Dive Brief:

-

Fiserv, a payments processing company, is expanding its strategic partnership with PayMyTuition to enable Chinese nationals to pay their tuition fees abroad in the U.S. as well as Australia, Singapore and Canada, the company said in a May 24 press release.

-

International students comprise over 5% of higher education enrollment in the United States, according to a study done by the Brookings Institution, and revenue from tuition and fees totals $2.5 billion. Fiserv's new offering may help Chinese students to pay their tuition in an easier, faster and more efficient way.

-

PayMyTuition integrates directly into educational institutions' student information and accounts payable (AP) systems. Students can pay their tuition without additional fees, "while colleges and universities save time, human resources, and money," the press release stated.

Dive Insight:

Brookfield, Wisconsin-based Fiserv and PayMyTuition, part of the Canadian global payments provider MTFX Group, plan to roll out the payment option around the world, starting in Australia and Singapore, and targeting their services to tuition fee payments from Chinese students.

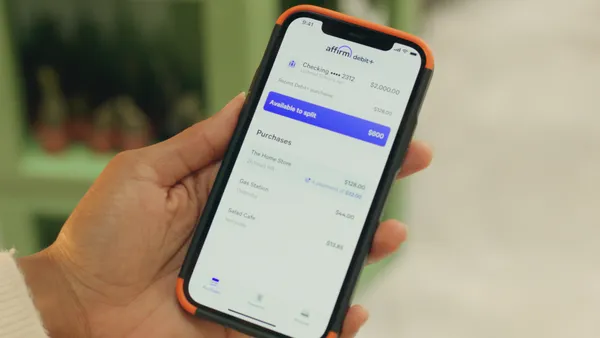

WeChat and AliPay are preferred Chinese consumer payment methods so the Fiserv partnership with PayMyTuition will let Chinese students make payments using those local digital payment tools, but allow for settlement of the payments in other currencies, such as U.S. or Singapore dollars, based on where the educational institution is based.

"We are excited to partner with Fiserv to expand upon our current offering of providing local payment methods and a seamless payment experience to Chinese students paying international tuition fees," said Arif Hariji, MTFX's director of chief market strategy. "Colleges and universities overseas serving Chinese students will benefit from payment settlement in U.S. dollars or their preferred currency, improving operating efficiency and saving in fees."

In 2019, there were approximately 370,000 Chinese students studying in the U.S., out of 1,095,299, total international students, according to the research group EducationData.org.

Currently, the majority of the cross-border payments made by foreign students are dependent on the correspondent banking model, which is opaque, slow and expensive. According to The World Bank, the global average cost of sending $200 was 6.5% in the fourth quarter of 2020.

The nearly 1.1 million international students enrolled at U.S. colleges in 2019 made up about 5.5% of the total U.S. student population, EducationData.org said. In 2018, the total contribution to the U.S. economy by international students was estimated to be over $45 billion and the impact of Chinese student enrollment on the U.S. economy was $14.9 billion, the group said.

"There's all kinds of delays and fees associated with [legacy cross-border money transfer methods,]" Erika Baumann, a senior analyst at Aite Group told Payments Dive recently. "You may or may not know what those fees are and then have to send a secondary transaction to make up for that if your recipient is short paid, because of the fees taken during the correspondent banking process."

Fiserv processed 12,000 transactions per second across more than 100 countries in 2020, according to the company's annual report.

Fintechs including Flywire, Wise (formerly known as Transferwire) and Fiserv are working to develop payment options that rival incumbent banks in cross-border payment channels.

"We are proud to support PayMyTuition's expansion in the market and their goal to simplify the payment of students' tuition and fees," said Sarah Wu, General Manager of Fiserv in Greater China. "Whether providing services or online shopping to Chinese consumers, it is always preferred to offer familiar payment methods."