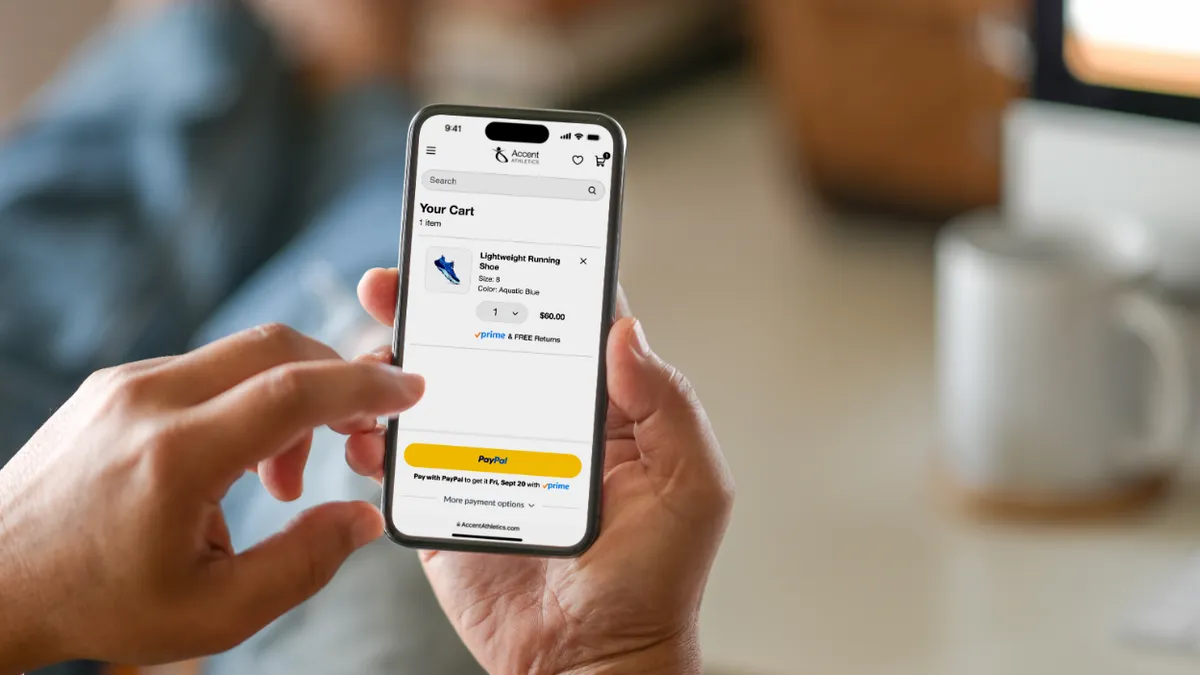

Digital payments that aim to reduce “friction,” and are aimed at making financial transactions quick and easy for customers, are rapidly gaining popularity.

The number of cashless transactions will increase nearly 50% globally, from 1.5 trillion in 2024 to 2.3 trillion in 2027, according to data from Statistica.

It’s easy to see why, said Brian Shniderman, senior managing director and head of the North American payments practice at Accenture.

“Frictionless payments are a game-changer for improving efficiency, customer satisfaction and staying competitive. They help cut down on transaction errors, streamline operations and meet the growing demand for flexible payment options,” Shniderman said in an email. “When businesses make paying easy, they’re more likely to see higher customer loyalty, fewer abandoned carts and new growth opportunities.”

Frictionless payments, including digital wallets like Apple Pay, contactless cards and payment links like QR codes, can also slash transaction times, reduce cash-handling, improve data security and provide valuable insights into consumer purchasing behavior and preferences.

Businesses have taken note and are increasingly using payment data to change their products and services to meet customers’ needs, said Phillip Goericke, CTO of engineering at embedded payments platform NMI.

“This is really valuable in subscription models or omnichannel environments where consistency and convenience are paramount,” Goericke said.

Privacy, security and data management challenges

While frictionless payments offer businesses and consumers a range of benefits, there are some drawbacks.

Frictionless payments are more vulnerable to certain privacy and security risks than other payment methods because they collect and transmit valuable information using technologies like near-field communication, radio frequency identification and biometrics.

That’s raised concern among consumers and data privacy advocates who worry about bad actors using information on consumer behavior for nefarious purposes, including unauthorized purchases.

As a result, businesses that adopt frictionless payments may experience increased disputes, chargebacks and returns, which can increase costs and lead to customer mistrust, said Jennifer Fagan, retail partner at consulting firm EY.

“It may be frictionless on the frontend, but there’s going to be friction on the backend,” Fagan said. “You could have a friendly fraud situation where you ask for a chargeback and say, ‘I didn’t purchase that,’ or maybe a family member had done it on your behalf.”

Due to their privacy and security risks, frictionless payments — like other financial tools — are also subject to significant regulatory oversight, making compliance challenging, especially for businesses operating across several markets. The European Union’s General Data Protection Regulation and Payment Services Directive 2 regulations “can complicate deployment,” Shniderman said.

Businesses that rely on digital wallets to complete financial transactions could also fail to collect valuable first-party data, Fagan said.

For instance, if a customer purchases a shirt from an online store using Apple Pay or Shop Pay, the retailer may not know who purchased it. In instances like that, the retailer may “spin their wheels” marketing that same shirt to the customer even though they already own it, Fagan said.

As the consumer, “you’re looking at it saying, ‘They don’t know me at all,’” Fagan said. “So, the whole value proposition around personalization is lost.”

Additionally, while digital wallets can make it easier for customers to participate in loyalty programs, customers could “miss out on loyalty points” if they forget to connect their account or login to a retailer’s website, Fagan said. That could negatively affect their customer experience.

Customer experience leaders must also be wary of alienating customers who are unwilling or unable to use frictionless payment methods, especially if they are essential to the business.

“You need to meet customers where they are,” Goericke said.

Frictionless payments best practices

There are several measures that businesses can take to ensure the successful adoption of frictionless payments.

“Customer experience leaders should prioritize three things: ease of use, security and integration,” Shniderman said. “People want convenience, but they also expect strong protection against fraud. Striking this balance is key, and tools like biometric authentication and AI-powered fraud detection can help.”

Integrating online, mobile and in-store payment systems is especially important to ensuring a predictable and smooth customer experience, especially for omnichannel retailers, experts say.

“Legacy systems can create roadblocks, so it’s essential to have the right infrastructure in place to support new technologies,” Shniderman said.

White label solutions can help ease the transition, Fagan said. Several third-party vendors offer products and services that provide a modern user experience, up-to-date technology, multiple payment options, and built-in privacy and security protections.

“For leaders considering frictionless payments, my advice is simple: Prioritize your customers’ experience while aligning with your business goals,” said Paul Anderson, co-founder and CEO of Integrity Turnkey Business Solutions. “Begin by identifying pain points in your current payment process — whether it’s speed, security or customer satisfaction — and seek solutions that address them holistically. Partner with a trusted payment processing provider who can offer scalable, innovative systems tailored to your needs.”

Customer education, data privacy and security investments, regular security audits, fraud detection systems, robust customer service and continuous monitoring of customer feedback are other measures that can help businesses get the most out of frictionless payments.

“Don’t view this as just a technological shift; it’s an investment in building stronger relationships with your customers,” Anderson said. “A seamless payment experience can be the difference between a one-time customer and a lifelong advocate for your business.”