Battles over card interchange fees, also known as swipe fees, will take center stage again this year, with payments industry forces clashing over them in Washington, at state capitols and in the courts.

While retailers, merchants and consumer advocates seek to rein them in, bank card issuers and partner networks are poised to push back, promising an escalation of tension over credit and debit fees.

“That is a topic that will continue to get a lot of attention in 2024,” said Andrew Bigart, an attorney specializing in payments at the law firm Venable in Washington.

The proposed Credit Card Competition Act is ground zero for the fight. That congressional legislation aims to lower fees by introducing more competition into the processing of credit card payments. It would require bank card issuers to give merchants access to an alternative network to Visa and Mastercard, which dominate the industry.

Republican Sen. Roger Marshall, a sponsor of the bill, has vowed to maintain his crusade to bring the bill to a floor vote. On the other side, Electronic Payments Coalition Executive Chairman Richard Hunt said late last month that his organization is fully funded to fight it.

“I really think that if we get this to the Senate floor, we have the votes to pass it because it’s the right thing to do,” Marshall predicted last month in an interview with Payments Dive.

For debit transactions, the Federal Reserve is also steering a path through the warring interests this year in considering a proposal to lower the cap on interchange fees that can be imposed when consumers use debit cards.

At the state level, some legislators are taking matters into their own hands, passing new laws that restrict the surcharges merchants can impose to recoup credit card processing costs. Such laws were passed in New York last month, and in New Jersey in August, with more states potentially following suit.

While the state laws increase pricing transparency for consumers by restricting the growing use of surcharges, they also hand a win to the card companies seeking to cap amounts merchants can add to transactions.

Visa and Mastercard have made progress in resolving decade-old litigation brought by merchants over such fees, but new lawsuits keep popping up. One filed against Visa last month in federal court in San Francisco has stoked interest from independent sales organizations integral to processing card payments. It may draw more ISO plaintiffs, and maybe merchants, as it seeks class-action status, said James Shepherd, an industry consultant.

FedNow gathers momentum

Real-time payments are bound to play an oversized role in payments and banking industry conversations this year following the launch of the Federal Reserve’s new instant payments system FedNow last year.

Key questions are: How fast will FedNow be adopted by banks, and how quickly will the financial institutions develop use cases to speed up U.S. payments for consumers and commerce?

The Clearing House CEO David Watson expects 2024 to be a “pivotal year” for real-time payments, he said in an interview last month. “The dialogue for real-time payments with FedNow live is going to get bigger and better,” he predicted. TCH has offered the rival RTP real-time network since 2017. “The gloves are off,” Watson said. “We can move forward.”

To the extent that additional banks sign onto FedNow, one by one that will increase the size of the ecosystem and attract more participants, industry professionals say. Still, persuading banks to adopt the ‘send’ functionality, in addition to the less risky ‘receive’ feature, will be essential.

Watson said TCH and Fed leadership are aligned “when it comes to the way this country needs to go and what it needs to do” to move forward on real-time payments. Despite having the biggest economy in the world, the U.S. is racing to implement real-time payment tools already common in other countries, such as China, Brazil and India.

JPMorgan Chase, the largest bank in the U.S., and smaller ones, such as Maine Community Bank, are among several hundreds of financial institutions that have signed on, but thousands more are still sitting on the sidelines. Other industry players such as fintech Plaid, the payments software company ACI Worldwide and technology company Jack Henry & Associates have also embraced FedNow.

While there may be relatively “slow adoption” of real-time payments, banks may be incentivized to shift to real-time payments as an alternative to the credit card networks, said Gary Stein, who is the chief portfolio officer at industry consulting firm 99Fintech.

The instant payments systems may become more appealing to banks, on a relative basis, if passage of the Credit Card Competition Act compresses interchange. “There's going to come a point at which these new forms of payments, and pay-by-bank at point of sale and other things like that, are going to gain momentum and create some competition,” Stein said.

Faster payments to egg on B2B digitization

Adoption of digital payments in the business-to-business arena is likely to pick up this year, partly thanks to FedNow’s launch.

Compared to consumer payments, B2B payments evolution has occurred more slowly; it’s an area where paper checks still have a notable presence, making up a significant percentage of B2B payments.

“Because of the technology capabilities that are available, we're starting to see that acceleration,” said Erika Baumann, director of commercial banking and payments at Datos Insights. The sizable opportunity in that segment has inspired a host of companies large and small to jump into B2B payments.

Although there’s no shortage of potential business use cases for real-time payments, “where we're still trying to figure things out is through the larger adoption,” Baumann said.

Real-time payments are garnering more attention because the expanded messaging capability such payments offer simplifies B2B payment transactions, said David Ritter, director of financial services strategy at IT consulting firm CI&T. Full invoice details can accompany a request for payment, making it easier to reconcile, he noted.

