Payments processor Fiserv has signed up about 200 banks for the Federal Reserve’s new real-time transactions system FedNow, but those clients are still scrounging around for use cases.

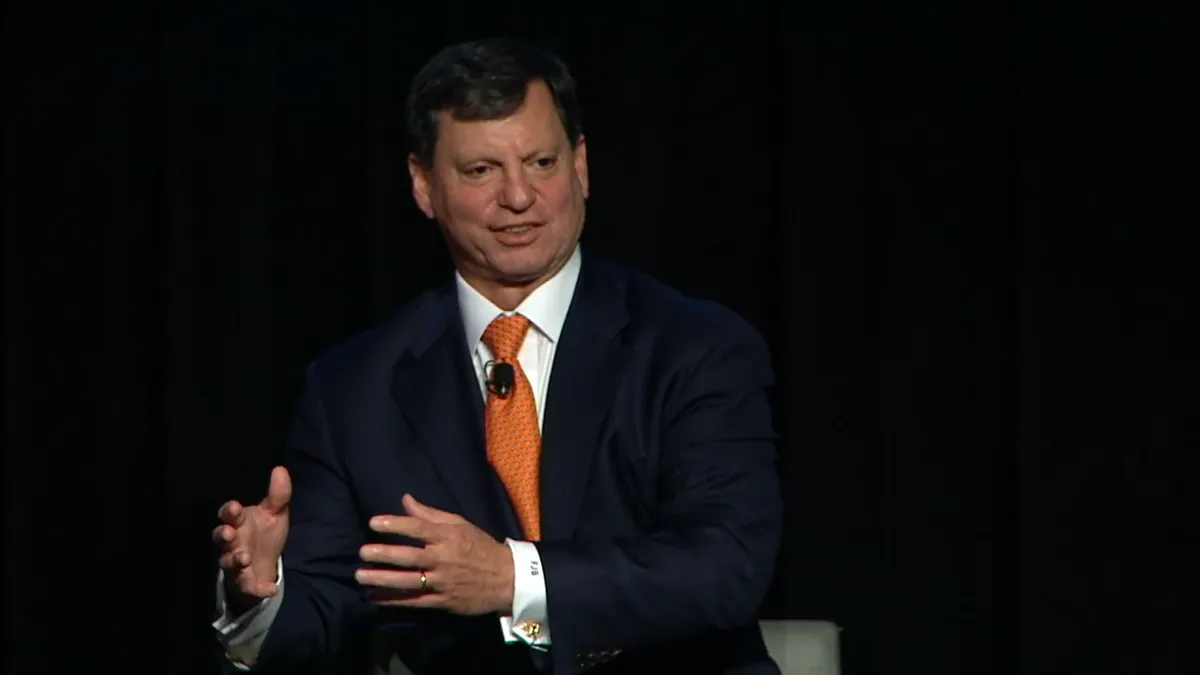

That’s according to Fiserv CEO Frank Bisignano, who talked about the Fed’s new payments system during an investor conference last week. When the host of the conference asked Bisignano about the adoption of the first new U.S. payments system in decades, he suggested the response has been tepid because the banks’ clients aren’t using FedNow yet.

“Our ability to implement is not the issue, our banks’ desire to have it is not the issue,” Bisignano said at the Annual Evercore ISI Payments & Fintech Innovators Forum last Wednesday. “Now we need client adoption, right? And I’d say that has not been nearly as fast as the Fed would want.”

Fiserv’s pack of bank customers linking to the FedNow system account for about 40% of the financial institutions lined up so far by the Fed to use the first real-time system offered by the government. The only other real-time system in the U.S. is the RTP network, which is operated by the bank-owned The Clearing House.

In sponsored content posted by the Fed on the ABA Banking Journal site this month, FedNow CEO Nick Stanescu said the Fed’s real-time system has now onboarded about 500 financial institutions, up from 35 at the start last July. He also commented on the types of uses emerging so far.

“The majority of payments on the network have been account-to-account payments, and I’m hearing a lot about digital wallet funding and defunding,” Stanescu said. “These examples make sense because consumers can experience friction during these transactions, and we can easily see the benefits of immediate access to money transferred between accounts.”

He noted FedNow is also being used for earned wage access and instant insurance disbursement services, and predicted that it will be tapped for bill-pay services as well.

In January, the Fed said it had signed up 400 financial institutions so far as senders or receivers of payments using the new FedNow system. It also emphasized that the pool of participants is diverse, with banks and credit unions of all sizes, with assets ranging from $500 million to more than $3 trillion, in 45 states nationwide. Only banks can join the network, offering the faster payment services to businesses and consumers.

In addition to Fiserv, FedNow service providers include the card network Visa and the payments services company ACI Worldwide.

While 400 is no small number, it’s a relatively minor slice of the nearly 10,000 bank institutions in the U.S. so the Fed has a long way to go in making the system widespread. That’s part of the conundrum for the central bank: it must attract banks to FedNow to make it more valuable as a network, but banks generally are less likely to be interested if the network isn’t comprehensive.

While a number of the biggest banks in the country have signed up, as of early this year there have been some notable hold-outs. Bank of America, Citigroup, PNC and Capital One Financial, all among the nation’s 10 largest banks, still haven’t signed on to FedNow, according to the Fed’s list of participants.

Fiserv has previously pointed out that FedNow isn’t bringing anything new to the table, but rather expanding the types of payments choices available. Tim Ruhe, Fiserv’s vice president of small and mid-sized business payments, downplayed the significance of FedNow to some degree last September.

“It's not a new concept to have multiple payment networks in the U.S. market,” Ruhe said in a post on the company’s website. “In fact, we were already operating in an environment where there were multiple real-time payment networks.” Still, he noted that FedNow expands the universe of service options. “It drives choice, innovation and ubiquity,” he explained.