Mastercard CEO Michael Miebach and FDIC Chairman Jelena McWilliams separately urged the financial technology industry Tuesday to play a constructive role in bringing more people into the financial system, albeit with an assist from the government.

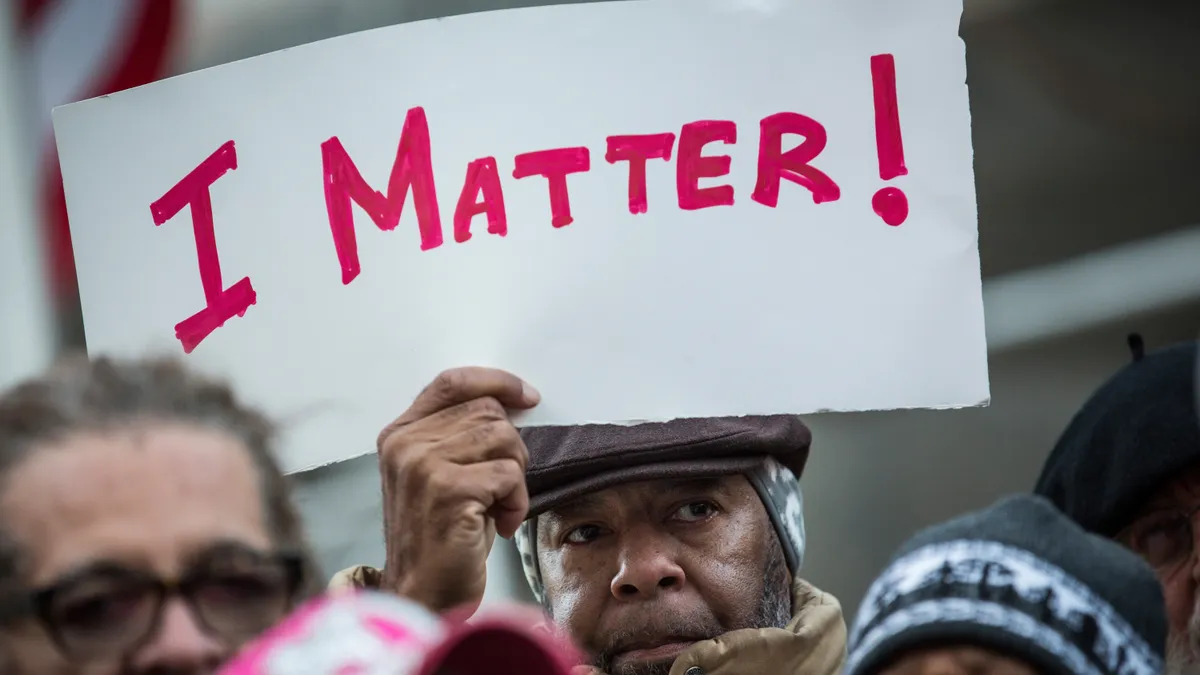

Over the past 16 months, the deadly COVID-19 pandemic and the killing of George Floyd has increased the urgency of discussions about people disenfranchised from the financial system, and the need to draw them in. Miebach spoke at the virtual Aspen Ideas Festival, addressing the topic “Fintech: Great Enabler or Great Divider” and McWilliams introduced the topic od financial inclusions at a virtual FDIC conference on “Fintech: A Bridge to Economic Inclusion.”

Miebach called Mastercard one of the “original fintech” companies in the payments space. Now, that industry is brimming with a swarm of younger fintech companies soaking up venture capital and looking to partner or unseat dominant companies like Mastercard. With a wealth of innovation happening in the industry, both Miebach and McWilliams acknowledged the importance of tapping this powerful pack of companies to better include the many unbanked and underserved people in a global financial system.

Financial inclusion as a national priority

Miebach backed the idea of making financial inclusion a U.S. policy priority that ultimately would include programs, laws and resource allocation for the effort. “The United States would be well-served to have that as a national priority,” he said in an interview at the Aspen Ideas Festival interview with the magazine Fast Company’s editor-in-chief, Stephanie Mehta.

He noted the high fees that unbanked Americans face in paying 12% fees to cash checks. Miebach suggested that tech tools, such as digital wallets, prepaid debit cards, mobile money and QR codes can all play a role in overcoming the barriers of a cash economy, but people need to be able to develop digital identities for those solutions to work. ”Thinking this through in its entirety, what are the identity questions that need to be resolved?” Miebach asked. With digital identities come questions of data security that have to be resolved too, he added.

Throughout the conversation, Miebach pointed to his experiences leading Mastercard’s Middle East and Africa operations to illustrate how creating financial inclusion needs to be a worldwide endeavor. He explained that while Mastercard initially targeted the African market to court affluent travelers, the company ended up developing a local market as well.

