Dive Brief:

- Even as buy now, pay later provider Klarna cut employees last year to keep up growth, the Swedish parent company’s net financial results reported Tuesday showed a wider loss last year than in 2021. Still, Klarna's loss for the fourth quarter last year was about half what it was for the same period in 2021.

- A gross merchandise volume increase of 19% in the fourth quarter of last year, over the year-earlier period, drove a 19% increase in revenue, the company said in the shareholder letter Tuesday providing the results. For the full year, GMV was up 22% over 2021, lifting revenue 21%, Klarna said.

- “The accompanying shift in investor sentiment from a total focus on growth to profitability has also had wide-ranging effects,” Klarna CEO Sebastian Siemiatkowski said in the shareholder letter. “At Klarna, it has required some hard but necessary decisions.”

Dive Insight:

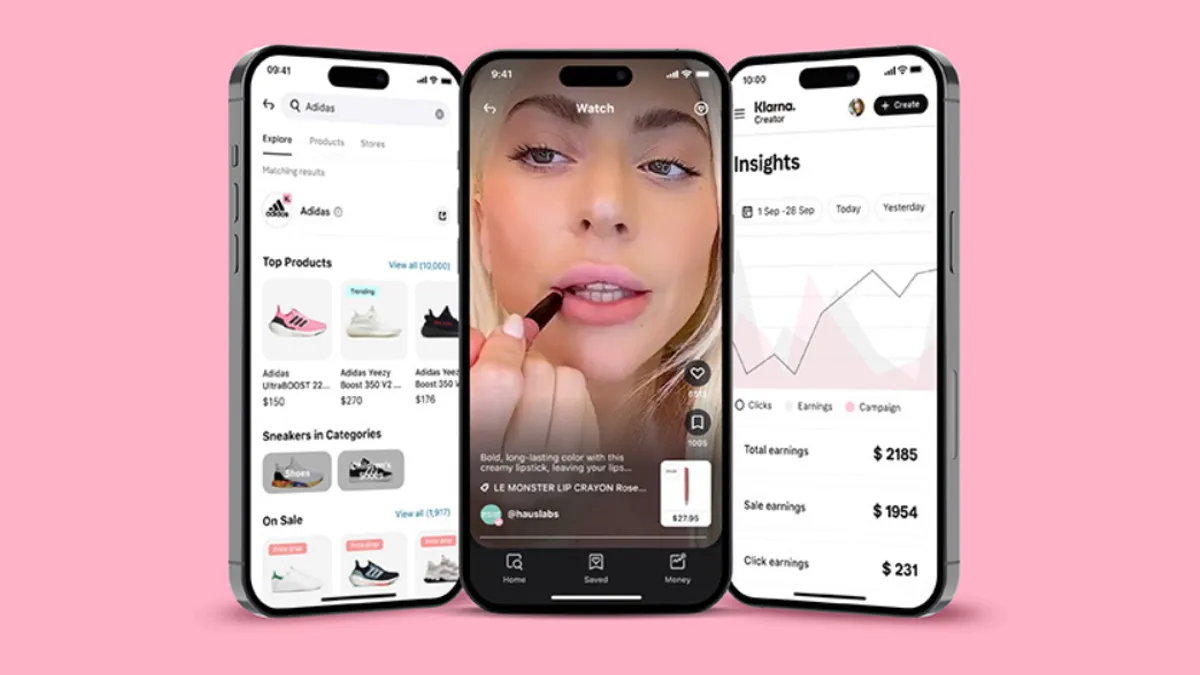

Klarna has continued to invest in growth despite cutting more than 10% of its workforce last year. It has added 12 new markets since 2020 and expanded in existing markets, especially the U.S. The company said earlier this month that the U.S. has become its biggest market, overtaking Germany in the process.

The growth comes as Klarna takes on additional risk in underwriting new customers. Klarna disclosed today that overall consumer credit losses in 2022 increased over 2021. “However, our focus on the path to profitability is already yielding results with two consecutive quarters of improvement in credit losses,” the company said in the letter.

Still, the company’s credit loss rate as a percent of GMV edged up to .68% for all of 2022, from .67% for 2021, according to the reported results.

After a period of rapid expansion, BNPL companies in recent months have begun to prize profitability over growth, largely due to a push from their investors who are worried about the gloomy global economic outlook. Stockholm-based Klarna isn't the only BNPL provider curbing costs and drumming up new revenue streams to reduce losses. Sydney-based Zip and San Francisco-based Affirm have cut workers, tightened underwriting standards and considered merchant fee increases.

Growth in the company’s interest income, at 9%, was below growth in total net operating income, showing that Klarna’s customers preferred interest-free, shorter duration payment options over its alternatives.