Block Head Jack Dorsey will have plenty to keep him busy as he adds Square CEO duties to his job next week.

Dorsey is taking over as Alyssa Henry, the CEO of Block’s merchant unit, departs Oct. 2. That CEO switch came just days after Square experienced an outage that stretched over two days, leaving sellers unable to process consumer payments or access their accounts.

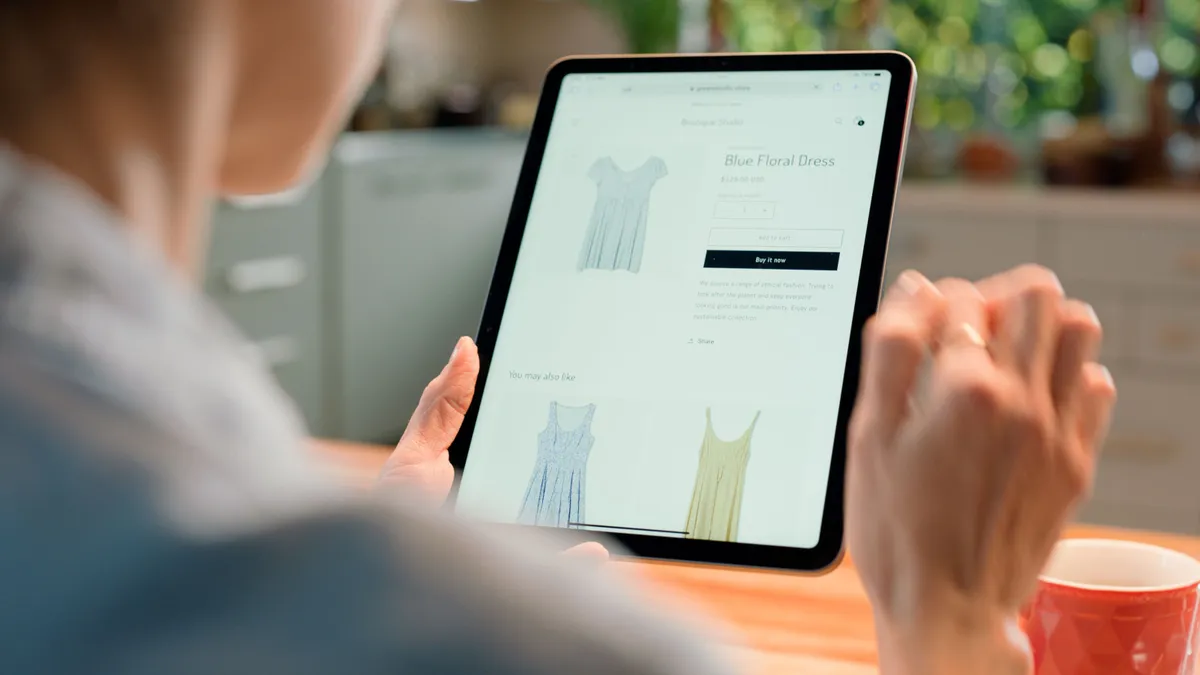

As more competitors fight for market share in the point-of-sale space and Square’s growth has slowed, Dorsey will be playing catch-up on the sales side. Square recently revamped its strategy to focus salespeople on specific industry verticals.

Those issues are likely to be some of Dorsey’s top priorities as he takes on the top post at the business he co-founded in 2009. Originally known for its white card reader that enabled small merchants to accept card payments, Square has since grown to offer an array of merchant software and services for sellers in addition to payment acceptance.

Dorsey may have his work cut out for him in fending off competition from the likes of Fiserv’s Clover and digital payments company Stripe. “This market is as brutal as ever,” said Cliff Gray, principal with Gray Consulting. “He’s got serious, deeply ingrained payment companies he’s up against, but he also has a good product.”

Block spokespeople didn’t respond to requests for comment on Dorsey’s priorities at Square. The company also hasn’t indicated how long he’ll hold the CEO title, but Dorsey could be settling in and weighing changes to the business, said Oppenheimer Analyst Dominick Gabriele.

“I have a feeling that if he’s taking this over, he’d probably want to make some changes of his own and see how they work out over some period of time, which is probably a year or two,” before bringing in someone new, Gabriele said.

Sales push

In merchant services, Square faces “formidable” competition, such as fintech Toast in the restaurant segment, noted Jason Kupferberg, Bank of America Securities analyst. In light of that, Kupferberg expects ramping up Square’s sales strategy will be a top priority for Dorsey.

Square revamped its sales approach this year, organizing its sales staff by industry to have dedicated teams focused on retail, restaurant and services, and adding salespeople seeking out new clients. Dorsey has acknowledged that Square needed to do a better job of getting its foot in the door as merchant services rivalries have intensified.

“Job No. 1 is to take this verticalized, direct sales force strategy – which is somewhat in its infancy for Square – and scale it,” Kupferberg said. “This is an area where they’re a little bit late to the game, not so much with product, but with the sales motion behind the product.”

As part of that push, Gabriele expects Dorsey in particular will be a key component of chasing larger merchant clients.

The company has been keen to grow its share of merchants that generate more than $500,000 in annualized gross payment volume, as they tend to be stickier clients. Square’s share of sellers that size has ticked up over the past two years, from 35% in the second quarter of 2021, to 39% in Q2 2022, to 40% in the second quarter of this year, according to Block’s most recent quarterly shareholder letter.

“It's a very important piece of the puzzle for that business, to keep moving upstream,” Gabriele said. Dorsey’s involvement in conversations with larger merchants could help close the deal in those seller negotiations, Gabriele said.

Outage fallout

Dorsey will likely jump first on correcting issues that caused the outage earlier this month, Gray predicted. The company apologized for the outage, which began midday Sept. 7 and lasted until midday Sept. 8. Square cited a domain name system error as the reason for the extended outage, which also affected Block’s peer-to-peer business Cash App.

“For a company of their scale and modernity, that outage was inexcusable – especially the length of time they were down,” Gray said.

The payments industry has long abided by the idea of “five-nines of availability,” meaning the system is available 99.999% of the time, Gray said. That equates to being down less than a few minutes per year.

Merchants need to be able to accept payments “far and away above everything else,” Gray noted. “That's why they pay so much to their merchant service provider. I know they’re not Visa, right? But they are Square. They should absolutely be meeting five-nines.”

To prevent a similar issue in the future, Square deployed a new set of firewall and DNS server changes; expanded offline payment capabilities so merchants can still accept payments in offline mode; and put in place added operational measures, the company said in its apology post Sept. 11. Square also pledged to better communicate with sellers.

International growth, solid product bets

Expanding Square’s international presence is another area Kupferberg expects Dorsey to direct his attention.

“They’ve gradually increased the non-U.S. footprint of the Square business over time,” including moving into some European countries last year, Kupferberg said. Beyond the U.S., Square has merchant clients in Canada, Japan, Australia, New Zealand, the U.K., Ireland, France, and Spain, according to Block’s annual filing with the Securities and Exchange Commission.

International is now about 16% of gross profit for Square – double the percentage it was in the second quarter of 2021, according to Block’s shareholder letter. Kupferberg believes Dorsey will want to further increase Square’s presence outside of the U.S. over time.

To be sure, executives at Square rivals Toast and Fiserv’s Clover have expressed similar international ambitions, and those companies are making moves to expand abroad as well.

Kupferberg also expects Dorsey to stick to “practical” product expansion, rather than deviating too much to investments that have “more uncertain payback periods.”

He pointed to Square’s addition of a kitchen display system for restaurant clients, underscoring Square’s aim to better serve large restaurants needing that service. Dorsey will double down on that approach, he said.