Nick Izquierdo is the executive vice president of payments at Lawrenceville, New Jersey-based accounts receivable software company Billtrust. He is based in Atlanta.

In payments and accounts receivable, one policy has consistently stirred controversy: recapturing card acceptance costs, known as surcharging.

Many see it as a customer-unfriendly practice, but what if we're looking at it all wrong? The time has come to rethink surcharging not as a necessary evil but as a strategic advantage that can benefit both businesses and customers. Yes, you read that right — surcharging can be a win-win.

Surcharging, or the practice of passing credit card transaction fees onto the customer, often gets a bad rap. Critics argue it alienates customers and deters sales. But let's face it — those critics are clinging to outdated notions. In reality, a well-implemented surcharging policy can enhance customer experience while bolstering a company’s bottom line. It’s time we challenge the stigma and embrace the strategic potential of surcharging.

AR teams today are not mere bill collectors. They are strategic financial managers armed with sophisticated software tools. By leveraging surcharging, AR teams can manage acceptance costs more effectively. This empowerment is crucial as it puts businesses in the driver’s seat, allowing them to tailor payment policies that align with their unique objectives.

Consider the flexibility that comes with establishing a comprehensive payment policy. Companies can manage acceptance costs and optimize cash flow by encouraging early payments or more dynamic and customized grace period configurability, as well as limiting high-cost payment methods. This approach not only reduces financial strain but also empowers AR teams with the tools and visibility needed to meet broader business objectives. For instance, surcharging can help businesses manage their cash flow by incentivizing customers to pay earlier for discounts or to use cheaper payment methods.

Contrary to popular belief, surcharging can improve customer satisfaction. How? Transparency and choice. When customers understand the cost structure and have options, such as early payment discounts or various payment methods, they feel more in control and trust the process more. A transparent surcharging policy is not punitive -- it’s empowering.

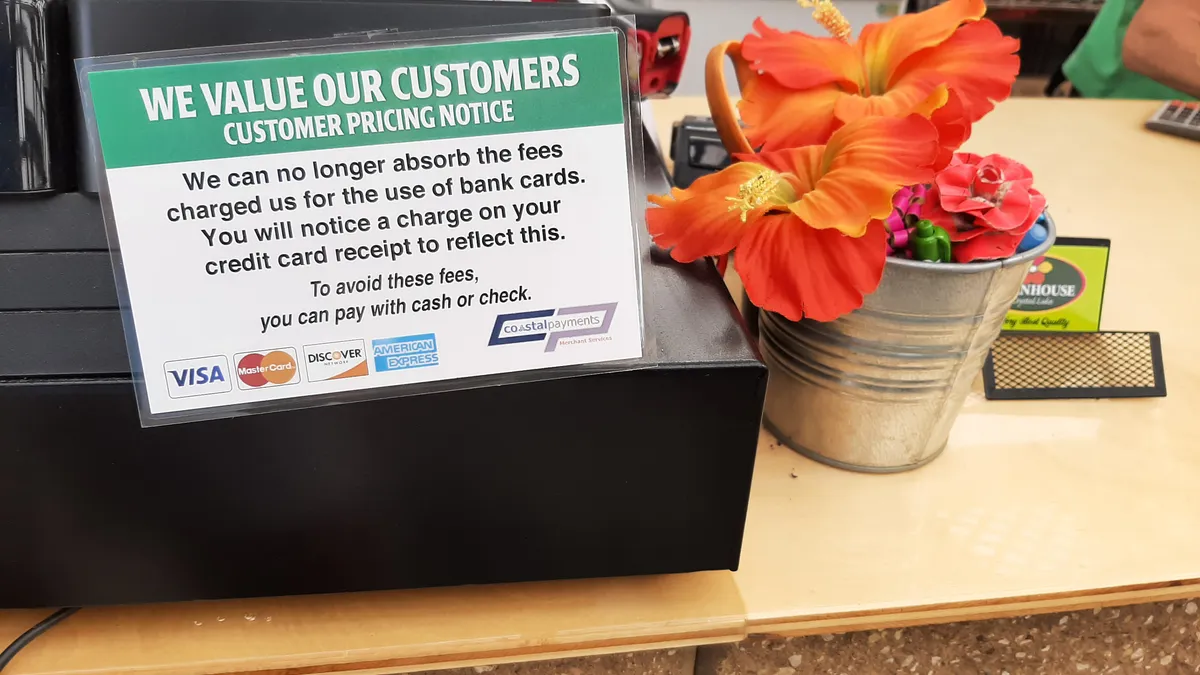

Clear communication is key. Informing customers about surcharging policies upfront, explaining the reasons behind them, and offering alternatives can enhance the customer experience. Customers appreciate honesty and transparency, especially when they understand that surcharging helps businesses maintain fair pricing and service quality.

Furthermore, offering a dynamic and flexible range of payment options demonstrates a commitment to customer convenience. This approach builds trust and loyalty – customers are more likely to continue doing business with a company that values their time and offers flexible payment solutions.

Let’s be clear: surcharging isn’t about nickel-and-diming customers. It’s about smart, sustainable business practices. By shifting the burden of transaction fees back to the user, businesses can maintain profitability without compromising service quality or hiking prices. More than just a way to save costs, it's a strategic move that allows businesses to reinvest savings into growth and innovation.

When combined with dynamic, flexible payment options, surcharging creates a cash flow-friendly environment. Businesses receive payments faster and more predictably, which is crucial for growth. Improved cash flow enables companies to meet operational expenses, seize new opportunities, and navigate economic uncertainties more effectively. This kind of financial stability isn't just nice to have -- it's essential for long-term success.

Surcharging also forces businesses to stay current with regulations, fostering a culture of compliance. This adaptability gives teams a competitive edge in a rapidly changing market. Staying informed about regulatory changes and ensuring compliance can help businesses avoid legal pitfalls and maintain a positive reputation. In essence, surcharging forces businesses to operate ethically and transparently, which builds customer trust.

Furthermore, surcharging empowers AR teams to move beyond basic invoice management and start strategically driving business objectives. This control translates to better decision-making and financial health. When AR teams implement payment policies that align with broader business goals, such as reducing reliance on high-cost payment methods and optimizing revenue streams, the entire organization benefits. This isn’t just about managing costs -- it's about transforming AR into a powerful tool for enhancing overall business performance.

Here’s the hard truth: many businesses are stuck in a rut with outdated payment policies. They avoid surcharging because it’s seen as customer unfriendly. But this is a losing strategy. The marketplace is evolving, and businesses must evolve with it.

Surcharging, when done transparently and fairly, can be a catalyst for positive change. It’s time to look past misconceptions and start leveraging the full potential of this powerful tool.

Surcharging challenges the status quo and forces businesses to rethink their approach to payment policies. By embracing surcharging as a strategic tool, businesses can optimize costs, improve cash flow, and enhance customer relationships. It’s a move that requires careful planning and execution, but the rewards are well worth the effort.