it would hold the Bitcoin used in transactions rather than convert it to cash.

PayPal customers paying in crypto can only use one type of coin per purchase, the company said, adding it would charge no transaction fee.

Dive Brief:

- PayPal's U.S. account holders will be able to buy, sell and hold cryptocurrency in their PayPal digital wallets in the coming weeks, and use digital coins to pay for purchases at the 26 million merchants on the company's payment network beginning early next year under an effort the company launched Wednesday.

- The company plans to expand those services to peer-to-peer subsidiary Venmo and international markets in the first half of 2021, it said.

- New York's Department of Financial Services also Wednesday granted PayPal a conditional BitLicense to offer the services through a partner firm, the crypto brokerage Paxos Trust Company. The state regulator aims to encourage more companies to enter the virtual currency space.

Dive Insight:

Traditional finance companies and governments have long held digital currencies at arm's length, painting them as niche fascinations. While crypto's volatility may be attractive to traders, it's exactly that quality that has made banking and payment titans reluctant to hang their balance sheets on it.

Wider crypto acceptance from PayPal — with 346 million active accounts worldwide and $222 billion in second-quarter payments processed — may convince other major players to double down on their investments in digital currency.

"The shift to digital forms of currencies is inevitable, bringing with it clear advantages in terms of financial inclusion and access; efficiency, speed and resilience of the payments system; and the ability for governments to disburse funds to citizens quickly," Dan Schulman, PayPal's president and CEO, said in a press release Wednesday. "We are eager to work with central banks and regulators around the world to offer our support, and to meaningfully contribute to shaping the role that digital currencies will play in the future of global finance and commerce."

To be sure, fintechs such as Square and stock trading app Robinhood already allow users to buy and sell cryptocurrencies. Square has offered Bitcoin support through its Cash App for more than two years. The company said it saw $875 million in Bitcoin revenue generated through the Cash App between April and June, a 600% increase year over year, the Financial Times reported. This month, Square invested $50 million in Bitcoin, while earlier, software company MicroStrategy put all of its $425 million in cash reserves into the digital coin.

But PayPal's size gives it the clout to create a domino effect, analysts said.

"There's no comparison with regards to the potential exposure between the upside of PayPal offering this, and the upside of any similar previous offering," Joseph Edwards of London-based crypto brokerage Enigma Securities, told Reuters.

"PayPal, with 300 million users, can be the bridge from traditional payments to cryptocurrencies by telling users, 'Here's an easy way to get into cryptocurrency; we can onboard you,'" Douglas Borthwick, chief marketing officer at blockchain trading platform INX Ltd., told American Banker.

"We have crossed the Rubicon," former hedge fund manager Mike Novogratz tweeted Wednesday, adding that banks will now race to service digital currencies.

Until now, PayPal would let users transfer funds in and out of cryptocurrency platforms but not hold or trade crypto directly within its own app.

With that said, there will be limits. Users won't be able to transfer coins in and out of accounts and can only hold cryptocurrencies they bought on PayPal, the company said, according to Bloomberg. The payment network will accept four digital currencies: Bitcoin, Ethereum, Litecoin and Bitcoin Cash. There will be no service fees for buying or selling cryptocurrency until Jan. 1, and no fees for holding cryptocurrency in a PayPal account, the company said.

On the merchant side, PayPal will manage the risk of crypto's price fluctuations. Merchants will receive payments in virtual coins, but transactions will be settled using traditional currencies, such as the dollar.

"We are going about it in a fundamentally different way to make sure we provide the maximum amount of safety to our merchants," Schulman told Reuters.

PayPal, over the past year, has been hot and cold on crypto. The company was among the original 28 backers of Facebook's Libra development, but last October became the first of several firms to withdraw from the project.

It signaled its interest in the space in March, telling the European Commission in a letter that it was "continuously monitoring and evaluating global developments in the crypto and blockchain/distributed ledger space," and that it hoped the technology could "achieve greater financial inclusion and help reduce [or] eliminate some of the pain points that exist today in financial services."

Traditional banks and regulators showed a gradual warming to virtual currency this year. JPMorgan Chase this spring extended banking services to two crypto exchanges, Coinbase and Gemini. Meanwhile, the Office of the Comptroller of the Currency in July clarified that national banks are allowed to provide cryptocurrency custody services, as well as hold unique cryptographic "keys" on behalf of customers.

Although the Federal Reserve Bank of Boston announced in August it is partnering with researchers at the Massachusetts Institute of Technology to build and test a hypothetical digital currency, Fed Chair Jerome Powell said Monday the central bank hasn't "made a decision to issue one," adding that more work needs to be done, along with "extensive" public consultation with stakeholders

Payment networks, too, have made strategic strides this year in broadening their crypto footprint. Visa built links to 25 digital currency wallets enabling users to spend from their crypto balance using a Visa debit or prepaid card. The crypto platform Wirex partnered with Mastercard to launch a card that gives users 1.5% back in Bitcoin for in-store purchases.

PayPal's maneuver puts it one step closer to the actual exchange of crypto than Mastercard. A Mastercard licensee like Wirex "will hold cryptocurrencies on behalf of consumers and issue Mastercard payment products," Eric Grover, a principal with Intrepid Ventures, told American Banker. "PayPal is a network but also an issuer. It will hold cryptocurrencies on behalf of PayPal users."