Dive Brief:

- In response to the rapid growth of buy now-pay later use among consumers, credit reporting agency Experian announced Wednesday it’s implementing the Buy Now Pay Later Bureau, which will provide a platform for BNPL providers, fintechs and point-of-sale lenders to share payment data tied to these transactions, the company said in a news release provided to Payments Dive.

- Experian said the specialty bureau, debuting in the first half of the year, will offer "a comprehensive view of consumer payments, including the number of outstanding BNPL loans, total BNPL loan amounts and BNPL payment status," per the release.

- In addition to real-time reporting of consumers' installment loan activity, the bureau will provide Fair Credit Reporting Act (FCRA) regulated scores and attributes that BNPL providers and traditional lenders can use when making credit decisions, the release said. To shield consumers’ scores from immediate negative impact, detailed information related to each BNPL transaction "will be stored separately from Experian’s core credit bureau data."

Dive Insight:

As BNPL has become more widely used, it’s also faced regulatory scrutiny, and both have prompted credit reporting agencies to adapt to the burgeoning trend.

Most BNPL accounts — like the shorter, smaller installment plans — are not currently reported to credit bureaus, because commonly used credit scoring models are based off on mainstream credit product behaviors, Experian noted.

Experian will store BNPL data separately, given that preliminary research shows that including all BNPL account information "can negatively impact consumer credit scores because of the way inquiries, new tradelines and utilization rates are reflected in credit score models," Greg Wright, executive vice president and chief product officer for Experian, said in an email.

In announcing the new services, Experian follows Atlanta-based competitor Equifax, which last month said it will use a newly created code to identify BNPL tradelines, specifically the popular "pay-in-4" plans.

Chicago-based TransUnion has said it will also soon share its own BNPL approach. Neither TransUnion or Equifax responded to requests for comment on Experian’s announcement. Wright wouldn't comment on competitors' actions.

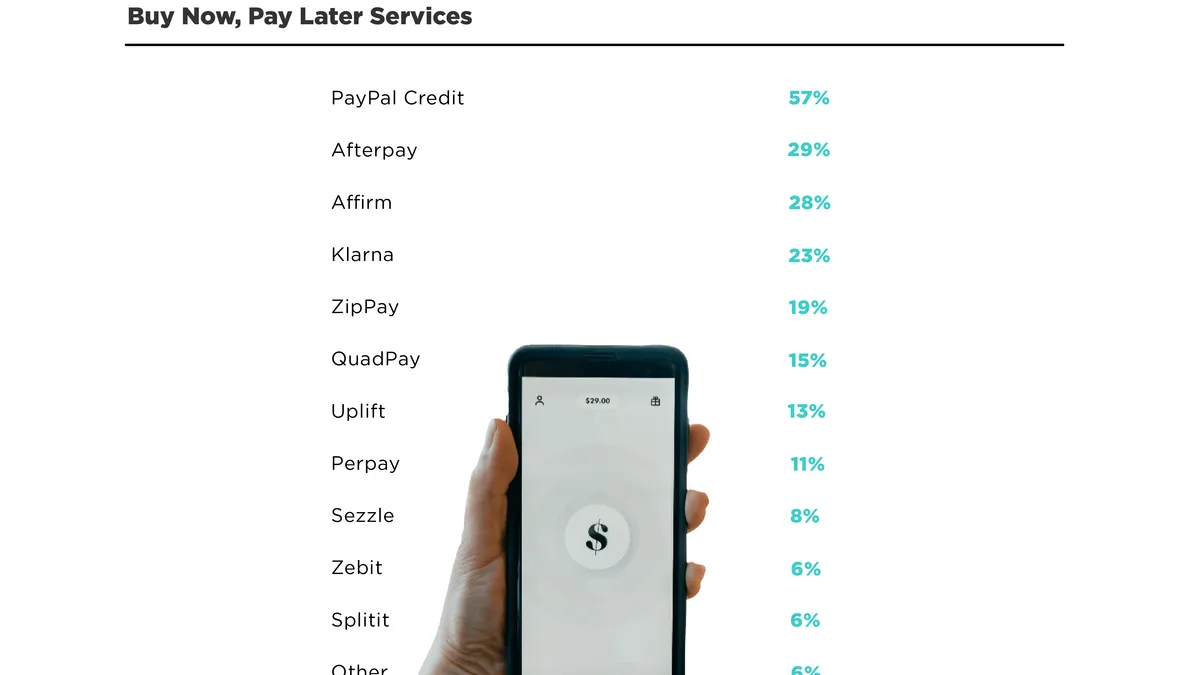

In December, the Consumer Financial Protection Bureau ordered five BNPL companies — Affirm, Afterpay, Klarna, PayPal and Zip — to provide information on the risks and benefits of installment loans. The federal agency and lawmakers have expressed concerns BNPL is saddling consumers with too much debt.

Wright said many BNPL providers are supportive of Experian's approach, and the credit reporting agency expects those providers to readily share data, given "their top priority is to protect consumer credit scores from negative impact, which aligns closely with our mission at Experian."

Ireland-based Experian said 45 million American consumers took advantage of the ability to pay in installments last year. BNPL, especially popular with younger consumers, allows shoppers to divide a purchase into equal payments over a defined period of time; BNPL providers typically skip a credit check or do a "soft pull" on their credit histories.

Experian wants to "drive financial inclusion while ensuring responsible lending and we believe the reporting of BNPL payments plays a critical role in achieving this," Wright said in the news release. "At the same time, we are committed to giving BNPL providers the confidence they can report information to us without negatively impacting consumer credit scores."