Dive Brief:

-

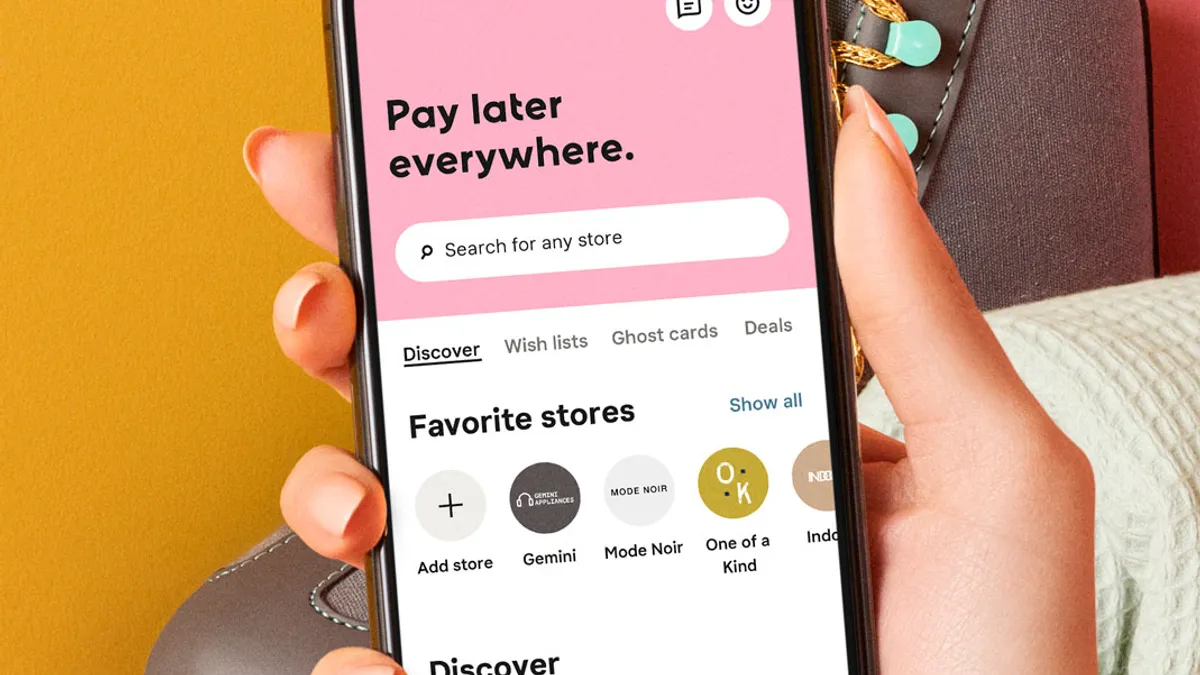

Amid the recent spike in popularity for buy now-pay later services, Klarna announced Monday that it has doubled its U.S. customers to 20 million users since June 2020. And its mobile app now has 4 million active U.S. users on a monthly basis, according to its press release.

-

The members of Klarna's Vibe rewards program have, to date, claimed almost $2.8 million in gift cards to use at retailers such as Amazon, Sephora, H&M and Target. Users also have saved more than 8 million items to their wish lists using the platform's Collections tool, the company said.

-

Klarna also said it had amassed 10,000 U.S. retail partners as of July 2021, more than doubling that count since June 2020. The platform has more than 250,000 retail partners globally, per the press release.

Dive Insight:

Over the last year, as e-commerce surged and consumers sought alternate payment options, Klarna has continued to attract shoppers to its platform. In June 2020, the company surpassed 7 million U.S. customers thanks to its partnerships with various clothing, cosmetic and shoe brands. In its Monday announcement, the company highlighted recent brand and retailer partners like Petco, Bed Bath & Beyond, The Honest Company and Yoox Net-a-Porter.

As Klarna builds its retail roster, the platform has also enhanced its mobile app over the past couple of years. Besides introducing its Vibe loyalty program last year, Klarna also integrated with Google Pay to allow in-store purchases through the platform. Shoppers have been able to purchase in stores using the Klarna app since 2019.

"The rapid growth of Klarna customers in the U.S. speaks to consumer demand for flexible payment options and a more seamless, convenient shopping experience," David Sykes, head of North America at Klarna, said in a statement. "In the year ahead, we will continue to expand our U.S. merchant base, offering greater opportunities for customer acquisition and engagement."

Klarna has recently bought other startups to enhance its digital offerings. In July, the company acquired social shopping startup Hero, and later that same month, Klarna also acquired Apprl, which lets creators and retailers collaborate with one another on shoppable content and tracking campaign outcomes.

Investors have been pouring money into Klarna to support its international reach and improve its digital services. In March, the company raised $1 billion in equity funding from various investors to expand internationally and work with new retailers. In June, the company raised another $639 million to fuel its global growth and offer more options to in-store shoppers.

While Klarna widens its global footprint, rival buy now-pay later companies are entering the U.S. market. Earlier this month, Square announced that it would acquire Afterpay for $29 billion, signaling that the buy now-pay later market is heating up.

However, Fitch Ratings noted earlier this month that such installment payment platforms pose a risk to providers, because the customers who use these options may be less capable of handling sudden financial hardships. In addition, some regulators concerned that the payment strategy may also pose risks for consumers have suggested it may require move oversight.