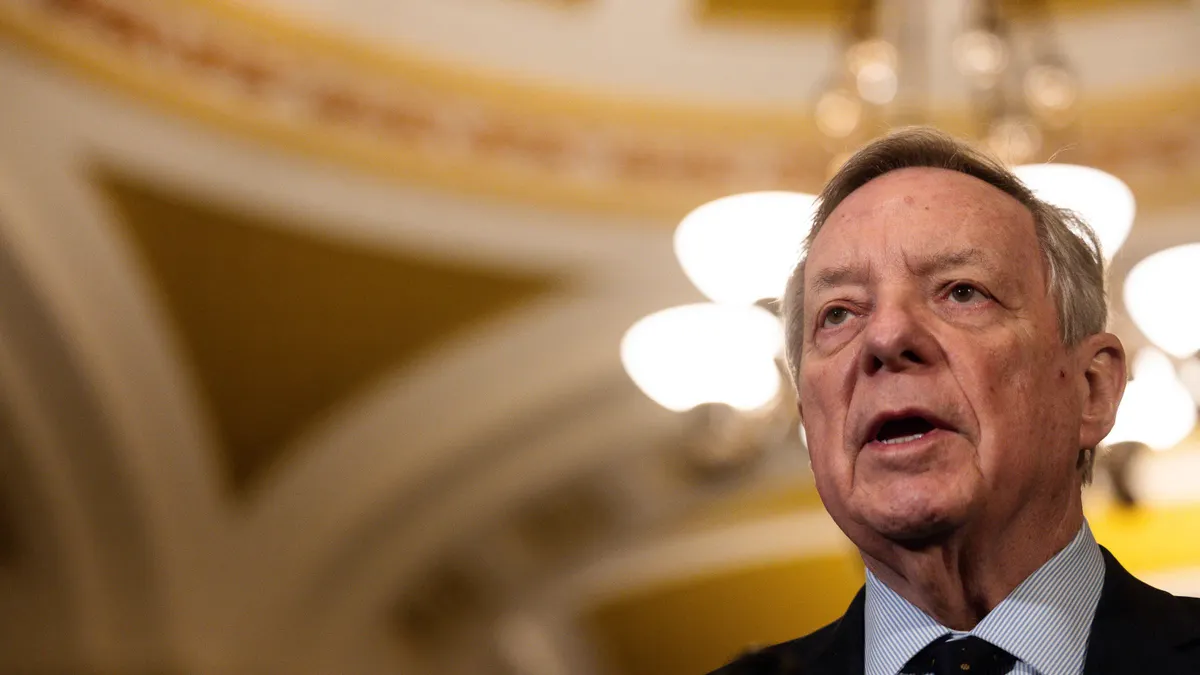

Sen. Dick Durbin is retiring, but that doesn’t mean he’s done with credit card reform efforts.

The Illinois Democrat announced last week that he wouldn’t seek re-election next year and his four-decade congressional career will end in January 2027.

Still, he plans to use some of his dwindling days in the Senate to continue a crusade for the Credit Card Competition Act. A spokesperson for his office confirmed that intent by email on Thursday.

That’s the piece of legislation that would force bank card issuers to ensure that credit card processing systems always make a network other than Visa and Mastercard available to retailers, restaurants and other merchants. It would be no small change, given that Visa and Mastercard handle about 87% of all transactions when consumers swipe their cards, according to industry research firm Nilson Report. (That’s all cards, but they dominate the market for credit cards alone too.)

The idea behind the legislation is that it would create an opening for more competitors to challenge the duopoly, ultimately cutting card processing costs.

Durbin, 80, has pushed the bill in the past two congressional sessions, with backing from Kansas Republican Roger Marshall. But so far this year, the legislation hasn’t resurfaced, despite Durbin’s promises it will.

Durbin is waiting for the right moment, says Doug Kantor, who serves as general counsel for the National Association of Convenience stores and who has been a major proponent of the proposal since it landed in 2022.

Durbin’s camp is keeping an eye out for a larger bill that would be a suitable vehicle for carrying the legislation across the finish line, Kantor said in an interview last week. The lack of movement this year has probably been a result of the chambers being preoccupied with other major issues like the budget, he said.

The Merchants Payments Coalition, which includes the National Retail Federation and the National Restaurant Association, among others, has also encouraged the legislation.

“There is a broad and growing recognition that the credit card companies don’t do business the right way, and this bill may be one piece of addressing that,” Kantor said.

But things aren’t so clear across the aisle. Marshall’s office has steadfastly not responded to requests for comment on the reintroduction of the legislation in recent weeks, despite his very vocal support last year.

On the House side, Arkansas Republican French Hill, who is chairman of the House Financial Services Committee, doesn’t see the bill going anywhere because Congress shouldn’t be in the position of refereeing between retailers and banks, he said recently. “This isn’t the way to resolve it,” Hill said during an event hosted this month by the media outlet Punchbowl News.

The lack of Republican interest may have something to do with other financial services priorities being floated by newly elected President Donald Trump, like his fascination with cryptocurrencies. That may be propelling a Republican congressional focus on pursuing stablecoin legislation.

In addition, interest groups on the other side of the fight, in particular the Electronic Payments Coalition and Bank Policy Institute, have not let up this year in skewering the CCCA proposal with press releases, statements and event appearances.

“We’re taking this extremely seriously,” EPC Executive Chairman Richard Hunt said at the Punchbowl News event, contending the bill is a favor for big box retailers that would undercut card rewards and security.

Hunt lamented Durbin’s success 15 years ago in passing his namesake amendment to the Dodd-Frank Wall Street Reform and Consumer Protection Act, which ushered in limitations for fees in processing debit card transactions.

Congressional Republicans are still seeking to blunt the impact of that law. A pack of House Republicans, including Hill, last month wrote to the Federal Reserve to reverse course on a planned reduction of the debit fee cap prescribed by that law.

For the long-time Democratic Senate whip, Republican control of both chambers and the White House has not only weakened Durbin’s power, it has seemingly reset the agenda. Some congressional colleagues have moved on to new card industry legislation that aims to protect consumers from high credit card interest rates.

Part of Durbin’s decision to retire may have been influenced by younger peers eager to take on leadership. He may find he has to leave his card reform agenda for them, if they’re interested.