With new evidence that the venture capital spigot is being turned down, money for payments startups, among others, is likely to be less free-flowing now than it has been in recent years.

Dollars invested overall during the first quarter declined the most over a prior quarter since 2012, according to the research firm CB Insights. Venture capital funding globally dropped 19% for the quarter to $143.9 billion, relative to a record-breaking fourth quarter, a report this month from the firm said. It was the biggest quarterly decline since the third quarter of 2012.

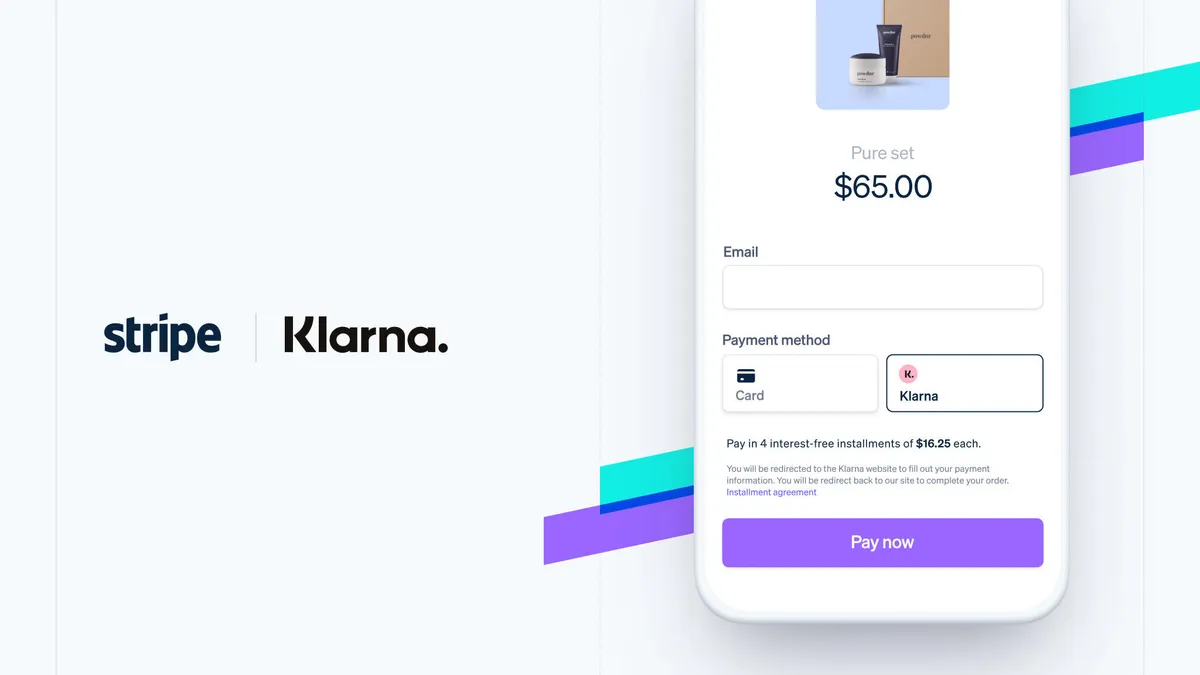

Payments company startups have been among the biggest recipients of venture capital money, soaking up billions of dollars in recent years, including record sums last year. Beneficiaries like digital payment tools company Stripe and the Swedish buy now-pay later giant Klarna have grown with a surge in e-commerce that accompanied the COVID-19 pandemic.

There have been warning signs on the horizon that venture capitalists were tightening their purse strings. Now, the first-quarter drop-off in venture capital likely reflects an investor community spooked by recent macroeconomic shifts, including rising U.S. inflation and worrisome production issues, like supply chain constraints, as well as geopolitical upheaval triggered by Russia’s invasion of Ukraine.

The venture capital decline comes just a week after one sizable San Francisco e-commerce checkout business, Fast, abruptly shut down, reportedly after being unable to raise new funding. That’s despite having landed some $124 million in recent years to fuel growth.

Will Fast be the canary in a coalmine?

"Fast evaporated quickly," said Matt McCall, a partner with Pritzker Group Venture Capital. "I can only assume they were trying to get a financing closed and that it fell through, for whatever reasons, at the last minute."

There may have been "missed milestones" at the company, and then the economic environment changed "dramatically" in the last couple months, he said.

