Dive Brief:

- The Consumer Financial Protection Bureau said Tuesday in a press release that it has finalized a new rule instituting an $8 late payment fee “threshold” for large credit card issuers. The new rule still allows for increases over that amount if issuers can justify a higher fee based on their costs.

- The federal agency estimates the rule change will help American households save about $14 billion annually as they cut $10 billion in late fees from their budgets because the “typical fee” will drop from $32. That will mean savings of $220 per person per year for some 45 million consumers, the CFPB said.

- The new rule will “cut excessive credit card late fees by closing a loophole exploited by large card issuers,” the federal agency said in the release. It takes effect in about two months, 60 days after being published in the Federal Register.

Dive Insight:

The CFPB announced the finalizing of the new rule in conjunction with a broader announcement from the Biden administration of actions that are aimed at saving Americans money in the face of what the executive branch called “corporate rip-offs and other unfair practices.” The bureau also said the rule would increase competition in the industry.

The “lower threshold” requires large card issuers to “either charge a maximum late fee of $8, or justify a higher amount by demonstrating that they need to charge more to cover their actual collection costs,” the CFPB release said. The edict will apply to about 30 to 35 of the 4,000 financial institutions that issue credit cards, according to a federal official who declined to be named.

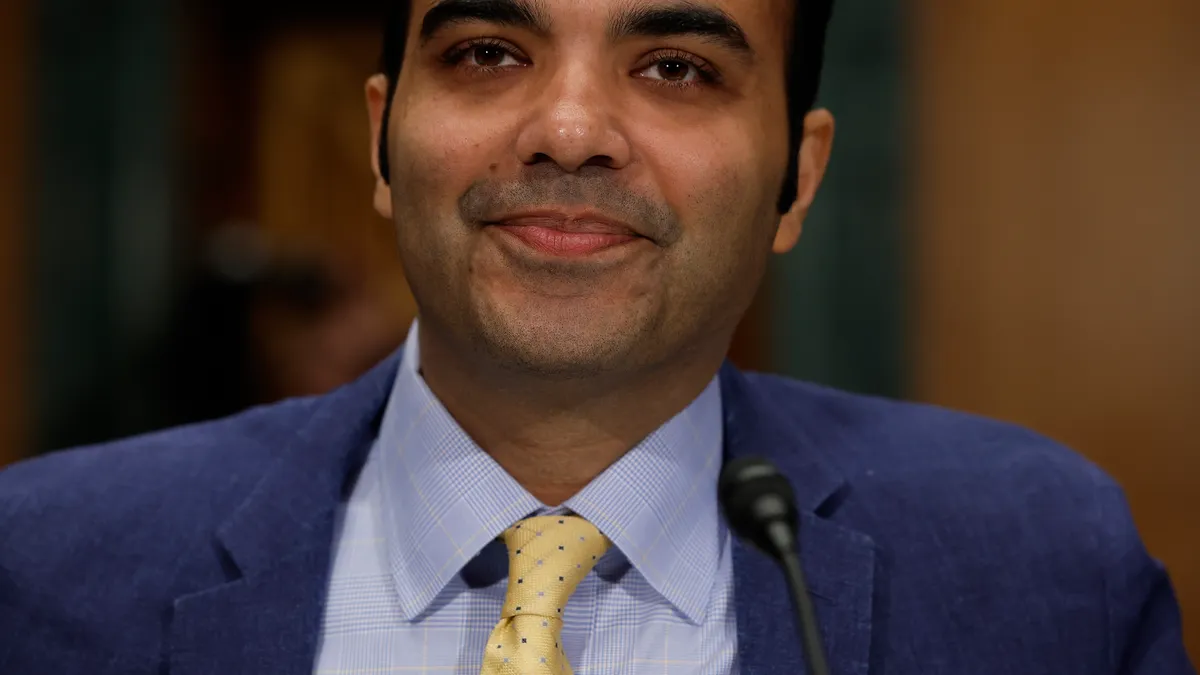

“For over a decade, credit card giants have been exploiting a loophole to harvest billions of dollars in junk fees from American consumers,” CFPB Director Rohit Chopra said in the release Tuesday. “Today's rule ends the era of big credit card companies hiding behind the excuse of inflation when they hike fees on borrowers and boost their own bottom lines.”

The new rule will apply only to large credit card issuers, those with 1 million or more consumer accounts. It will also prohibit the issuers from increasing late fees based on inflation, as they might have in the past, the CFPB said. These larger issuers account for 95% of outstanding credit card balances, the agency said.

“CFPB data shows that smaller issuers tend to charge lower rates and fees to their borrowers, while the vast majority of the largest issuers charge close to the maximum,” the release said.

Generally, bank credit card issuers have increased the amount they’ve charged in late fees, both collectively and on average, on an annual basis since 2010, the agency said it discovered after researching the issue.

The issuers charged consumers about $14 billion in 2022, equal to about 10% of the $130 billion charged generally for interest and fees. Meanwhile, the average late fee climbed to $32 in 2022, from $23 at the end of 2010, the agency said.

The new rule builds on the “original intent” of the Credit Card Accountability Responsibility and Disclosure Act of 2009, also known as the Card Act, Chopra said in a separate statement. That law called on card issuers to keep fees in line with their costs for infractions.

Some members of Congress, including Sen. Elizabeth Warren, a Democrat from Massachusetts, had urged the CFPB to act on the proposal.

The CFPB first proposed lowering the late fee cap a little over a year ago, in February 2023, portraying those charges as part of a broader problem of consumers being overburdened by junk fees. A battle over the proposal ensued, as some credit card issuers pushed back on the proposed rule.

That tension persisted this week, with the American Bankers Association issuing a Tuesday statement calling the new $8 fee a “cap” and arguing that it will decrease competition and hurt consumers. The trade group also threatened to take action to fight the mandate, without being specific.

The “flawed final rule will not only reduce competition and increase the cost of credit, but will also result in more late payments, higher debt, lower credit scores and reduced credit access for those who need it most,” ABA President Rob Nichols said in the statement. “We will closely review this final rule and consider all options to fight the harmful consumer policy coming out of Director Chopra’s CFPB.”