The movement toward faster payments in B2B has become evident as some accounts payable tools have rolled out real-time capabilities, said Scott Reynolds, a senior associate at consulting firm The Strawhecker Group.

Embedded payments are expected to spiral upward too, as more companies seek to streamline the payment experience and integrating financial tools into software becomes easier.

Because they’re faster than automated clearing house payments and cheaper than receiving payment by card, real-time payments will “start to chip away at both of those payment types, as it gets embedded in these fintech and third-party payment tools,” Reynolds predicted.

The digitization of global trade – which is highly paper-based – is also poised to foster more B2B payments because it lowers barriers to processing payments, increases efficiency and reduces costs, Reynolds said. Big banks, including Bank of America and Citi, have launched new initiatives related to trade digitization.

Consolidation revs up

With increased acquisition activity and companies shuttering due to financial constraints, the payments industry may be smaller by the end of the year.

That’s especially likely in areas saturated with players offering services, such as embedded finance or buy now, pay later, analysts and consultants said. Regulatory dynamics in the U.S. and abroad may also spur consolidation in the sector.

BNPL companies in particular face a grim outlook, given intense competition, rising regulation, tough economic times and persistent losses, Moody’s Investors Service said in a report late last year. That firm predicted few BNPL companies will remain independent.

“Any place you’ve seen a whole lot of new market entrants, you’ve got an 18 to 24-month runway before you start to see either those companies fail and their intellectual property gets soaked up, or distressed properties getting acquired,” said Aaron Press, research director of worldwide payment strategies at IDC Insights.

Strategic acquirers such as Fiserv, Fidelity National Information Services and Global Payments are expected to be active, picking off small fry whose valuations have fallen. Upstarts that are starved for capital may also be more open to being acquired as an exit plan. As they evaluate potential targets, big payments companies “have the ability to be picky now,” said Drew Glover, general partner at venture capital firm Fiat Ventures.

Payments giants may see those current circumstances as opportunities to expand their offerings by snapping up companies with cross-border payments capabilities or payment services for software platforms, said Jordan McKee, research director at data and intelligence firm S&P Global Market Intelligence.

In a bold forecast, CB Insights predicted this month that commerce company Shopify will acquire digital payments startup Stripe and that card issuer American Express will absorb spend management software firm Airbase. An Amex spokesperson declined to comment, and a Stripe spokesperson didn’t immediately respond to a request for comment.

Serial strategic acquirers may find themselves competing for deals with private equity firms circling their prey in a distressed environment. “With valuations down at a more realistic place, the private equity buyers are increasingly interested in the sector,” McKee said.

As startups consider their futures, mergers and acquisitions could occur earlier in company life cycles than they have in the past. “That’ll change the dynamics because you’ll have a lot of smaller companies getting acquired,” said Joshua Silver, CEO of Atlanta-based payment services startup Rainforest.

On the flip side, would-be acquirers have also become mindful of snapping up businesses before they become too pricey. “You might actually see an acceleration, where more corporate development teams are saying, ‘Hey, we need to be making these acquisitions earlier,’” said Oban MacTavish, the CEO of New York-based data fintech Spade.

More digital wallets arriving

Tech giants Apple and Google will be trying to move past a 2023 spent taking on legal challenges and regulatory crackdowns on their digital wallets. The Consumer Financial Protection Bureau scrutinized both companies’ control of contactless payments on their smart devices. And Apple reportedly offered to open up its NFC chip to rivals in Europe. But leading the companies to open up their payments businesses won’t be easy.

“My first gut [instinct] is this is gonna be somewhat of a fight with Apple and Google,” RegAlytics CEO Mary Kopczynski said in an interview. “This is a private company’s technology and the government would be coming to basically tell them how they can use it and I feel like both companies are going to push back really hard on that.”

One competitor to watch is Paze, which quietly launched last year. Since it is backed by the same group of big banks behind peer-to-peer payment service Zelle, this e-commerce only digital wallet will enjoy a head start in terms of consumer trust. It will be well-positioned to take a bite out of PayPal’s large slice of digital commerce. It’s expected to slowly add more users and more merchants in 2024.

Another wallet entrant may be X, formerly known as Twitter. The social media platform has 14 of the 50 state licenses it needs to become a full-fledged payment app. But even if the payments feature has a limited roll-out, it could make a compelling case to small businesses tired of paying credit card interchange fees, according to NMI Chief Product Officer Tiffany Johnson.

X could negotiate with acquiring banks, or handle payment processing in-house to offer small businesses a cheaper way to accept customer payments, Johnson said in an interview. Then, every time a small business accepts a payment via X, it would drive revenue to the social media platform.

Apple, Google and Samsung spent the last year stuffing some states’ driver’s licenses into their digital wallets, and others are expected to follow suit in 2024. Similarly, in Europe, a digital wallet pilot program is paving the way for free, secure digital IDs and peer-to-peer payments.