Startups "don’t usually shut down that quickly," McCall noted. "Things just go boom in the night when you're driving, ironically, fast," McCall said. "There's a turn ahead, and if you haven't slowed down, you're going into the wall."

Fast had financial backing from big players in the industry, including Stripe, which last year reached a remarkable $95 billion valuation, and from the venture capital firm Index Ventures, which has backed a slew of fintechs, including Revolut, Plaid and Adyen.

McCall predicted there will be more implosions like Fast coming down the road. "I think you’re going to start to see a lot more of these as people start to get a lot more conservative in these financing markets," he said.

The Tiger trips

Another big investor in private fintechs has been Tiger Global Management, which CB Insights said was the single largest investor in startups during the first quarter. The firm invested in 120 companies during the first three months of the year, up from 107 in the fourth quarter of last year, the research firm said. Tiger’s biggest investment round was the $1 billion it injected into digital payments player Checkout.com along with other investors.

Still, Tiger may start pulling in its claws following its recent losses in the public markets. The New York investment firm, which had about $100 billion invested across the public and private markets as of the end of last year, reported a 34% drop in the value of its publicly-traded assets during the first quarter, the news outlet Bloomberg reported earlier this month.

The Standard & Poor's 500 Index had slipped about 8% so far this year as of the market's close on Tuesday.

Tiger, which invested in Stripe, among other payments players, also marked down the value of its private holdings to adjust to declines at public market peers, Bloomberg reported, citing a letter from the firm to its clients. Stripe, which sells payments software to digital shops, said this month that its growth this year won't be as strong as last year.

Across venture investing generally, this year’s first-quarter total was still the fourth-biggest quarterly haul on record and it was 7% higher than the same quarter last year, CB Insights said.

U.S.-based startups received $71.2 billion of the total invested, or nearly half (49%) of the global funding, but that was the lowest level in five quarters for the country, according to the research firm. U.S.-based startups accounted for only about a third (37%) of all fundraising deals in the quarter.

Some fintechs stand stronger

"With the public markets in a bit of turmoil, what's clear is that many investors not only didn't know what they were buying, but at this stage aren't even sure what they are selling or over-selling," Financial Technology Partners CEO Steve McLaughlin said via email.

The private markets are being affected differently, and not all companies are feeling the downdraft equally, McLaughlin said.

"We've not seen private markets as penalized, but we operate in an upper tier deal landscape where companies and valuations we see are still mostly growing, highly sought after and full-steam ahead," said McLaughlin, whose San Francisco firm assists startups in landing capital. Among FT Partners' recent deals were financings for the checkout company Bolt in January and the banking-as-a-service company Cross River last month.

Indeed, financial technology companies drew more money than any other sector during the first quarter, taking in one out of every five dollars, according to CB Insights. (The firm's report didn't provide payments-specific data.)

Private companies raising new financing so far this year have pulled off median valuation increases overall, relative to their prior funding round, with early and mid-stage valuations trending up, but late-stage firms' values moving lower, the research firm said.

Private markets might be suffering, but public markets are worse off, McLaughlin said. "While overall private markets deals are down, there's near zero IPOs," he said.

Public market exits nosedive

CB Insights picked up on that trend, too. The number of exits by venture capitalists through initial public offerings or special purpose acquisition companies, also known as SPACs, plummeted 45% in the first quarter, relative to the prior quarter, the research firm said.

Kevin Jacques, a partner with San Francisco-based multi-stage investment firm Cota Capital, said most company management teams are reacting more quickly than they did in past to downturns, when they didn’t realize funding would become scarcer and they needed to think about "efficient growth versus growth at any cost."

Some companies are at a place where they can adjust and others aren’t, said Jacques, whose firm has $1.3 billion in assets under management.

Jacques said companies are likely revisiting hiring plans. "There’s a lot of companies that have already very quietly made adjustments," he said.

We saw more situations like Fast in prior downturns, and we’ll see fewer this time around, Jacques predicted. "More companies are just reacting more quickly," he explained. "It’s important to be disciplined in a market like this."

Asked whether the capital drop-off will affect companies' plans, his Cota Partner Ben Malka said: "Undoubtedly, it will." It won’t be immediate, and it won’t be in every case, but there will be a set of companies that will have difficulty raising capital, Malka said. "It’s a natural, cyclical adjustment, but it’s been a while since we had one," he said.

Caitlin Mullen, an associate editor at Payments Dive, contributed to this story.