Dive Brief:

- In surveys of customer satisfaction with credit card and bank digital experiences, consumer research firm J.D. Power reported a nearly across-the-board decline in customer satisfaction, with a drop in approval for credit card mobile apps, credit card websites, national bank mobile apps and regional bank mobile apps, according to a June 2 press release. Only national bank websites had a slight uptick in satisfaction, though their banking apps had the biggest decline, the results showed.

- "When it comes to delivering that level of personalization through high-touch digital channels, most banks and credit card providers are missing the mark," the press release said. "Overall satisfaction with most digital channels has declined as usage has increased."

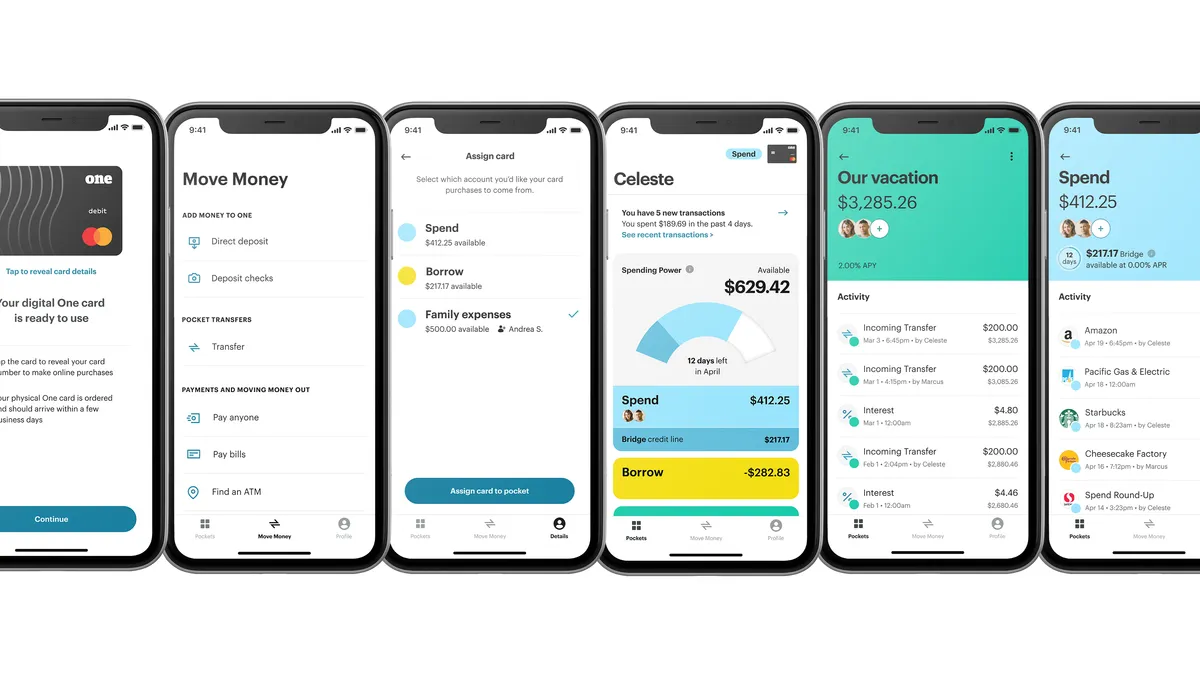

- The research firm identified "one bright spot" in that consumer satisfaction rose for all segments when they had access to digital spending analysis and budgeting tools.

Dive Insight:

Consumers’ fluctuating sentiment regarding their digital banking tools could be linked to their financial precarity. The J.D. Power study, based on responses from 16,132 retail bank and credit card customers nationally between February and April 2022, found that the share of respondents who felt “financially healthy” dropped by ten percentage points from 53% to 43%. Conversely, the percentage of respondents who were “financially vulnerable” rose from 25% to 32%, the study said.

Still, those results are somewhat at odds with a recent Federal Reserve survey. That 2021 Economic Well-Being survey found that 68% of 11,000 survey respondents said they could cover a $400 emergency — the highest share since the agency began surveying in 2013. Nonetheless, that still means 32% of respondents don't have that financial wherewithal.

Those mixed insights may underlie some of the varied sentiments that J.D. Power's satisfaction surveys revealed. “We’re seeing a lot of volatility in customer satisfaction scores in the digital banking and credit card space driven by a combination of heightened customer expectations for what a digital experience should look like,” J.D. Power Senior Consultant Jennifer White, who covers banking and payments, said in the release.

“Based on their experiences with other consumer apps and websites that anticipate their needs and offer a highly personalized customer experience, bank and credit card customers are expecting more from their digital solutions," she said. "The tough economic climate has amped up the urgency of those expectations.”

Discover ranked highest among credit cards for mobile app satisfaction, followed by Capital One in second place, Bank of America in third, American Express in fourth and JPMorgan Chase in fifth, with all of those ranking above the industry average while a pack of banks ranked below average.

With respect to credit card online satisfaction, Discover ranked in the top slot again, followed by Bank of America in second place, and American Express, Capital One and Chase tied for third, with all ranking above the average mark and a group of banks again ranking below average.

Capital One was ranked the highest in mobile banking app satisfaction among national banks, followed by Chase and Wells Fargo, according to J.D. Power’s 2022 U.S. Banking Mobile App Satisfaction Study. For online banking satisfaction, Capital One topped the list, followed by Chase and then Bank of America.

Though nearly three-fourths (73%) of bank customers who bank in-person say they have a personal relationship with that bank, only 53% of consumers who use digital bank channels said the same, according to the study.

Meanwhile, in J.D. Power’s 2022 U.S. Direct Banking Satisfaction Study, American Express ranked first in overall satisfaction among direct banks, followed by Discover Bank. By contrast, Ally Bank came in fourth, and Varo Bank ranked eighth.