Would you entrust your savings to Elon Musk?

The question may seem hyperbolic, but essentially, that’s the multi-billion dollar query at the heart of Musk’s “everything app” vision, that he’ll be able to convince millions, even billions of people to entrust his X platform with all of their money, in order to conduct various financial transactions, all in-stream.

Musk’s view, based on his history in developing the first iteration of PayPal, is that facilitating payments is not enough, and that apps like PayPal could do so much more, in terms of providing banking services, loans, credit options. Essentially, Elon’s view is that if online apps can cater for payments, then why can’t they replace banks wholesale, and enable simple, fee-free funds transfer, in various forms, to streamline and improve the banking system?

In theory, this makes sense. According to McKinsey, the average U.S. household generates around $2,700 in banking revenues each year, based on fees and charges attached to their various accounts and loans, and that amount rises significantly for those earning over $100k. Imagine, then, if you didn’t have those extra costs, or you could limit them through alternative means.

Remittance is another key use case. Every year, over $100 billion in remittance is sent back to families in India alone, and all of that is subject to transfer fees and costs, much of it costing families that need money the most.

The case for cheaper, faster transfers is clear. But actually making it happen is no simple task.

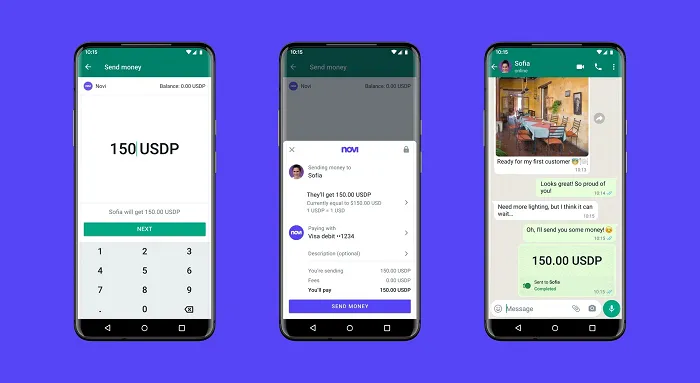

Meta found this out the hard way. Over the last decade, Meta has attempted various forms of in-stream payments, all of which have been opposed by various governments and regulators in different regions.

Meta’s big payments push was Diem, its in-stream currency, which it hoped would enable it to side-step existing financial frameworks, and bring more money into its ecosystem.

Back in 2019, Meta announced the first stage of what was originally titled its “Libra” cryptocurrency project, which would offer fee-free transfers and payments in the app.

Meta leaned on another former PayPal executive to lead the project, in David Marcus, but after three years of being put through the regulatory ringer, Meta eventually gave up on the project entirely last year.

Why?

Because those making the decisions on such projects didn’t trust that Meta should be handed the responsibility of dealing with payments, which could potentially put more people at higher risk.

The project was seemingly doomed from the start, with big-name launch partners quickly rescinding their support due to scrutiny from U.S. regulators, who questioned Meta’s push to get into payments. That scrutiny eventually led to Meta CEO Mark Zuckerberg appearing before the House Financial Services Committee to justify the initiative, but eventually, after trying various angles and avenues, the project was shuttered, and Meta moved on to facilitating payments via Meta Pay, which is also still facing significant pushback from many regulators.

The problem is, those making such decisions do not feel comfortable allowing social media networks to become payments providers as well, given their collective track record on data security, privacy, etc. Add to this the fact that the powerful banking lobby is urging politicians to oppose any such move, and the wall confronting social apps looking to move into payments becomes very significant. As such, it’s going to be increasingly difficult for any individual platform to facilitate full payments in-stream, let alone banking, loans, and whatever else may come of such.

It’s hard to see Elon Musk, who’s made his dislike of the SEC and FTC very public, gaining the required nods and ticks to go ahead on his own all-encompassing payments app vision.

Maybe, there’s some other leverage that the world’s richest man can lean on to force his will, and make this happen, and maybe there is another avenue that Meta couldn’t find in its development process.

But right now, it’s hard to see how X becomes that next-stage app, similar to Chinese messaging platforms like WeChat which have become ingrained in everyday life. Your WeChat barcode is your digital identity in many respects on the Chinese mainland, but can X do the same, and become the critical connector, for everything, as Musk envisions?

He’s definitely going to try. X has already gained initial payment licensing agreements in various US states, which is a critical precursor to enacting this push.

And Elon has a history of working in difficult niches.

If it were anybody else, I suspect the payments proposal would be dismissed already, but few are bold enough to bet against Musk, and what he may be able to do, based on past history.

But even if he can get all the approvals, the question remains. Would you entrust your life savings to a platform run by Elon Musk?