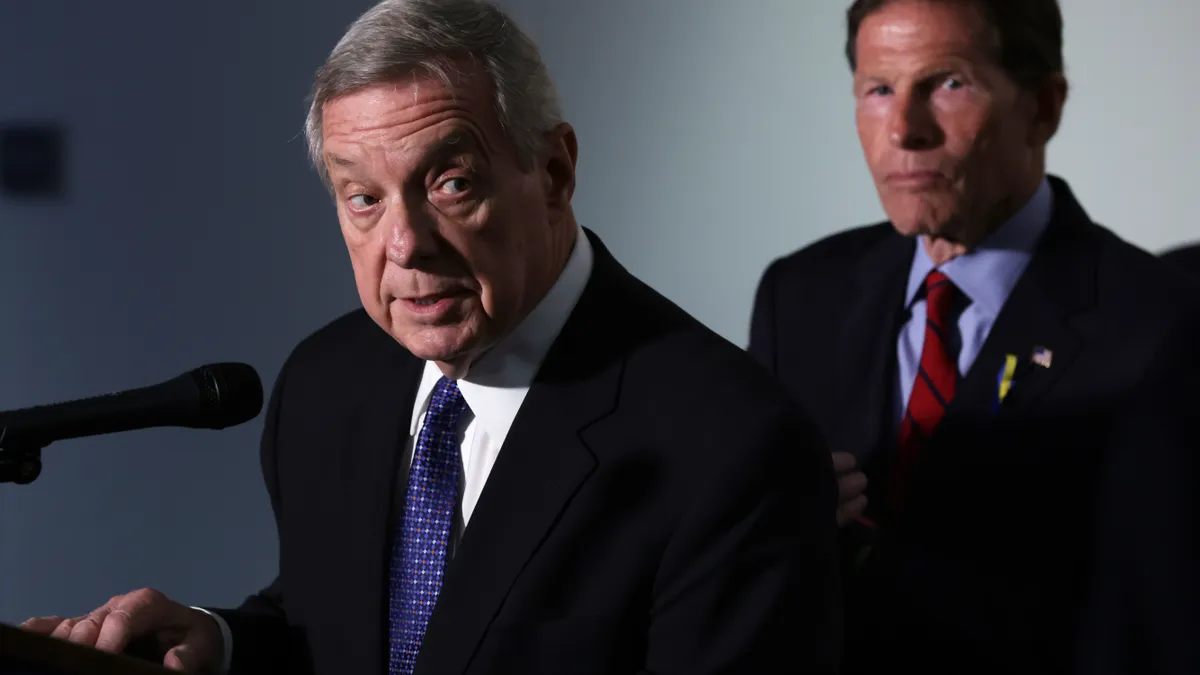

Sen. Dick Durbin opted to postpone a Senate Judiciary hearing this week focused on Visa and Mastercard’s business practices after CEOs of the credit card companies declined to appear Tuesday.

But Durbin, who chairs the committee, is still angling to bring those chief executives to Washington, according to his staff. “The witnesses and date of the hearing remain part of what's being negotiated,” said a spokesperson for this office. “Nothing has been cancelled.”

The Democratic senator from Illinois and a Republican colleague, Sen. Roger Marshall of Kansas, have been angling to put Visa CEO Ryan McInerney and Mastercard CEO Michael Miebach in the hot seat before the committee to have them explain how their companies impose fees on merchants every time a credit card is swiped by consumers.

Since news of the previously scheduled April 9 hearing, Visa and Mastercard signed a sweeping legal settlement with merchants last month that included the two big card networks agreeing to cap their fees for five years. The settlement, which also includes card processing rule revisions, was one of two settlements signed to resolve litigation brought by the merchants years ago over what they alleged were overcharges by Visa and Mastercard. It’s still subject to approval by a federal judge overseeing the litigation.

San Francisco-based Visa is the largest network operating in the U.S., with Purchase, New York-based Mastercard a no. 2 rival. Spokespeople for the networks didn’t immediately respond to requests for comment.

The networks charge interchange, and other fees, for their own benefit and on behalf of banks that issue the cards when consumers use their credit cards to pay for goods and services. JPMorgan Chase and Capital One are two of the biggest issuers of credit cards.

Durbin and Marshall are seeking the CEOs’ testimony as they campaign for passage of the Credit Card Competition Act, which they proposed as a means to injecting more competition into credit card processing market. If it were to become law, the new law would require bank card issuers to make sure alternatives to Visa and Mastercard were available to merchants for processing credit card payments.

The senators argue that the card networks have a monopoly in that market and are overburdening merchants with fees that ultimately impose higher costs on consumers too. Marshall has pledged to continue pushing for passage of the bill this year, despite the increased difficulty of winning support in an election year. While the bipartisan legislation hasn’t made progress in the Senate or the House, it has won a few additional supporters.

Retail and merchant trade groups, including the Merchants Payments Coalition and National Association of Convenience Stores, have supported the legislation, contending that the fees keep rising despite efforts to keep them in check. That camp is confident that the hearing will be rescheduled, according to Doug Kantor, who is general counsel for the association and an MPC executive committee member.

“We’re happy to show up anytime any place in any form to talk about this issue and it’s telling that the other side is not,” Kantor said in a Tuesday interview. “It tells me that they’re afraid to talk about it because they know the merits aren’t on their side.”

Opponents of the legislation, including the banks as well as payments processors and credit card networks, say it would undercut the services that are offered for consumers, including the rewards programs tied to the cards. Trade groups objecting to passage, including the Electronic Payments Coalition, argue that the bill is mainly aimed at benefiting larger retailers seeking to reduce their costs.

“This hearing was never about anything more than an attempt to silence American corporations that opposed the deeply flawed mandates in the Durbin-Marshall credit card bill,” an EPC spokesman said by email. “If it were a serious hearing, Senators Durbin and Marshall would have also demanded the CEOs of the nation’s largest retailers appear before the committee.”