For many small business entrepreneurs, a recurring pain point involves how to be paid faster: unpaid invoices pile up and outstanding payments for services rendered become administratively cumbersome.

Intuit’s QuickBooks platform is introducing a new contactless payment service – in an already crowded field – that allows contractors, plumbers, landscapers, professional independent contractors and others, removed from a traditional point-of-sale payment device, to be paid using their Apple iPhone to tap credit and debit cards.

The goal is to improve cash flow for the 10 million small and medium-sized businesses using QuickBooks, David Hahn, senior vice president of QuickBooks, told Payments Dive in a March 7 interview. The platform handles tasks such as accounts receivable, payroll and benefits processing. It also enables access financing.

“No matter what kind of business that you’re in, they’re all concerned about cash flow,” he said.

Intuit says it will include Android phones later, likely this year, for the service, which involves using its QuickBooks mobile or GoPayment apps. Users won’t need a separate card reader, Intuit said Tuesday in a news release. The tap-payment feature starts rolling out Tuesday and will be available to all U.S. QuickBooks Online customers with a payments plan in the coming weeks, Intuit said in the release.

Modern payment schemes have, for the most part, not been adopted so far by many small business owners who run their businesses on the go, Hahn said.

Other companies – including Stripe, Toronto-based Jobber and ServiceNow, in Silicon Valley – have deployed software to offer more modernized invoice and payment solutions for businesses that provide services in residences and other non-retail settings.

“Even if this exists elsewhere, there’s just not a lot of adoption of it yet by this cohort,” he said. “This cohort is busy, they are small businesses. They don’t have time to be investigating 15 different pieces of (payments) software.”

These systems also must marry invoices and payments with companies’ accounting platforms. Jobber, for example, says it integrates with QuickBooks and Stripe.

Intuit said its new payment feature will sync directly with a customer’s QuickBooks online account to manage payments and keep their books updated.

Intuit’s solution will accept contactless credit and debit cards, Apple Pay and other digital wallets, without the need for separate hardware to accept a payment.

“The thing we kept hearing from our customers was that they’d lose the dongles, they’d get smashed by heavy equipment, the Wi-Fi wouldn’t work, all kinds of problems,” Hahn said. “What we realized is that, especially with tap-to-pay, we had an opportunity to enable all of our customers, and especially all those in the mobile app, to instantly be able to accept credit cards.”

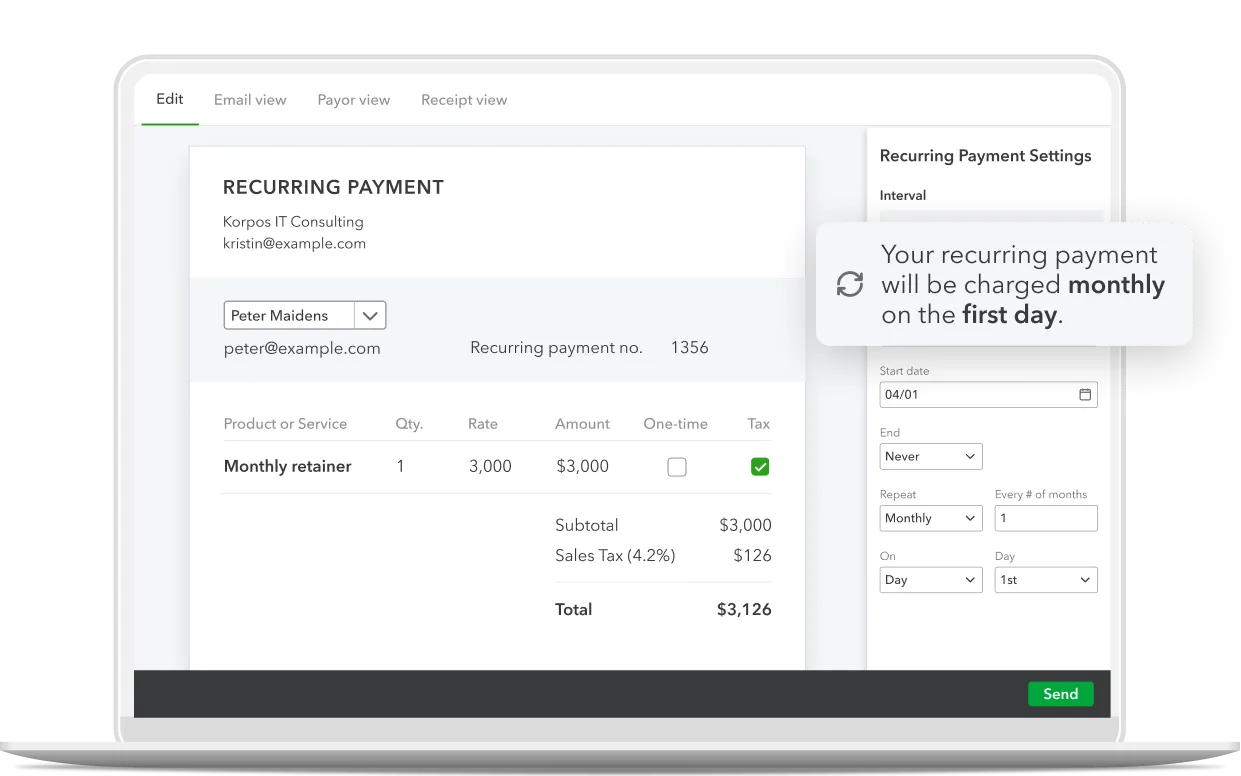

The new smartphone payment option came with separate Intuit news that the company is beginning a recurring payments feature. The goal is to get rid of a small business’s need to create invoices or send payment requests for repeat sales of services or products, such as a lawn service or pool cleaning.

Small businesses carry an average of $27,000 in unpaid invoices they’re owed, and more than half of small businesses have invoices that are more than 30 days late, according to Intuit’s July 2024 quarterly survey of around 5,000 companies in the U.S., Canada, Australia and the U.K.

Intuit, which is based in Mountain View, California, says it processed $124 billion in online payments in its 2024 fiscal year, up 20% from the previous year.