Dive Brief:

- African payments company Flutterwave has acquired 13 U.S. state money transmitter licenses this year, the company said in a Thursday press release.

- In August, the company received its first state license from Arkansas, according to the Nationwide Multistate Licensing System.

- “These licenses move us one step closer to our vision and we will continue to expand” for coverage of all the states, and beyond them, Flutterwave CEO Olugbenga Agboola said in the release.

Dive Insight

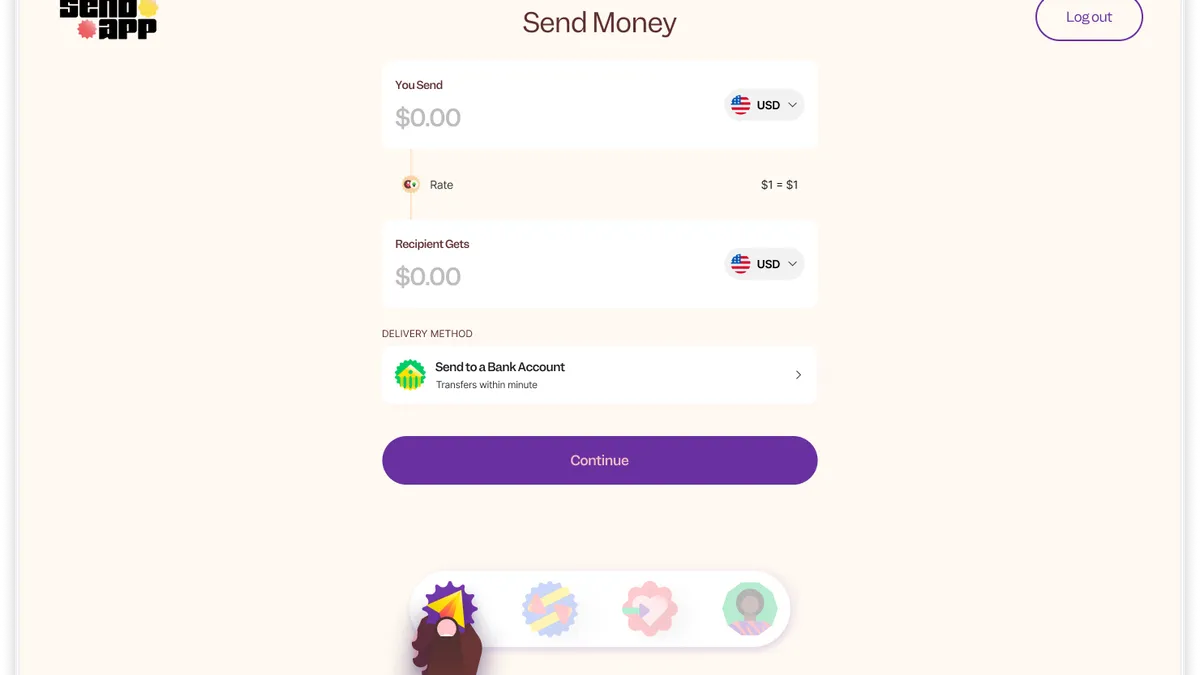

The company launched its remittance app at the beginning of August. Agboola talked about the app briefly during a November fintech conference hosted by Georgetown University. In particular, he said his vision for Flutterwave was to give all Africans living in the U.S. the ability to send money back to the continent and that he wanted to bring more foreign money to the country of Nigeria.

The United Nations estimates that over 200 million Africans receive remittance payments. The value of such payments to Africa has doubled in the past decade, reaching $100 billion in 2022.

Flutterwave’s growing reach into the U.S. is part of an international expansion that kicked off this summer. The Africa-focused fintech started rolling out partnerships in June aimed at connecting its customers to the U.K., Europe, U.S. and Canada.

In combination with a financial institution partnership, the licenses enable users of Flutterwave’s remittance app to send money to Africa from a total of 29 states, the release said. The company didn’t immediately provide details of that partnership and it didn’t respond to requests for further comment.

The company was founded in 2016 and is headquartered in San Francisco, though it runs its operations out of Lagos, Nigeria, according to business news outlet Forbes. As of March of this year, it had processed 100 million payments totaling nearly $20 billion across some 33 African countries.

The company has experienced its share of growing pains, according to global tech news outlet Rest of World. Since April of last year, Flutterwave has been rocked by allegations of administrative errors, mismanagement, security breaches and sexual harassment.

Last month, the Kenyan high court withdrew its second and only remaining case against the company, according to tech news outlet TechCrunch. The two cases against the company were based on allegations of fraud and money laundering, and involved government seizure of over $50 million in funds. The removal of that hurdle cleared the way for Flutterwave to pursue payments service provider and remittances license from the Central Bank of Kenya.

Flutterwave did not immediately respond to questions about the state licenses and its remittance app.