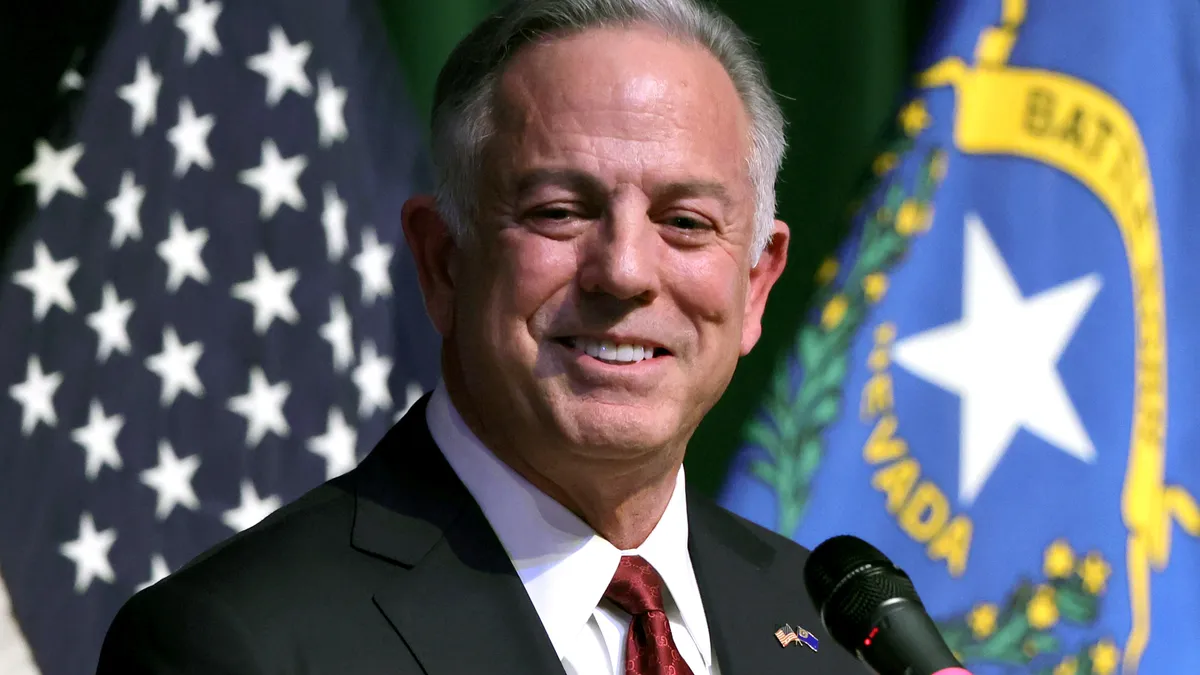

Nevada Gov. Joe Lombardo signed an earned wage access bill into law Thursday that advocates of the legislation say is the first such state law to put “guardrails” on the industry.

The Republican governor’s action on the bill follows the state’s Democratic-controlled legislature passing the bill earlier this month to create a licensing process for earned wage access providers operating in the state. The legislation also appoints the state’s Commissioner of Financial Institutions to oversee the industry.

“We applaud Nevada for putting in the effort and the work,” said Phil Goldfeder, CEO of the American Fintech Council in New York. “We’re hopeful and optimistic that other states will take their lead.” He said the legislation “creates real guardrails for the EWA industry.”

The council’s members include DailyPay and Payactiv, which are both earned wage access companies in the U.S. that have helped expand the on-demand pay trend, giving workers more immediate access to their pay.

A similar bill was introduced in the Missouri state legislature this year and is awaiting approval by that state’s governor. In California, regulators are reviewing rules for the industry. Lawmakers in Utah, New Jersey, New York, Georgia, North Carolina and South Carolina have also debated EWA legislation, without passing any new laws on the EWA front.

Earned wage access providers are essentially intermediaries between an employer and employee that let the workers access their wages before regular pay cycles elapse. Some EWA providers charge employers a fee for the service while others charge employees. Some also earn revenue through interchange fees that result from the workers using credit or debit cards that get loaded with wages when they take their pay early.

The industry has exploded over the past decade with more than two dozen companies now offering some variety of on-demand pay services. While it began as a service mainly for lower-income workers, it has expanded its reach in recent years with the explosion of gig workers during the COVID-19 pandemic.

“This law includes strong, first-in-the-nation consumer protections for Nevada's earned wage access consumers,” DailyPay CEO Kevin Coop said in an emailed statement. It aims “to empower American workers to improve their financial health by avoiding expensive and predatory financial products and strategies.”

Still, some consumer protection groups aren’t pleased with the legislation. The National Consumer Law Center doesn’t support the new Nevada law. “It’s disappointing and it denies reality” by claiming that these payouts aren’t loans, and by exempting them from the state’s lending laws, NCLC Associate Director Lauren Saunders said in an interview last week regarding the bill after it passed the legislature. “I don’t think there are really meaningful protections,” she said.

Under the Nevada bill, EWA providers in the state will be subject to a state exam and audit, with a fee and levy to pay for that oversight, according to a summary of the bill. Any license applicant will also be required to submit fingerprints for a criminal background check, and participate in a state registry for such companies.

The Nevada legislation also says the EWA providers are not lenders, which is an important provision because it has been a point of controversy as to whether they should be subject to lending laws. Specifically, the bill says EWA services extended by a licensed provider “are not a loan or money transmission and are not subject to any provisions of existing law governing loans and money transmitters.”

The Consumer Financial Protection Bureau, the federal agency tasked with protecting consumers in the financial services realm, said last year that it would give more guidance regarding how the definition of “credit” can be applied under the Truth in Lending Act and Regulation Z. That statement from the agency came when it terminated special regulatory treatment it had previously extended to Payactiv.

That decision by the CFPB followed a statement that the agency made in January 2022 regarding legislation that was then moving through New Jersey’s legislature.

California’s Department of Financial Protection & Innovation is in the process of finalizing rules that would govern EWA providers. That state government has already largely determined that EWA advances are loans.