“There's always a new emerging technology that we lean into, and digitization plays as much of a role (for) currency in emerging markets as in developing markets,” he said.“Today, we have a thriving business in the domestic economy, having pulled a lot of people into the system,” he said. “Basic infrastructure wasn't there so you needed offline solutions, you needed to deploy technology in a totally different way.”

With respect to how the fintech industry can solve those challenges, he was hopeful that the sector is increasing diversity in its ranks, particularly with respect to science, tech, engineering and math talent, so that “all walks of life” are represented.

He was also hopeful of the industry’s efforts to expand broadband access to more people. “That's where it all starts and I think we have a very patchy landscape,” he observed. He praised corporate initiatives underway, like beaming internet connections from balloons and satellites. “That's not what we do for a living but we're very happy that that is seen as a priority,” he said.

Cryptos not helpful

With respect to cryptocurrencies, he said that while they may have a role to play in some use cases, he doesn’t consider them particularly helpful to lower-income people who depend more acutely on the stability of a currency. If “your hard-earned dollar” changes “in value dramatically as you're trying to buy critical goods and services for everyday life, that's problematic,” he said.

While stablecoins might be useful in financial inclusion efforts, he couldn’t say the same for cryptos. “We have very categorically said to the likes of Bitcoin, and other types of free floating cryptocurrencies--it’s not useful for payments,” he said.

“Other types of digital currencies that have a link to value, to a fiat currency, like private sector stablecoins, central bank digital currencies--definitely very much, they could play a role,” he said, citing the benefit to cross-border remittances between relatives.

Still, he noted the need for regulators with respect to stablecoins to set “guardrails.” “There have been private stablecoin undertakings for the last two years or so that haven't really gone anywhere,” he noted, explaining that’s partly because “there is no firm regulatory framework at this point.”

He credited regulators for driving financial inclusion by spearheading business conditions that allow startups and innovators to prosper, unperturbed by dominant companies. “More and more regulators are stepping in and saying ‘we're going to break up the market to drive for innovation; there has to be a chance for newcomers coming in; we will watch that there isn't large companies that buy to kill when it comes to a new technology;’” Miebach said. “All that, I think, is pointing in the right direction.”

With respect to corporations taking the lead on some of the financial inclusion initiatives since last year, Miebach emphasized it will take a cooperative approach for sustained change.

It’s incumbent on corporations to “continue to raise their voice and make sure this goes in the right direction but I think it's also important to realize guardrails cannot be set just by the private sector itself,” he said. “I think that will actually not be trusted, and you need a partnership across the public sector and the private sector and nongovernmental organizations in the middle.”

FDIC efforts

According to recent FDIC surveys, nearly 5% of the U.S. households were underbanked in 2019 compared to 7.7% in 2009, McWilliams said at the FDIC webinar held yesterday.

“Our survey showed that 7 million households do not have a banking relationship with which to deposit their checks to or save for unexpected expenses,” McWilliams said. “That number reflects households, meaning that the number of actual unbanked individual Americans is many times higher.”

The COVID-19 pandemic has underscored the importance of financial innovation for banks and customers alike while pushing many Americans towards accessing digital banking tools for the first time, McWilliams said.

FDIC is taking a “multi-prong novel approach” to make banking more inclusive and beneficial for Americans, including hosting programs in which companies, particularly startups, race to solve a financial technology problem, McWilliams explained.

“We're looking at financial innovation occurring in the private sector and are taking steps including hosting tech sprints to identify additional solutions,” McWilliams said. “We're collaborating with a minority depository institutions and community development financial institutions to better allow them to compete in a modern era and we're conducting targeted public awareness campaigns regarding the importance of a banking relationship.”

The FDIC aims to double down on its efforts for developing new tech tools, like using alternative data points to evaluate a consumer's credit history, McWilliams said. The agency is also seeking to bring Americans in rural areas who have limited banking options into the country’s financial system through digital and mobile banking.

The use of digital banking increased to 35% of American households in 2019 from 10% in 2015, Leonard Chanin, who is deputy to the chairman for consumer protection and innovation, said during the webinar.

The FDIC appointed Sultan Meghji as its first chief innovation officer in February, and assigned him to lead its efforts in promoting “the adoption of innovative technologies across the financial services sector,” according to a February 16 press release. Meghji’s job focuses on working with the private banking sector to develop new technological tools that can be leveraged to bring more Americans into the banking system.

During a discussion on "fintech and inclusion," at the FDIC conference, he said he plans on digitally revamping the the agency to be mobile-first and reach as many Americans as possible. Many community banks that serve rural populations might not have the digital tools they need to serve more people, and the FDIC will work with them to update their digital infrastructures, Meghji said.

FDIC aims to bring more Americans both, absolutely as well as a percentage of the population in the banking system along with providing banks with capital to invest in community projects and people, Meghji said.