The New Jersey legislature has passed a bill limiting the surcharge merchants can impose on credit card payments to the amount they pay to process the transaction.

The bill, backed mainly by Democrats, passed both houses of the legislature on June 30, according to the state’s legislative website.

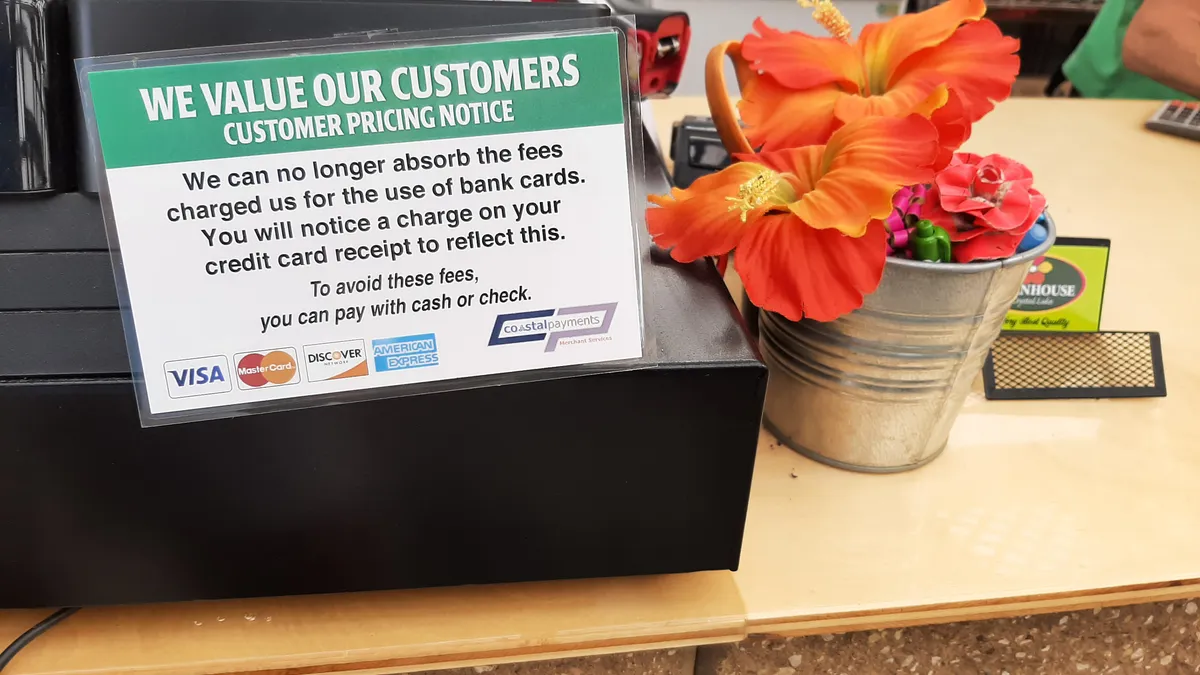

The legislation prohibits a merchant in the state from imposing a surcharge that is more than “the actual cost to the seller to process the credit card payment,” according to a draft of the bill. It also requires merchants to disclose the surcharge before a transaction and to post a “clear and conspicuous sign” regarding the surcharge.

New Jersey’s move comes as more restaurants and retailers seek to add a surcharge to tabs to help them pay for interchange fees imposed by card network companies, mainly industry heavyweights Visa and Mastercard. When surcharges are imposed, they also often cover additional fees imposed by the vendors that sell the merchants card processing hardware or services.

Average interchange fees imposed by Visa and Mastercard for card transactions in 2021 were 2.22%, according to a report last year from card industry research firm the Nilson Report, but that average likely edged up last year following increases for some cards.

New Jersey Sen. Gordon Johnson, a Democrat, said he backed the bill after being approached by Assemblyman Paul Moriarty asking for his support. To Johnson, it seemed “a pretty straightforward bill” aimed at “trying to protect the consumer” from being overcharged, he said in an interview.

“Credit card surcharges are something we pay every single day, but lately we have seen reports of businesses tacking on their own surcharge on top of the cost of the service,” Johnson said in a follow-up emailed statement. “It goes unnoticed most of the time, but because so few people carry cash these days, the added dollars and cents here and there really do add up.”

Johnson said there is a good chance the bill will be signed by New Jersey Gov. Phil Murphy, who is also a Democrat, because the governor’s office asked for amendments to the bill that were made. As to when the governor might sign off, Johnson said he didn’t have any inkling as to timing, noting that could happen anytime before the session ends in December.

Still, if the bill does become law, there are sure to be complaints from the third-party vendors that stand between merchants and card networks, providing payments processing services. They’ve already been in an uproar this year over card network giant Visa’s efforts to cap surcharges at 3% and to impose fines on those who don’t comply.

“We understand that businesses should not have to swallow the cost of the transaction, but nor should they be inflating the processing fee to boost their own bottom line,” Johnson said in the statement. “At a time when affordability is New Jerseyans number one concern, adding this unknown charge is not fair, not honest and not acceptable because most people don't even know what they are paying for — this bill ends that scheme.”

Moriarty didn’t immediately respond to a request for comment. The only Republican to sign the bill was Assemblyman Robert Singer.