“One thing that is perfectly clear, whether you look at Europe or the U.S., or anywhere else in the world, is that wallets are going to accept evermore credentials,” OpenWallet Foundation Executive Director Daniel Goldscheider said in an interview.

With more cards, buy now, pay later loans and fintech savings accounts, wallets will try to help users keep track of it all. “You can see the marketplace responding this way for a more holistic approach for consumers managing their financial lives, such that they are able to store all of these different apps and services in one place and have them actually communicate so that I as a consumer have a better snapshot of my larger financial picture,” Consumer Reports Director Delicia Hand said in an interview.

Meanwhile, the CFPB is looking to regulate big tech companies like banks. The bureau has proposed a rule that would subject them to regulatory oversight that already applies to banks.

Fraud overshadows payments progress

Regulators and lawmakers are also paying attention to a recent explosion of payments fraud driven by a rise in digital transactions. The industry will keep grappling with the ramifications of that increase this year, just as new risks are surfacing with real-time payments.

Banks, processors, card networks and a host of intermediaries and fintechs are all affected by ballooning fraud. Dark web incursions have been routine for years now, with cybercriminals finding ways, often through credit card breaches, to pry into consumers’ accounts and transact fraudulent payments. More recently, the rise of scammers that entice consumers to make payments under false pretenses is causing trouble.

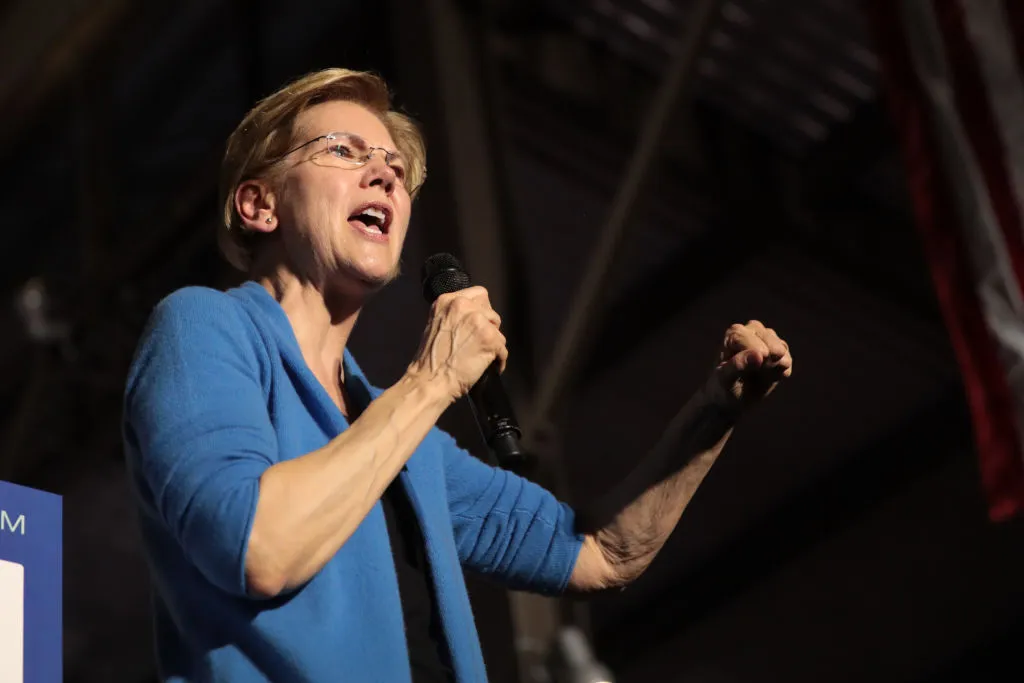

Just last month, Democratic Sens. Elizabeth Warren of Massachusetts, Sherrod Brown of Ohio and Jack Reed of Rhode Island put PayPal and Block on notice that the lawmakers are not satisfied with the companies’ responses to inquiries regarding reimbursement for customers duped on Venmo and Cash App payments apps, respectively.

With the growth of push payment fraud, via account-to-account payments and peer-to-peer payments, there will be a regulatory focus on figuring out who’s responsible for that and how to protect consumers, said Venable’s Bigart. “You’re going to continue to see that getting attention, especially as these services grow,” he said.

There are also concerns that as the industry races to adopt real-time payments, which can significantly increase the speed of payments, there will be faster fraud, with less ability to reverse transactions. That emerged as a serious concern for potential users of FedNow during an online discussion hosted by the Fed last month.

Fraud is showing up in emerging technologies as well as paper checks, noted Kristen Larson, who is of counsel for the law firm Ballard Spahr in Minneapolis. “There's been all these emerging payments (types), as payments are shifting to electronic payments, and new types of fraud to monitor,” she said.

As the industry advances digital payments, fraud will keep challenging its progress.

Correction: This story has been updated to correct Delicia Hand’s name. It also clarified remarks from Gary Stein.