Dive Brief:

- Drivers would prefer to pay road tolls with digital tools like PayPal (55%), Apple Pay (50%), Venmo (33%), Google Pay (32%) and Cash App (30%), according to results of fintech firm PayNearMe’s survey released Tuesday.

- While 48% of cash-paying drivers use cash for budgeting reasons, 17% of cash-payers don’t have bank accounts, and 12% aren’t credit or debit cardholders, according to the February survey of 1,548 U.S. drivers.

- The results of the survey also showed that 45% of respondents said they are open to Scan-to-Pay QR codes, a press release from the company said.

Dive Insight:

The new survey from PayNearMe, the Santa Clara, California-based payments processor, offers some insight into the payment challenges drivers face when passing through toll roads.

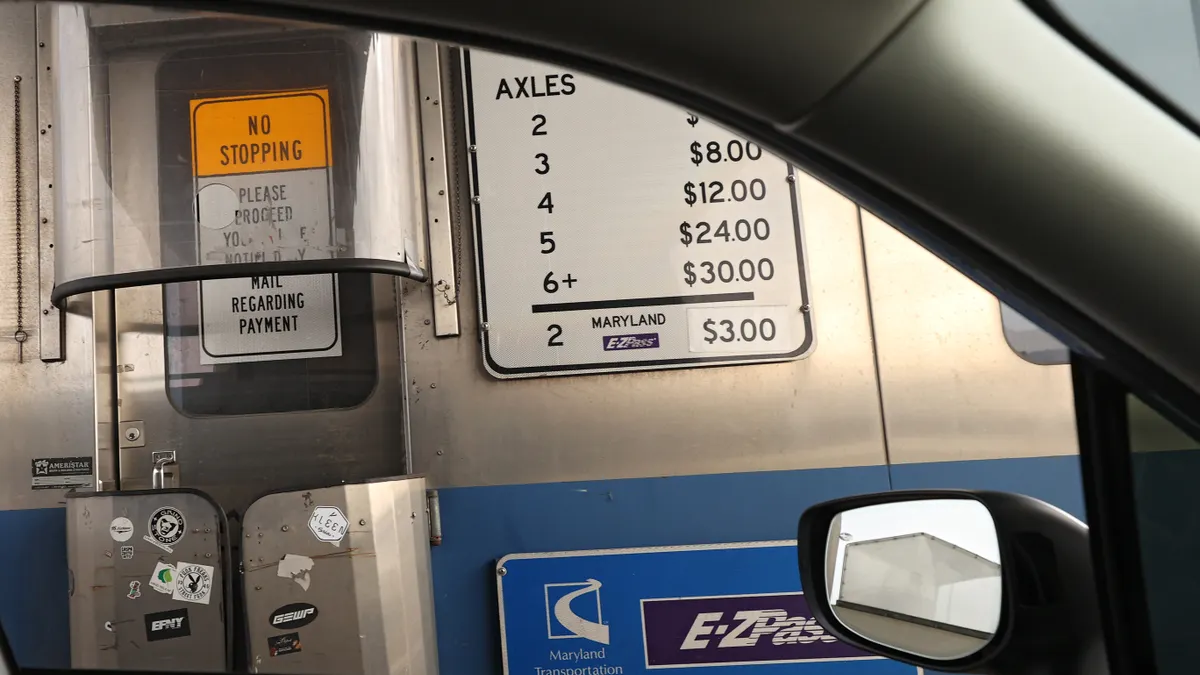

About three in ten drivers (28%) said they couldn’t pay tolls with their desired payment method. Meanwhile, 30% of drivers who missed payments said a digital wallet option wasn’t available to them, the survey noted.

“Digital wallets are essential to how consumers manage their money,” Anne Hay, chief marketing officer and executive vice president of PayNearMe, said in a statement. “Our research found that 51% of consumers store funds directly in payment apps, effectively using them as alternative bank accounts.”

For about a fifth of the consumers surveyed, a toll request turned into a violation during the past year and about half said it could have been avoided with easier payment options. The company estimated that toll systems lose out on $2.24 billion annually, and suggested that figure could be reduced by increasing payment options.

“When agencies don’t accept digital wallets, they are missing payments drivers are ready to make,” Hay said. “Consumers are storing money in these apps. Agencies need to meet them there.”

PayNearMe has been enhancing its own payment capabilities. Last October, the company expanded its partnership with PayPal Holdings, allowing PayNearMe to grow its banking collaborations and offer more reliable services.

As PayNearMe highlights the lack of digital wallet options, usage of the payment technology is expected to grow in the coming years. Use of digital payment options, including digital wallets, account-to-account payments and buy now, pay later providers, is expected to exceed $33.5 trillion by 2030, according to Worldpay’s 10th global payments report.