The embattled CEO of PayPal, Dan Schulman, plans to retire at the end of the year, after the digital payments pioneer has struggled in recent years to meet growth goals and beat back mounting competition.

Schulman said he spoke multiple times with PayPal’s board about the company’s succession plan and informed the directors recently that he intended to exit at yearend to give them enough time to find his replacement, he told analysts on an earnings call today. He noted that his decision comes shortly after he turned 65, and said he would be flexible if the board asked him to stay longer.

There recently had been speculation from analysts that he might retire soon. Schulman also said that he looks forward to continuing to be on the company’s board. “I will remain fully focused on maintaining our momentum and executing on our plan,” he told analysts on the call.

Schulman took the top post at the payments behemoth as CEO-designee in 2014, and added CEO and president titles formally in July 2015. Nike CEO John Donahoe has served as PayPal’s board chair for that period.

“It’s never a good time to retire because it’s always a bittersweet moment,” Schulman said. But he went on to say he has a lot of interests outside of work that he’d like to pursue.

He also noted it seemed to be an appropriate time to leave the company. “We feel that 2023 is shaping up to be a strong year,” he said. At one point, he also called it a potentially “transformational year.”

Indeed, the company reported that fourth-quarter net income rose 15% to $921 million on a 7% increase in net revenue to $7.38 billion, according to the earnings release. Meanwhile, operating costs for the quarter rose 4.6% to $6.14 billion.

Results for the full year of 2022 were less impressive. Net income sank 42% to $2.42 billion as revenue climbed 8.5% to $27.5 billion.

End of long CEO tenure

Schulman’s “decision to retire marks the end of a remarkable run that has seen impressive accomplishments in establishing PayPal as one of the world’s most trusted brands and as the leader in democratizing the management and movement of money,” Donahoe said in a press release Thursday. “He has delivered for our shareholders and other stakeholders.”

Schulman’s exit doesn’t have anything to do with any disputes with PayPal, the company said in a regulatory filing Thursday.

While the release pointed to PayPal’s market capitalization outpacing the Standard & Poor’s 500 Index since Schulman began leading the company after it’s separation from EBay, stockholders have been disappointed more recently. The shares have declined about 34% over the past year.

“Dan's had notable success in growing (PayPal) materially over the years, however the change may remove an overhang for some investors given recent/post-pandemic volatility,” Darrin Peller, an analyst with Wolfe Research, said in an investment note to clients.

Competition mounted

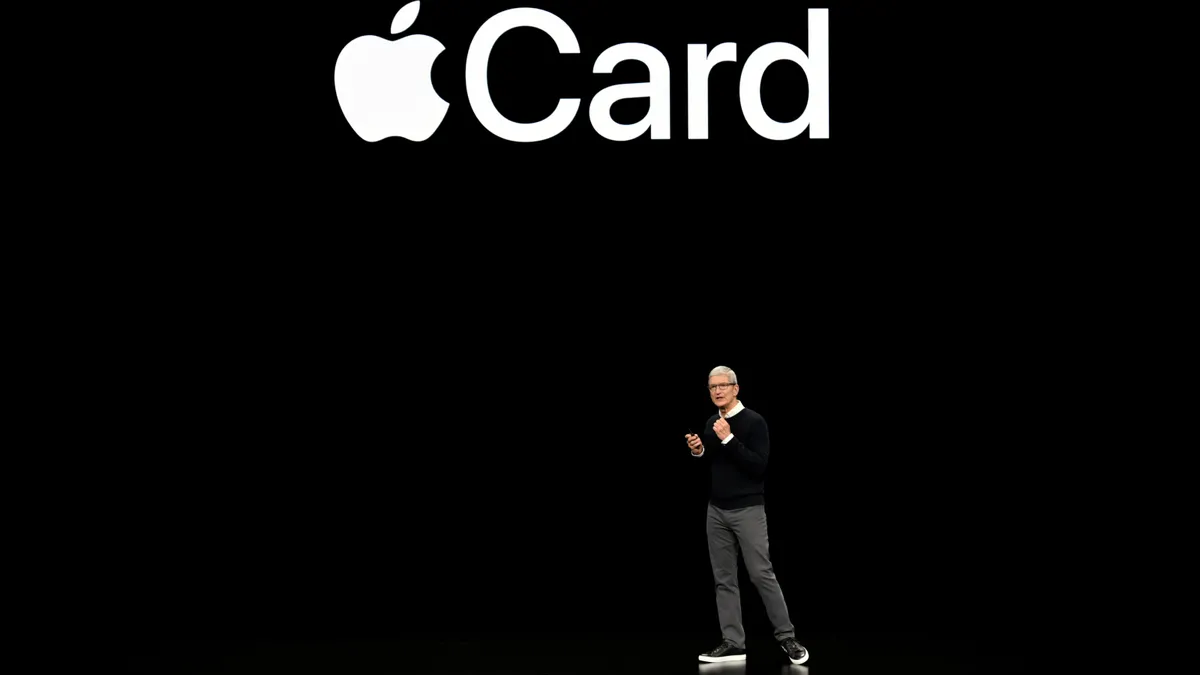

Rising competition has been a big part of PayPal’s challenges. In addition to tech heavyweights like Apple increasing their payments plays, the company has had to contend with a pack of expanding digital wallets, including Block’s Cash App, as well as buy now, pay later providers, including Klarna and Affirm.

PayPal was trying to regain its footing last year after falling short of growth goals in 2022, and then came under more pressure from a large new investor, the activist investment firm, Elliott Investment Management. As that firm began leaning on the company, Schulman staked out PayPal priorities that included streamlining the checkout process; eliminating a reliance on passwords; and drawing more consumers to its buy now, pay later services.

PayPal had 400 million active consumer accounts and 35 million active merchant accounts as of the end of the year, according to the annual filing it made with the Securities and Exchange Commission on Thursday.

Several years ago, PayPal aimed to collect 750 million consumer accounts by 2025, but it scrapped that plan in favor of stoking more user engagement. “Given our strategic focus we do not expect total active accounts to grow in 2023," the company's acting chief financial officer, Gabrielle Rabinovitch, told analysts on the call.

With respect to the company’s market share in checkouts specifically, Schulman told analysts: “As I look across the world, there are some places where we’re gaining a lot of share, some places like the U.S. where we’re probably holding, and other countries where we’re losing a little bit but overall steady in terms of our market share.”

His challenges mounted last year when the U.S. economy began sagging under the weight of rising inflation and higher interest rates that led consumers to reduce their spending. In the wake of those economic headwinds, companies have cut tens of thousands of workers.

PayPal was among them, eliminating 2,000 jobs, or about 7% of its workforce last month. The company had 29,900 employees as of the end of the year, including 44% in the Americas, according to the annual filing, compared to 30,900 as of the end of 2021.

As the board seeks Schulman’s successor, PayPal is also waiting on the return of its chief financial officer. Just weeks after PayPal appointed Blake Jorgensen as CFO last August, he left for medical reasons. Rabinovitch has been acting CFO since then, in addition to serving as senior vice president of investor relations and treasurer.