Dive Brief:

- As contactless payments rise, Google is introducing Google Wallet in South Africa, Serbia, Moldova, Azerbaijan, Qatar and Iceland, according to an announcement emailed to Payments Dive Wednesday. Including the additions, the wallet is now available in 45 countries, a Google spokesperson said.

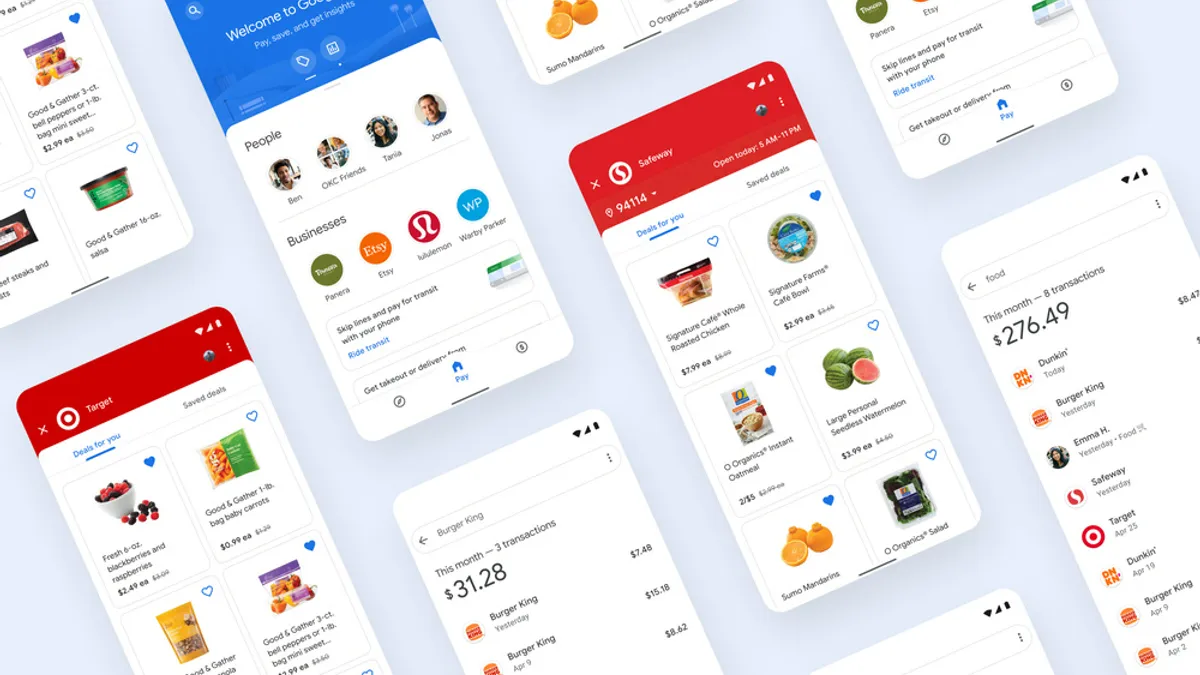

- Customers in those new countries can add their payment cards to their Google Wallet on their Android or wearable devices and pay at merchants that accept contactless payments. They can also store their loyalty cards and boarding passes from international airlines that support Google Wallet, the company said.

- Google will introduce its wallet on Android devices first and roll out the tool on wearable devices “in the upcoming months,” per the announcement.

Dive Insight:

Google touted the Google Wallet’s cybersecurity features, including biometric authentication and encryption, to protect users’ privacy. However, other Google Wallet features listed on the website, such as COVID-19 vaccination cards or government-issued IDs, are only available in select locations.

The rollout of Google Wallet is part of Google’s payment services expansion. Marqeta assisted Google in adding the Google Pay mobile wallet to the Instacart app in March 2020, just before the COVID-19 pandemic forced consumers to adhere to shelter-in-place orders. Later that year, Revolut, the international fintech app, added Google Pay to its mobile app, initially offering the option to customers in Austria, Bulgaria, Greece, Estonia, Latvia, Hungary, Lithuania, the Netherlands, Romania and Portugal.

In May 2021, the company introduced a peer-to-peer payments option for customers in the U.S. to send to other users in India and Singapore.

Google Wallet’s entry into new countries comes as contactless payments are expected to rise over the next two years, and the payments industry is rethinking its standards. In its 2020 report, Juniper Research estimated that contactless payments will jump from $2 trillion in 2020 to $6 trillion globally by 2024.

Meanwhile, EMVCo, which implements payment technology standards, collected public comments for new contactless payments specifications between May and June 20, with a goal to finalize the new standards by the end of 2022.

But as Google enters new markets with its payment tools, it faces competition from Apple Pay and Samsung Pay. As part of its payments push, Apple and Block partnered in June to introduce a tap-to-pay function for Square’s point-of-sale app, enabling customers to pay using Apple’s iPhone contactless payment feature. Amid fluctuating cryptocurrency prices, Samsung unveiled a new digital wallet that same month which could house digital currencies, identification cards, payment cards and other items.

Research from Visa suggests that consumers are open to contactless payments for public transit. The card network company released a report in July indicating that most of its survey respondents expect public transit to provide a contactless payment option, and less than half of respondents viewed the service as convenient.

The public transit app called Transit added Apple Pay and Google Pay to its app in March, allowing consumers to pay for their fares in select areas using the payments tools.