Dive Brief:

- Google Pay, the smartphone payments unit of that tech giant, said in a press release today that it's signed on with Marqeta to offer a new virtual payment card that expands its users ability to use the digital wallet for more purchases at more venues.

- The new virtual card will let Google Pay users spend down their balances with more merchants, using Marqeta's signature tokenized card embedded in the Google Pay mobile wallet.

- "We are always looking for ways to make Google Pay more helpful to our users," Google Pay Vice President Tarun Bhatnagar said in the release. "By working with Marqeta, we are able to give our users another way to spend the funds in their Google Pay balance, making it even easier to pay for everyday items."

Dive Insight:

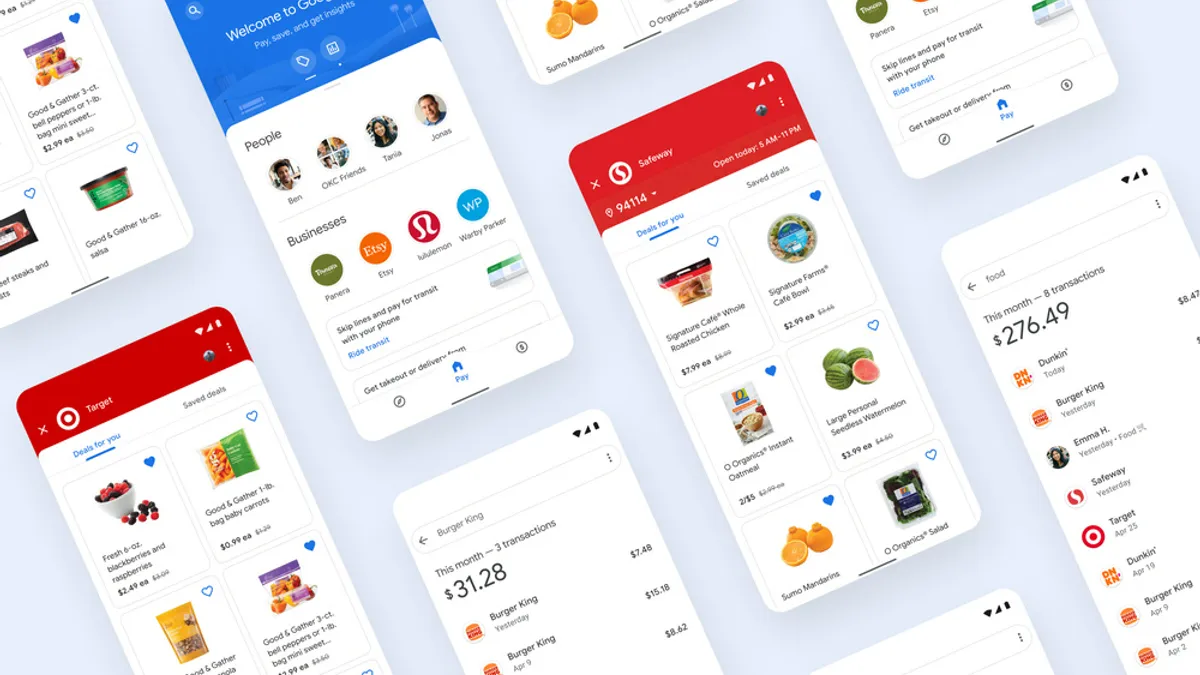

Google Pay has been expanding its capabilities as the world of digital payments mushrooms in the wake of the COVID-19 pandemic, which led consumers to seek out contactless forms of payment to guard against the virus. That phone and online payment app had been principally a means for peer-to-peer payments, but increasingly Google is adding features that lets users scan with a phone to make other payments.

Earlier this year, Google Pay launched partnerships with major retailers Target and Safeway to offer promotions through the app to shoppers. The tech titan has also been working on ways to use the payment app for expenditures on public transit in some 80 cities.

Aside from those partnerships and the P2P payment options, Google Pay users in the past have mainly been limited to making payments at Google-owned venues like its Play Store and YouTube units, or transferring funds to a bank account, the press release said.

While Mountain View, California-based Google announced additional functionality earlier this year, this is the first time it's disclosing it will be working with Marqeta, Marqeta spokesman James Robinson said. Google didn't immediately respond to a request for additional comment.

"We’ve been exploring the right opportunity to work together with Google since 2018," Marqeta CEO Jason Gardner said by email. "The work on the Google Pay balance project itself came together over a series of months, launching in June 2021."

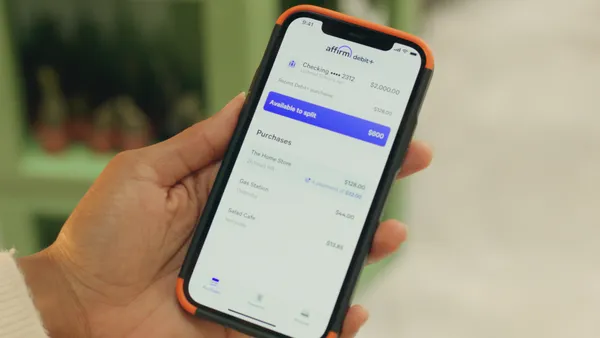

Oakland, California-based Marqeta is among a new generation of payments companies that are benefiting from a pandemic boost to digital payment technology. Venture capitalists have been backing new fintech companies like Marqeta in a big way over the past year as those companies ride a wave of enthusiasm for technological advances disrupting the traditional banking and payment systems.

Marqeta is fresh off a June initial public offering that allowed it to raise more than $1 billion to build out its modern, digital approach to the notion of credit cards in the marketplace. To that end, the company has been striking up partnerships with a host of big brand names, including banking behemoths JPMorgan Chase and Goldman Sachs as well as the ride-share company Uber and the crypto exchange Coinbase.

"Marqeta's modern card issuing platform is designed to be able to help the world's most innovative companies execute game changing products," Gardner said in the release.