A trade group for Ohio’s 234 credit unions urged the Consumer Financial Protection Bureau this week to rein in buy now-pay later (BNPL) providers, saying their installment payment services may "harm" consumers.

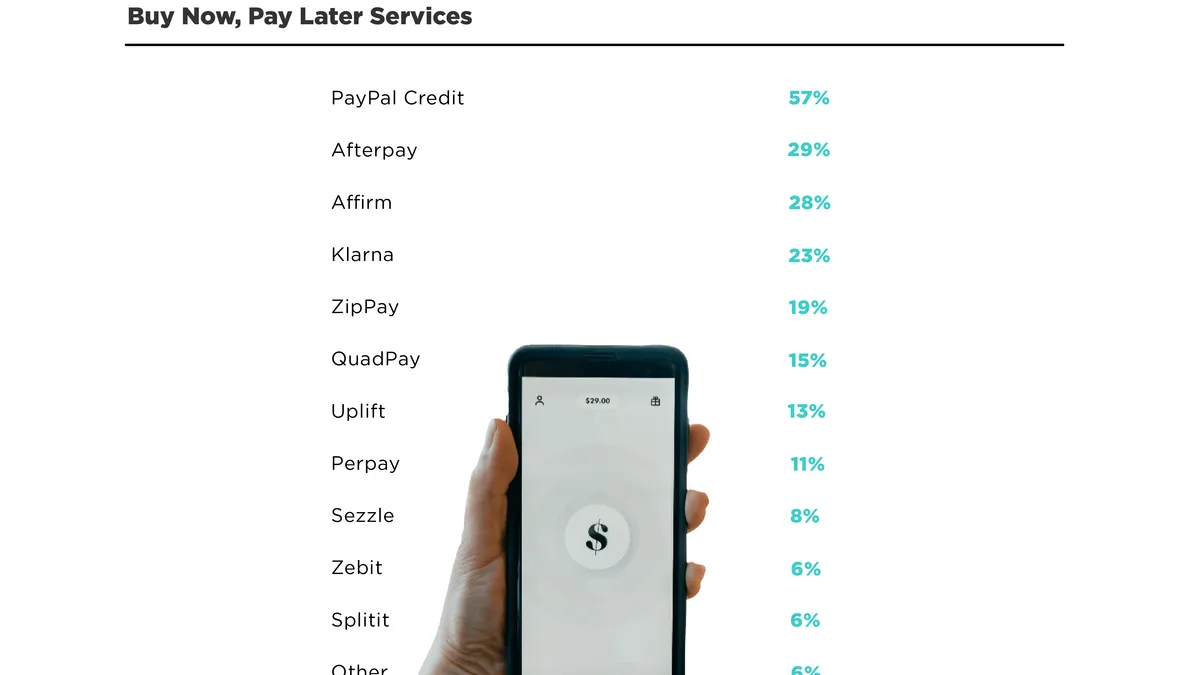

That input came in response to the CFPB's request in December for public input on the emerging financing trend. The CFPB also ordered five of the biggest players in the BNPL market (Affirm, Afterpay, Klarna, PayPal, and Zip) to provide detailed information about their operations. The agency's actions followed complaints from Democratic senators and consumer activists.

Echoing the sentiments of other BNPL critics, the Ohio Credit Union League argued in its comments submitted to the CFPB on March 20 that the industry "has the potential to do consumers harm" because it remains "largely unregulated." The league, which said its credit unions have some three million members, also contended the new fintech service providers are skirting existing laws, like the Truth in Lending Act.

"In the absence of any specific regulations, BNPL products further cultivate a financial environment in which consumers make decisions without adequate details regarding the potential harm of these products," the league's letter said.

Critics of the industry have said they are concerned that consumers using the popular financing tool may accumulate too much debt as their purchasing data is mined for marketing. The new payment service lets consumers pay for a purchase over time, usually interest-free, but they may face late fees.

BNPL financing has become an international trend for consumers, especially young people making smaller purchases of clothing and fashion accessories. The craze got underway initially in Australia, but has become popular in the U.S. in recent years, too, driven by a pack of companies that are now gaining CFPB attention.

CFPB Director Rohit Chopra has expressed skepticism about the new trend as he takes an aggressive approach in his new role. "Buy now, pay later is the new version of the old layaway plan, but with modern, faster twists where the consumer gets the product immediately but gets the debt immediately, too,” Chopra said in the press release announcing the inquiry.

One industry lawyer said the CFPB inquiry may result in an enforcement action.

Some BNPL companies have rejected claims by critics that they are unregulated, while others are trying to see the government's inquiry in a positive light. Affirm's CFO said earlier this week that he considers the CFPB inquiry an "attempt to understand the market."

Affirm and Klarna were the only BNPL providers to publicly acknowledge meeting a March 1 deadline to submit company responses to the CFPB's demand for documents. Square, now Block, acquired Afterpay for $29 billion last year. The documents submitted by the companies aren’t considered public records so they won't be released.

Members of the public have until Friday to submit their comments as part of that separate information-gathering effort related to the probe. Only a handful of comments have been submitted so far.

BNPL providers and regulators have been at odds over whether BNPL services, which vary widely from one provider to another, should be classified as loans.

"Many BNPL providers structure these products to avoid certain consumer protection obligations under the Truth in Lending Act or the Military Lending Act," the Ohio Credit League’s letter says. "Consumers are making financial decisions not knowing that many BNPL companies do not offer dispute protections like those of credit card companies." The league also asserted that BNPL companies may report consumer defaults to credit bureaus, but not timely payments.

A student commenter who submitted a response to the CFPB noted the increasing popularity of the new financing tool among younger consumers, who often access it through a phone app.

"As these novel financial platforms are heavily advertised as the 'cool' alternatives to traditional credit cards, BNPL financings are particularly well-received among Millennials, Generation Z ("Gen Z") consumers and, disproportionately, young women," wrote Boston College Law School student Elaine Lee in a separate CFPB submission.

"Consequently, consumer advocates are concerned that lenders irresponsibly extend credit to a cohort of consumers who may be especially vulnerable to predatory lending schemes or otherwise be denied conventional credit," said Lee, who attached a 31-page report on the BNPL industry, laws that apply to it and proposed reforms.