The Consumer Financial Protection Bureau asked a federal court in Washington for 60 more days to respond to a lawsuit against the agency over its efforts to oversee technology companies that offer digital payments tools.

The federal agency finalized a new rule aimed at those nonbank companies last November, allowing it to police those that process more than 50 million consumer transactions annually, with potentially stiff new penalties.

Lawyers for the CFPB argued the agency needs more time to assess the lawsuit largely because of the change in leadership that resulted after the Trump administration appointed Secretary of the Treasury Scott Bessent as acting director of the agency in January, and the following month designated the director of the Office of Management and Budget, Russell Vought, to that role.

“The Bureau’s new leadership needs time to review and consider its position on various agency actions, including the Larger Participant Rule challenged in this case,” the agency said in its filing on Friday. “Defendants respectfully request that the Court extend by 60 days Defendants’ deadline to answer or otherwise respond to the complaint, from March 24, 2025 to May 23, 2025.”

The filing noted the agency doesn’t intend to use its new supervisory authority under the rule during that 60-day period.

The rule for payment apps, digital wallets and other tools took effect in December, in the waning days of the Biden administration, over the vehement opposition of large retailers and technology companies including Apple, Etsy, Google, Lyft and Netflix.

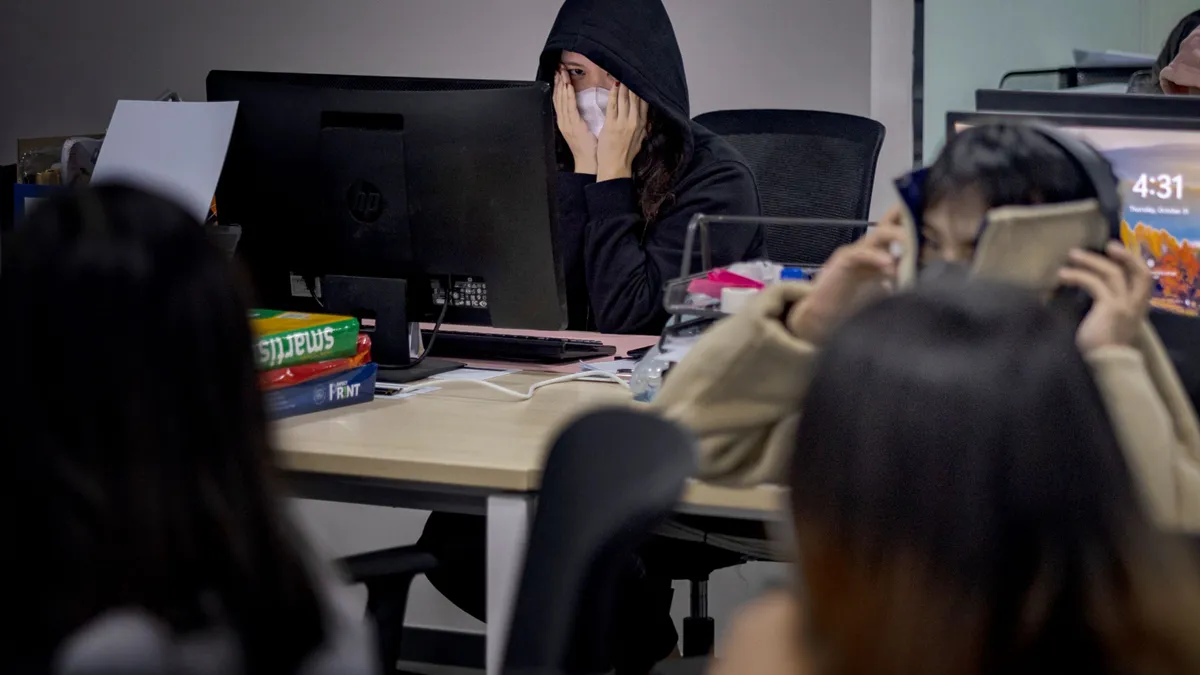

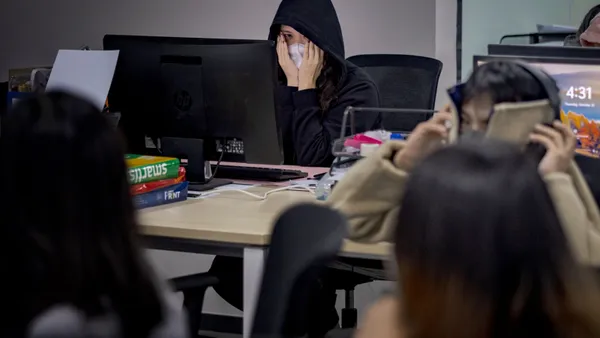

It gave the CFPB authority to supervise and examine nonbank technology companies that offer peer-to-peer money transfer and digital wallet services, such as Cash App, Google Pay, Apple Pay and PayPal’s Venmo. Such tools have become commonplace, the agency said, necessitating the rule. The agency said it was seeking to prevent fraud, protect consumers’ privacy and thwart illegal account closures.

The large companies reacted swiftly, viewing the bureau as appropriating sweeping new enforcement authority that allows regulators to scrutinize not just consumer payments but potentially all aspects of their businesses.

“The CFPB’s rule doesn’t benefit consumers or the market, but it would stifle fintech innovation as the Bureau tries to turn itself into a general technology regulator instead of a financial one,” Carl Holshouser, an executive vice president at industry trade group TechNet, said in an email.

TechNet and NetChoice – which represent more than 135 large companies collectively – moved quickly to battle the rule in both federal court and Congress.

The groups sued the CFPB and former director Rohit Chopra on Jan. 16. They’re asking the U.S. District Court for the District of Columbia to permanently enjoin the rule, “Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications,” which took effect in December.

“One of the scariest things” about the new rule is that the CFPB can regulate all digital payment providers, “so P2P services would be treated as if they were the too-big-to-fail biggest banks,” said Chris Marchese, director of the NetChoice Litigation Center.

In Congress, Sen. Pete Ricketts and Rep. Mike Flood, both Nebraska Republicans, introduced a resolution under the Congressional Review Act, which allows U.S. lawmakers to overturn specific regulatory branch rules.

The Nebraskans’ resolution passed the Senate March 5 on a party-line vote, save for one Republican senator, and is expected to be considered by the House in the coming weeks. President Donald Trump said in a statement on the day of the Senate vote that he would sign it if Congress passes it.

Some consumer advocates have supported the rule. It “closes a loophole that permits non-bank payment app companies to operate without supervisory reviews, unlike bank app funds transfer services,” Consumer Reports said in a March 4 letter to U.S. senators opposing Ricketts’ CRA. Congress “would create a blind spot” if it dispatches the rule, according to the letter from Chuck Bell, the organization’s program director.

In 2023, consumers reported losing $210 million to scams on P2P payment apps, with a median loss of $500, Bell wrote. Scams involving P2P apps surged 62% from 2021 to 2023, according to Consumer Reports.

The CFPB rule “failed to identify risks to consumers that “existing regulation does not already mitigate, failed to define a market, and conflated diverse uses and products into a one-size-fits-all approach,” Penny Lee, president and CEO of the Financial Technology Association, said in a statement praising the Senate vote.

Meanwhile, the CFPB has been “effectively shut down” by Vought, its acting director, according to one law firm, Reed Smith. That has called into question whether it will even enforce its oversight power of large technology companies’ payments businesses.

“It’s hard to say precisely what the CFPB is going to look like when all is said and done,” Marchese said.