Fiserv’s high-profile collaborations with Walmart and DoorDash made waves in the financial services industry after the Milwaukee-based payments processor announced the partnerships in recent months.

The association with the mega-retailer Walmart — which Milwaukee-based Fiserv confirmed on Sept. 20 — will let customers pay for goods and services at the store chain directly from their bank accounts. And the payment firm’s initiative with DoorDash — which the company announced on Oct. 22 — will give drivers the opportunity to get paid early, and access some banking services.

Fiserv isn’t the only payments firm collaborating with a company that employs gig workers. Oakland-based card issuing platform Marqeta is also working with Mastercard to offer Uber drivers a debit card.

Gig workers are often unbanked, said Sunil Sachdev, head of embedded finance at Fiserv.

In an interview with Payments Dive on Oct. 29, Sachdev discussed the company’s latest partnerships, why it pursued them and what might be on the horizon for the payments giant.

Editor’s note: This interview has been edited for clarity and brevity.

PAYMENTS DIVE: Can you tell me a little bit about these two recently announced collaborations?

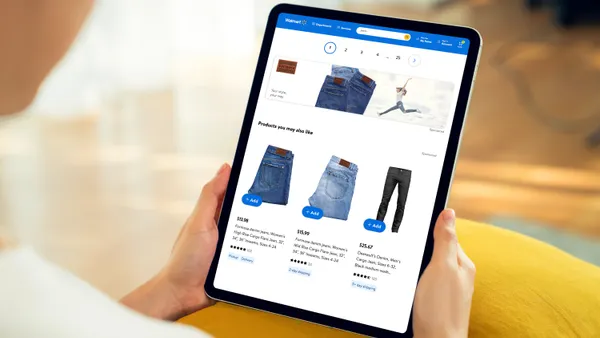

SUNIL SACHDEV: The first one is the ability to do a pay-by-bank transaction at one of our largest merchant customers, Walmart. The customer is able to facilitate a real-time transaction through the point of sale and pay for their goods through a pay-by-bank transaction. Pay-by-bank continues to grow in popularity and we feel that it's an important element of merchants providing choice to their customers. In addition to that announcement, we also are proud to announce a collaboration with DoorDash, where we are helping them introduce formal banking services for their drivers through an instant payment product called Crimson, and that product allows DoorDash drivers to get paid after every delivery. It also gives them access to a formal banking and checking account.

Does this mean DoorDash drivers will get paid faster than they do now?

They get paid a little bit faster. But also, I think it's important to say they get access to formal banking services, because if you think about the [workforce] segment that has a side hustle or drives for DoorDash, these are folks that are making anywhere between $60 to $100 a week. They need access to formal banking to build credit, and to do other things that will help them from a daily life perspective.

What banking services do they specifically have access to?

Well, they have a checking account, they get a debit card [connected to that checking account]. That's step one, and then ultimately that allows the financial institution to learn more about their customer and then be able to provide different types of lines of credit or other products.

What is the appeal of pay-by-bank for a retailer like Walmart?

Merchants like pay-by-bank because it allows them to bend the curve on some of their backend operational costs. But at the same time, customers also appreciate an opportunity to pay directly from their bank account, as opposed to writing a check or having to use a credit card.

The appeal for the merchant is that they are saving money, right?

A merchant has to pay interchange on [a customer] swiping a debit card, versus if you were just helping someone take money out of his bank account, there's less of a cost there to process that transaction. It's a more efficient payment method for the merchant, and from a customer perspective, it just gives them more choice.

Are partnerships something you are constantly on the lookout for?

Absolutely. We recognize today that the next generation is banking through non-traditional user experiences and non-traditional methods. Historically, people would go to a financial institution, open up the bank account, and be able to work with their financial institution, then share information with that financial institution to grow their access to other banking and investment products. Today, we have companies like Robinhood Markets. You have companies like DoorDash, you have other platforms out there that are engaging with customers and providing them with different types of financial services. At the end of the day, financial institutions are always behind those user experiences.